Market Segment

January 28, 2020

SSAB Reports Rough Quarter

Written by Sandy Williams

SSAB Americas posted a loss of $23 million (-222 million SEK) for the fourth quarter of 2019 due to lower realized steel prices and maintenance costs associated with a planned outage in Mobile, Ala.

Heavy plate demand was good in the first half of the year, but weakened in the fourth quarter due to inventory destocking as prices fell. Sales dropped 19 percent from the third quarter and 25 percent from a year ago. Lower demand was noted from heavy transportation and construction machinery.

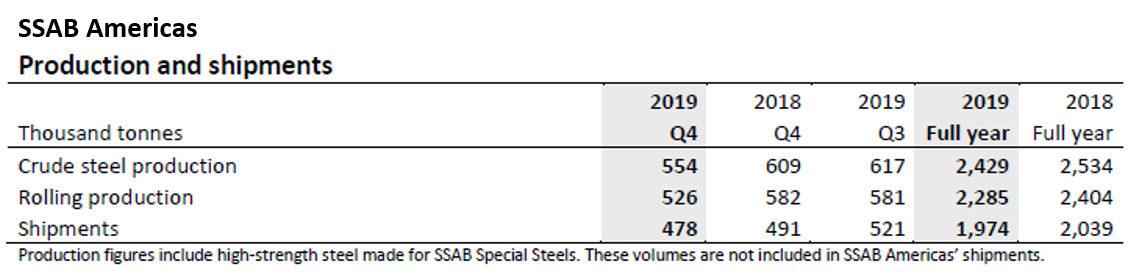

Crude steel production declined 10 percent from Q3 and 9.0 percent from Q4 2018. Rolling production dropped 9.0 percent month-over-month and 10 percent year-over year. Declines were attributed to the Mobile maintenance.

SSAB expects demand for heavy plate in North America to be stable in the first quarter of 2020. With the maintenance outage at Mobile out of the way, shipments are expected to pick up in Q1. Prices are expected to be generally unchanged from the fourth quarter.

Group Results

Swedish SSAB Group saw sales slip 10 percent from third to fourth quarter to 16.97 billion SEK ($1.77 billion U.S.). The company posted a net loss of $129.4 million (-1.24 billion SEK) due to negative results in all business segments except Ruukki Construction. Crude steel production and rolling production were down 15 percent and 13 percent, respectively, from Q3. Steel shipments totaled 1.48 million metric tons.

“In Europe, demand was somewhat weaker throughout the year,” said SSAB. “During the first half of the year, it was primarily the automotive segment that slowed down, but later demand also decreased in other segments, including heavy transport. During the fourth quarter, demand was marked by destocking both by end customers and distributors.”