Market Segment

January 28, 2020

Nucor Beats Earnings Estimates for Q4

Written by Sandy Williams

Nucor beat analysts’ estimates for the fourth quarter, reporting net earnings of $107.8 million due to an unexpected surge in sales during December.

“Stronger than expected steel mill segment performance in December was the primary driver for higher actual fourth-quarter earnings than we indicated in our mid-December quantitative guidance,” said Leon Topalian, Nucor’s new president and CEO. “We believe that the inventory destocking that occurred throughout most of 2019 concluded in the fourth quarter, when customers resumed more normal buying patterns. Additionally, general business conditions improved in the fourth quarter due to a number of factors, including a rate cut by the Federal Reserve, the new labor agreement between the United Automobile Workers and GM, and definitive progress on the trade front.”

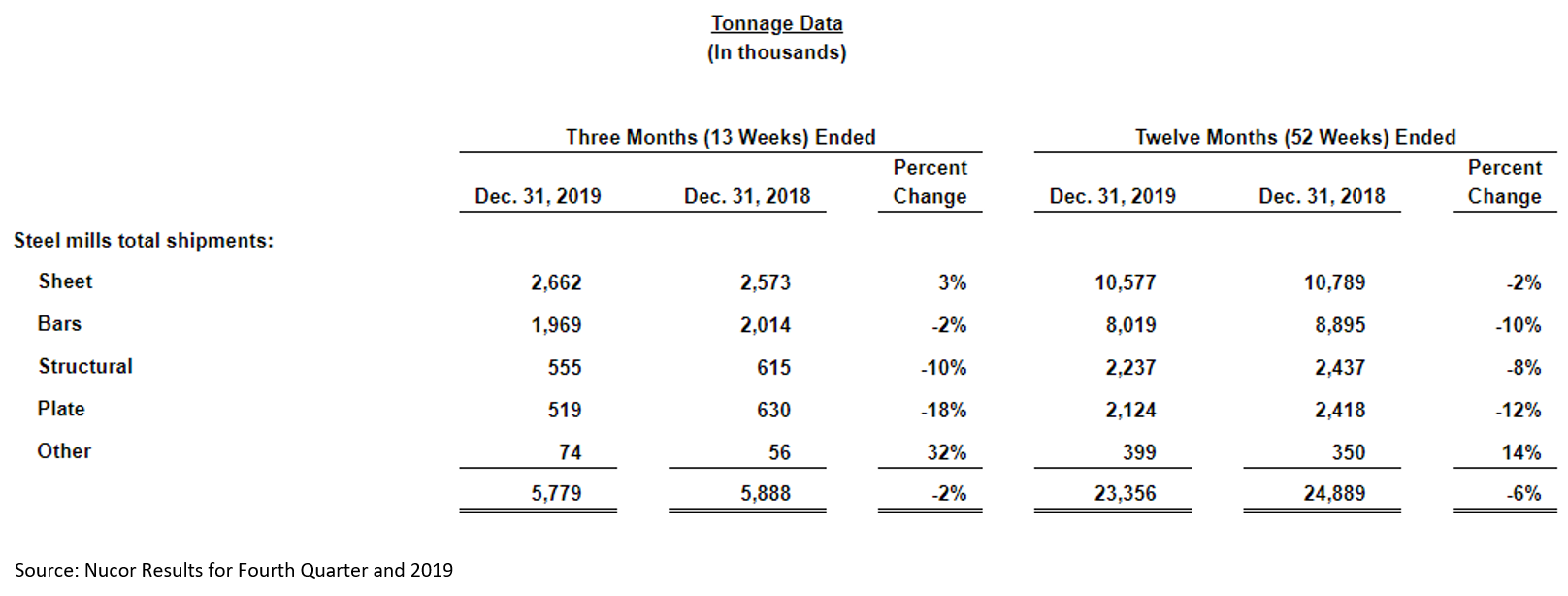

Net sales for the quarter totaled $5.13 billion, a 6.0 percent decline from the previous quarter and an 18 percent drop from Q4 2018. Shipments of 6.5 million tons to outside customers were flat compared to the third quarter and down 3.0 percent from a year ago.

Nucor’s full-year 2019 results included a 10 percent decline in net sales to $22.59 billion and a 5 percent drop in shipments to outside customers to 26.5 million tons. Average sales price for the year dropped 5.0 percent.

Nucor’s average scrap and scrap substitute cost per gross ton used in the fourth quarter of 2019 was $275, an 8 percent decrease from the third quarter. A planned outage at the Louisiana DRI plant in mid-November significantly increased losses in the raw materials segment.

Topalian noted that strong performance in many of Nucor’s businesses helped to offset the impact of destocking during the year. The Vulcraft/Verco and Building Systems groups achieved record profitability due to a favorable nonresidential construction market in 2019. “We are encouraged by recent economic trends and confident that our positive momentum will continue in 2020,” he said.

Nucor acquired TrueCore, LLC, a producer of insulated metal panels for the cold storage market, during December as well as announcing plans for a new coil paint line at Nucor Steel Arkansas. The coil paint line will have a capacity of approximately 250,000 tons per year and is expected to start up in the first half of 2022.

The mill at Sedalia is in the start-up phase with a melt going through the entire steel process on Thursday. The cold mill at Hickman continues to ramp up.

“Several projects are coming online right now, including the galv line at Gallatin, the Hickman cold mill, the Sedalia bar mill and the Kankakee merchant bar mill. Those four are going to make a make a nice contribution to Nucor by end of this year and a really good contribution next year,” said CFO Jim Frias.