Market Data

January 26, 2020

SMU Market Trends: Prices Maintaining Momentum?

Written by Tim Triplett

The benchmark price for hot rolled steel dipped by about $20 last week to an average price of $590 per ton, according to Steel Market Update data. Despite the small decline, most of the steel buyers responding to SMU’s latest market trends questionnaire believe prices still have upward momentum. Let’s look at the data for evidence.

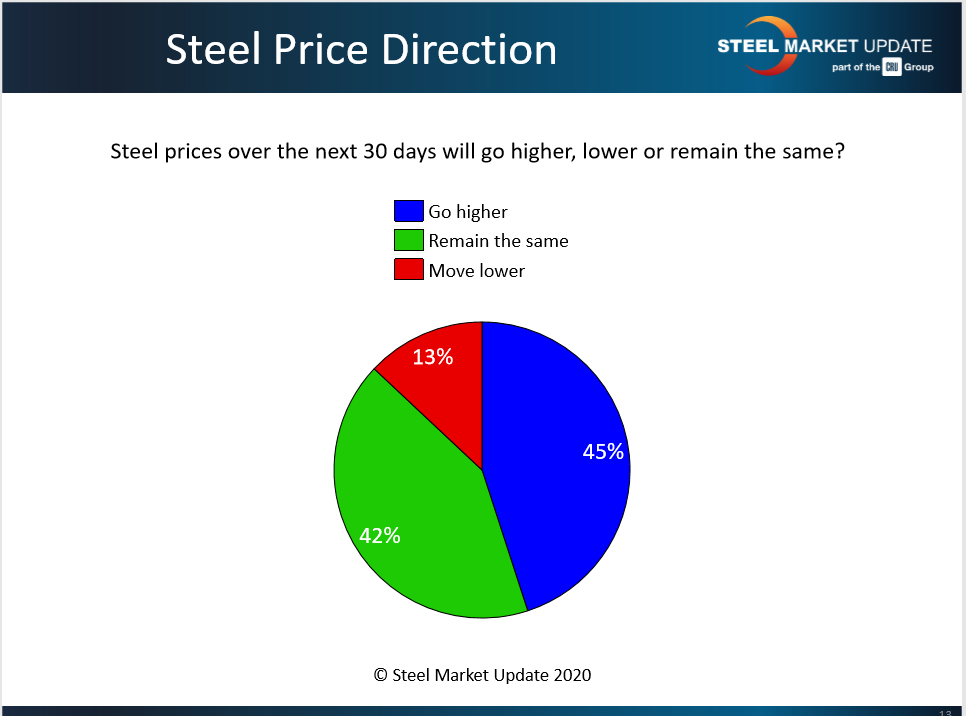

Price Direction

SMU asked: Will steel prices over the next 30 days go higher, lower or remain the same?

Around 45 percent see prices rising. Almost an equal number, 42 percent, see prices leveling out. Only 13 percent expect a decline. Therefore, the consensus view is that prices are unlikely to see further declines in the coming month.

Some respondents’ comments:

“There are no significant economic headwinds facing pricing for the next several weeks.”

“I think prices will remain the same. I don’t think the current run-up in pricing will continue.”

“You will see prices still moving up, but headwinds are going to get stronger. As distributors fill up their inventories and reduce buying, it will be hard for the mills to keep pushing up prices.”

“About $60-70/ton of the five announced increases will probably stick. Demand is not there to keep all the mills full regardless of price, and certainly not at the levels where mills have tried to position themselves.”

Demand

SMU asked: Are you seeing demand for your products improving, remaining the same or declining?

Whether steel prices stall or resume rising depends to a large degree on demand levels. The majority (61 percent) of respondents see flat/stable demand in the current market. About 26 percent report improving demand for their products. But 13 percent see demand declining. So, the demand outlook is modestly favorable, but with some uncertainty.

Some respondents’ comments:

“Demand is off slightly from our forecast.”

“Everyone is flush with inventory and waiting to see which way prices go. Most feel prices will pull back a little for April orders.”

“Demand—as in actual orders or even inquiries—has been down, even given the higher prices in the market.”

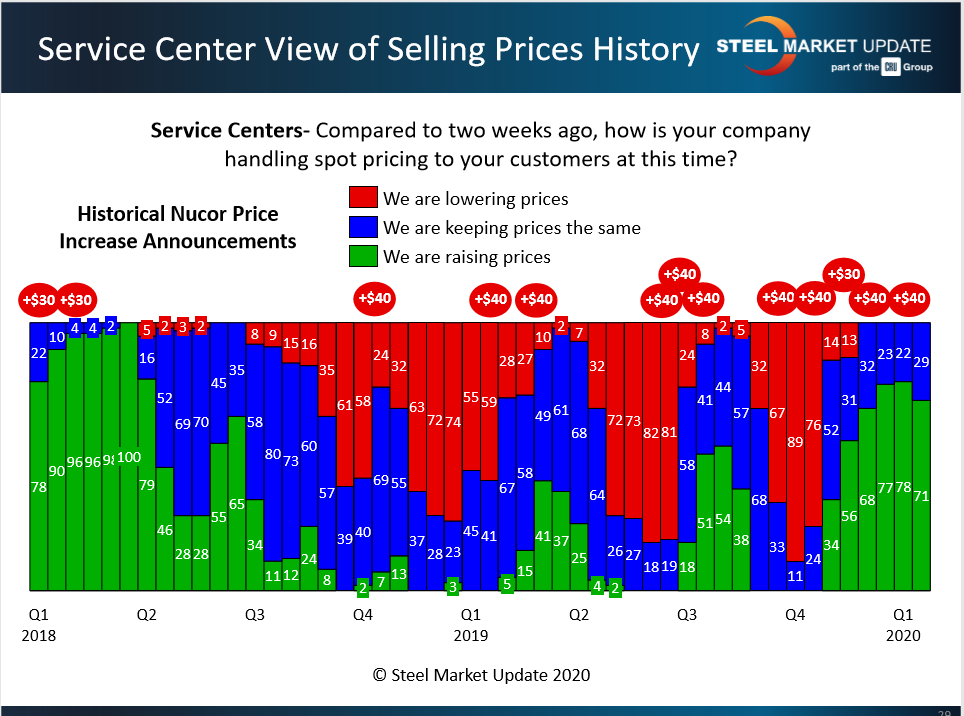

Service Center Pricing

SMU asked: Compared to two weeks ago, how is your company handling spot prices to your customers?

In addition to demand, rising prices require the support of distributors. The vast majority of service centers (71 percent) continue to raise spot prices to their customers. The other 29 percent said they are keeping prices the same. None of those responding to SMU’s survey said they are yet lowering prices to win orders. This was the first week since early November, however, in which a smaller percentage said they are raising prices, which may hint at a change in service center support.

Said one service center executive: “It would be a wonderful world if all service centers decided to sell at the market price, not their current inventory cost. Companies are leaving so much money on the table.”

SMU note: The red ovals indicate Nucor price increase announcements.

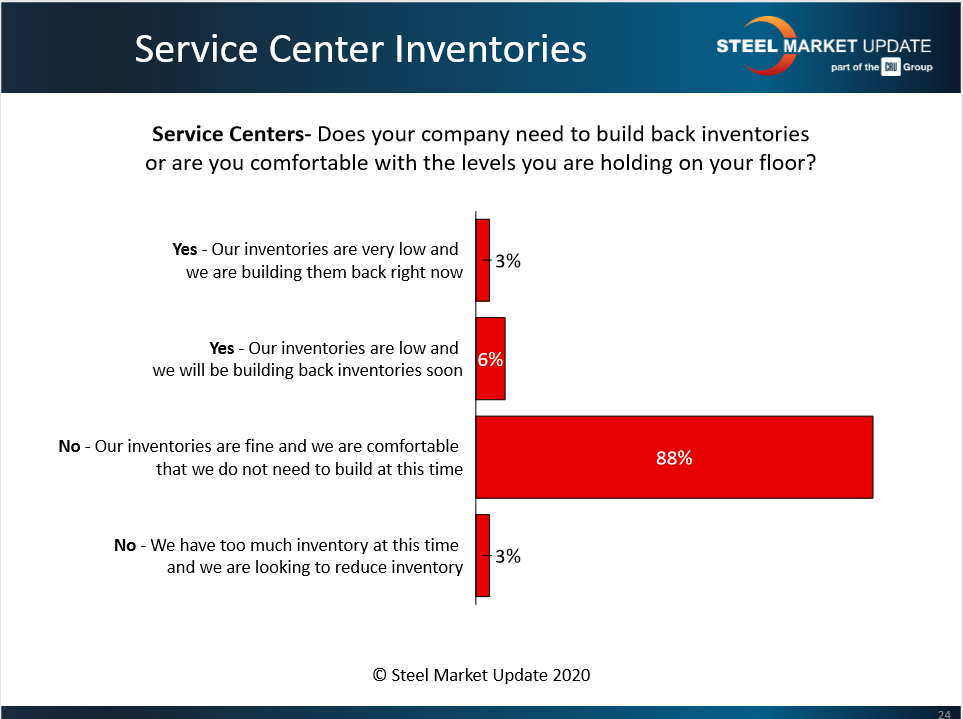

Service Center Inventories

SMU asked: Does your company need to build back inventories or are you comfortable with the levels you are holding on your floor?

One big component of demand is distributor inventories and whether service centers are in a buying mode. A whopping 88 percent of SMU’s respondents said they are comfortable with their current inventory levels. Another 9 percent said their inventories are somewhat or very low. Only 3 percent feel the need to reduce excess inventories at this point. Therefore, buying by service centers is unlikely to add much incremental demand to the market in the near term.

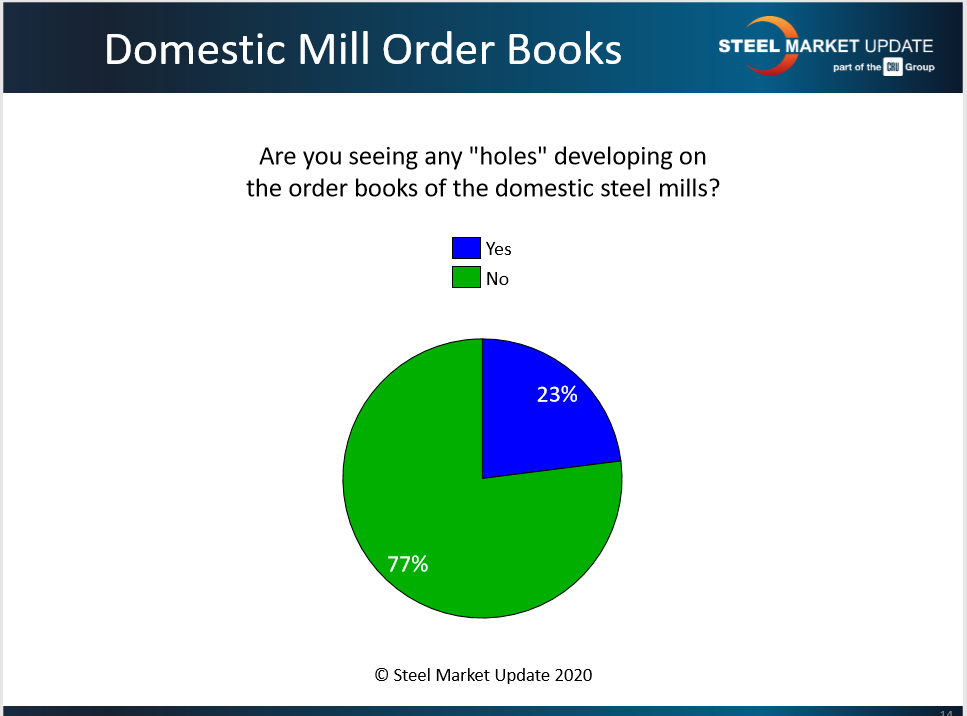

Seeing Any Holes?

SMU asked: Are you seeing any holes developing in the order books of domestic steel mills?

Most buyers (77 percent) said their mill suppliers appear to have strong order books, but a small minority (23 percent) did reports signs that some mills may have holes to fill and thus be willing to negotiate on price.

Some respondents’ comments:

“Panic buying as prices moved upward has left some holes now.”

“Spot deals are available.”

“There’s some softness in hot rolled and a little more so in cold rolled.”

“I get concerned when the mills heavily focused on automotive [in the Midwest] offer product out West at very competitive prices. Hopefully it’s an aberration.”

“Certain mills have capacity for February.”

“End-of-year deals by mills in the East created a hole in January. You can see that reflected in last week’s drop. Most likely, those deals were done in late October when the HDG index bottomed.”

“Mills that are heavy in contract seem to be OK, but those more reliant on spot business are struggling.”

“All the mills are calling, looking for business, obviously at higher numbers. This is a prelude to overcapacity and pushing prices up with no discipline. Prices will turn; they’ve been pushed to high too fast.”