Market Segment

January 23, 2020

NLMK Trading Update Q4 & 2019

Written by Sandy Williams

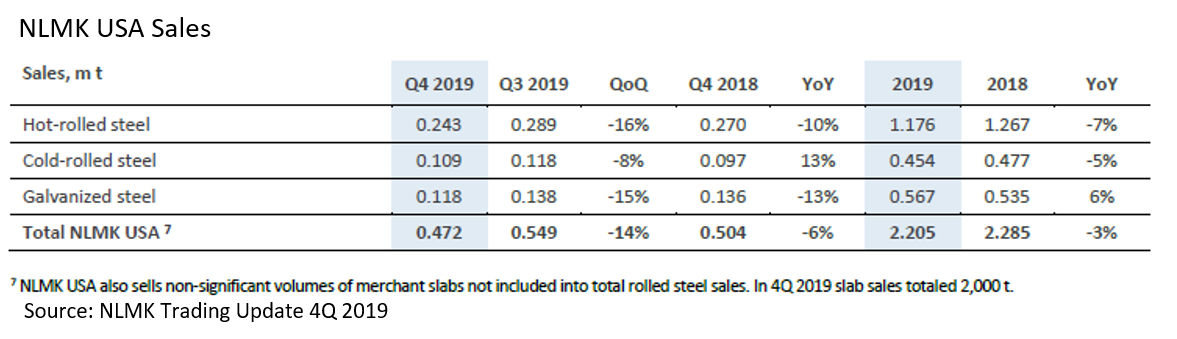

NLMK USA sold 472,000 metric tons of steel in the fourth quarter of 2019, a decline of 14 percent from the previous quarter and 6 percent from a year ago. The decrease was attributed to a seasonal slowdown in steel buying activity.

Sales for the full year of 2019 declined 3.0 percent to 2.2 million MT due to lower demand for hot-rolled steel in the pipe industry.

NLMK Group output increased by 1 percent quarter-over-quarter to 3.8 million MT, following the completion of major repairs at the NLMK Lipetsk blast furnace and steelmaking operations. NLMK Group sales improved 4 percent to 4.2 million MT during the quarter.

The maintenance at Lipetsk and lower demand for billets on the export market led to a 10 percent decline in steel output for the full year in 2019. Lower output of 15.7 million MT caused a 3 percent drop in sales for the year to 17.1 million MT. Declining sales were offset in part by destocking of inventory and by switching the NLMK USA division to third-party slab supplies.