Government/Policy

January 23, 2020

Mercatus Study: Objections Derail Tariff Exclusion Requests

Written by Sandy Williams

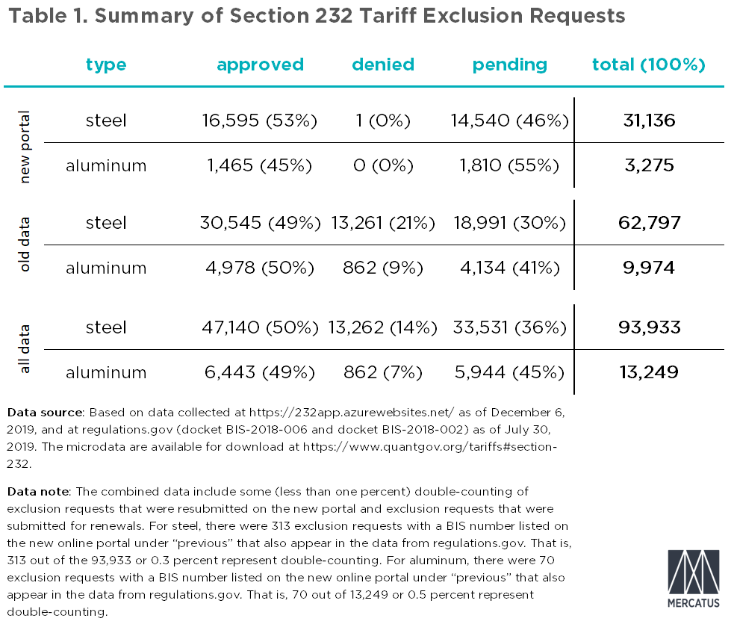

U.S. manufacturers have requested a total of 93,933 exclusions from steel tariffs and 13,249 exclusions from aluminum tariffs since the Trump administration imposed Section 232 in 2018. To get an exemption, an applicant must make the case that the metal they require is not available domestically in a sufficient quality or quantity. While Commerce has approved roughly half of the exemption requests to date, nearly all those that drew an objection from a domestic producer have been denied or are still pending.

Researchers at the Mercatus Center at George Mason University scoured data from the new and old government portals to compile a comprehensive analysis of the exclusion process.

Mercatus found that 50 percent of steel exclusion requests have been approved, 14 percent denied and 36 percent remain pending. Aluminum faired similarly with 49 percent approved, 7 percent denied and 45 percent pending.

The new portal was launched on June 13, 2019, and as of Dec. 6 U.S. companies had filed 31,136 steel tariff exclusion requests. Of those, 16,695 were approved, one was denied and 14,540 remain pending. Of the 3,275 aluminum requests filed, 1,465 were approved, zero denied, and 1,810 remain pending. Table 1 by Mercatus shows the details.

“Objections remain consequential,” wrote Christine McDaniel, Senior Research Fellow at the Mercatus Center.

The researchers noted a pattern of denial or inaction in cases where exclusion requests received objections. In an April 2019 analysis, Mercatus found that less than 1 percent of steel tariff exclusions with an objection had been approved, and just 2.7 percent of aluminum requests with an objection received relief.

Producers have filed objections against 6,371 steel exclusion requests on the new portal. Since the new portal came online, no exclusion requests for which an objection has been filed have been approved, for either steel or aluminum. In nearly all cases, requests were not rejected but are still pending. Mercatus found that 16,595 of the 24,765 requests made without objections were approved and one was denied.

During the initial months of new portal use, an average of 4,427 exclusion requests were filed monthly. Between Aug. 28 and Dec. 6, the average shot up to 7,190 requests.

The analysis also reveals the onerous task of filing exclusion requests to cover incremental changes in product design. During the new portal period, 34,411 steel and aluminum exclusion requests were filed by just 628 firms—an average of 55 requests per company.

The new portal was designed to simplify the exclusion process and improve data integrity and quality control. Mercatus found that the changes to the reporting process make it more difficult for firms to access information about objections.