Prices

January 19, 2020

Steel Market Update: Will 2020 Be a Better Year for Steel?

Written by Tim Triplett

2019 was a challenge for steel suppliers, with both demand and pricing on a downward slope for the first three quarters of the year. Although it’s still early, there are signs 2020 could prove to be a better year for the steel industry.

Steel mills, and the service centers that process and distribute their products, live and die by steel prices. These producers and distributors have shockingly little control over the price of their products. As a global commodity, the price of steel is subject to the shifting sands of supply and demand and various other random economic forces. When steel prices get too low, it’s not healthy for steel companies or the manufacturers and fabricators who depend on them.

In 2019, the benchmark price of hot rolled steel dipped to unprofitable levels, reaching a low of $470 per ton in October, down nearly 50 percent from the recent peak of $915 per ton in July 2018, according to Steel Market Update data. In the headlines were plant closures, furnace idlings and worker layoffs.

In hopes of reversing the trend, the major flat rolled mills announced their first price hike in late October. With the support of distributors, the increase gained some traction. Prices began to rise, and the mills followed up with four more increases, totaling $190 a ton, over the next two months.

As of mid-January, the price of hot rolled steel had topped the $600 per ton mark once again, cresting a psychological barrier that many saw as unreachable just weeks prior, and giving a boost to industry optimism heading into the new year.

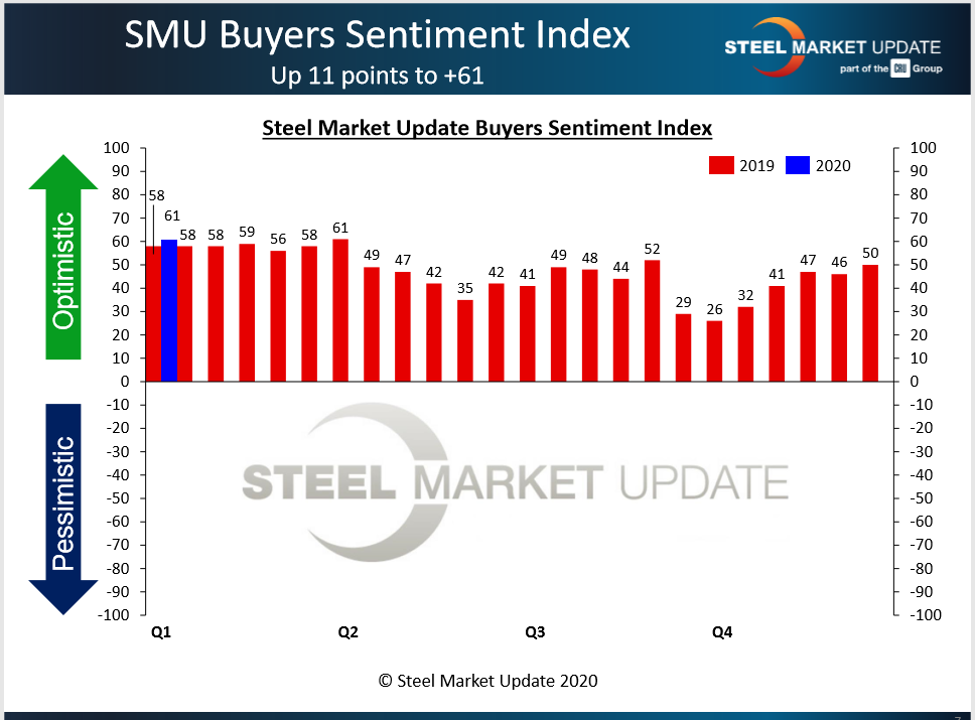

Steel buyers’ sentiment has seen a notable improvement in January as business conditions appeared more favorable to start the new year. Steel Market Update regularly surveys steel buyers to measure how they feel about their company’s ability to be successful given the current market conditions and conditions they foresee three to six months in the future. Results from SMU’s latest poll of the market show a Current Sentiment reading of +61, up 35 points from October when the price of steel hit its low point. Future Sentiment registered +64, up 33 points. Sentiment levels in the mid-60s are comparable to readings in the strong market of 2018.

Mills Have Service Centers to Thank

Whether mills succeed in raising spot prices depends in large part on the support they receive from distributors. Steel Market Update data from service centers, verified by data from their customers, indicates that service centers continue to work to collect higher prices.

As shown by the green bars in the charts below, service centers have been raising spot prices to their customers since November. Seventy-eight percent of the service center executives responding to SMU’s questionnaire in the week of Jan. 6 reported they were still raising prices. The other 22 percent said they were keeping prices the same. None said they were yet lowering spot prices.

Considering prices from the manufacturer’s point of view confirms the trend, as 64 percent of the OEMs and fabricators responding to SMU’s survey were still seeing higher prices from their service center suppliers. None reported a price decrease.

Looking at the charts, the red bars at the beginning of Q4, at 75 percent or more, clearly show what steel Market Update calls “the point of capitulation”—the point at which steel prices had gotten so low that service centers were more concerned about the value of their inventories than their sales. The pendulum will swing back the other way in time, and service centers will begin discounting again to win orders, but there’s no sign of that transition yet.

Lead Times and Scrap Prices

Lead times for steel delivery are a measure of demand at the mill level. The longer the lead time, the busier the mill. Except for plate, lead times for all steel products are up to a week longer than they were at this time last year, signaling healthier demand. As of mid-January, the average lead time for hot rolled steel is nearly five weeks, cold rolled is six and a half weeks and coated steels are around seven weeks. Plate lead times are up to five weeks.

Increases in ferrous scrap prices are lending support to higher finished steel prices. The price of scrap, the main feedstock for electric arc furnaces, increased by a total of $80 per ton from October through January. Scrap prices typically rise as inclement winter weather slows scrap collection and tightens supplies. But with relatively mild weather in the early part of the year, the primary driver of higher scrap prices has been demand from the mills. The American Iron and Steel Institute reported mill capacity utilization rates above 82 percent in January, indicating that steel producers have dialed up production in anticipation of higher steel prices and better margins in the first quarter.

As of Jan. 14, Steel Market Update’s survey of steel buyers showed the average market price of hot rolled steel at $610 per ton ($30.50/cwt) FOB mill, east of the Rockies. Cold rolled and coated steels (galvanized and Galvalume) had an average spot price around $800 a ton ($40.00/cwt). Steel plate was lower at an average of $700 per ton ($35.00/cwt) delivered to the customer’s facility. SMU’s Price Momentum Indicators were pointing higher, indicating that prices were expected to continue moving upward. As always, how high and for how long is the subject of much debate, as can be seen in the following comments from service center and OEM executives:

• “I think $600 hot rolled is the first test. Will the market support $600 short term? More importantly, will the market support $640 or higher? I don’t feel the market is strong enough to support anything over $600, short or long term. If scrap goes sideways or down in February, I believe pricing will quickly stall.”

• “I believe the mills will move prices higher in the first part of Q1, then they will stabilize for a few weeks before retracting.”

• “I think the market will continue to rise through the end of Q1, then start to decline as initial spring demand stalls. Import offers are starting to get in line for buyers to start seriously considering a potential restart of an import buying strategy.”

• “Steel prices are trending up at the same time that service center volumes are down and new steel mill capacity is coming online. The price increases will stall very soon. Mills need to be more sensitive to end market demand. If demand is trending down, piling on price increases will likely cause a significant pullback in manufacturing.”

• “I cannot see the mills getting more than what they have already announced without a traumatic event. However, in the near term, lead times are strong and contract buying is robust. Until contract pricing catches up with spot pricing, we would expect the mill order books to remain pretty populated.”

• “Mills won’t be able to move prices higher unless someone takes out some capacity. If capacity is not removed from the market, I believe prices will slide sooner than later.”

Emboldened by record earnings in 2018, many mills have announced ambitious plans to build new mills or add/restart furnaces over the next few years. Some industry estimates put the new flat rolled steel capacity now in the works at an additional 7-8 million tons. Proponents call it a long overdue modernization of the American steel industry. Others predict the market is poised for disaster as supply will inevitably outpace demand, producing a steel glut that drives prices below $500 per ton once again. Some of that new capacity is due to begin hitting the market in 2020. Right now, steel demand and steel prices are reasonably healthy, but it’s difficult to predict what lies ahead.