Analysis

January 23, 2020

Existing Home Sales and Pricing Accelerate in December

Written by Sandy Williams

Existing home sales grew 3.6 percent in December, bouncing back from a slight decline in November and jumping 10.8 percent from a year ago. The National Association of Realtors reported existing home sales were at a seasonally adjusted annual rate of 5.54 million in December.

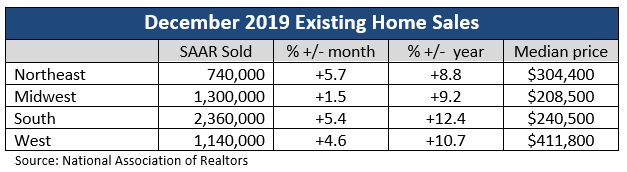

For 2019, total sales ended on a par with 2018 at 5.34 million. Yearly sales were 2.2 percent higher in the South, offsetting declines of 1.8 percent in the West and 1.6 percent in the Midwest. Sales in the Northeast remained unchanged.

Lawrence Yun, NAR’s chief economist, said home sales fluctuated a great deal last year. “I view 2019 as a neutral year for housing in terms of sales,” said Yun. “Home sellers are positioned well, but prospective buyers aren’t as fortunate. Low inventory remains a problem, with first-time buyers affected the most.”

At the end of December, inventory was estimated at 1.40 million units, a decline of 14.6 percent from November and down 8.5 percent from December 2018. At the current sales rate, inventory is at a 3.0 month supply, indicating fewer choices for prospective home buyers.

The median existing home price in December grew 7.8 percent year-over-year to $274,500. “Price appreciation has rapidly accelerated, and areas that are relatively unaffordable or declining in affordability are starting to experience slower job growth,” said Yun. “The hope is for price appreciation to slow in line with wage growth, which is about 3.0 percent.”

Sales of single-family homes rose to a SAAR of 4.92 million in December and were 10.6 percent higher than a year ago. The median price for an existing single-family home was $276,900, an 8.0 percent increase from December 2018.

Existing condominiums and co-op sales were up 10.7 percent from November to a SAAR of 620,000 units. Median existing condo price rose 6.0 percent year-over-year to $255,400.