Market Data

January 13, 2020

Employment by Industry: Job Creation Down 21.3 Percent

Written by Peter Wright

Job creation decline by 21.3 percent in 2019, compared with 2018, according to Bureau of Labor Statistics data. The December employment reports were delayed by a week due to the holidays. In December, 20,000 jobs were created in construction and 12,000 jobs were lost in manufacturing. The private sector gained 139,000 jobs in December as government gained 6,000 positions.

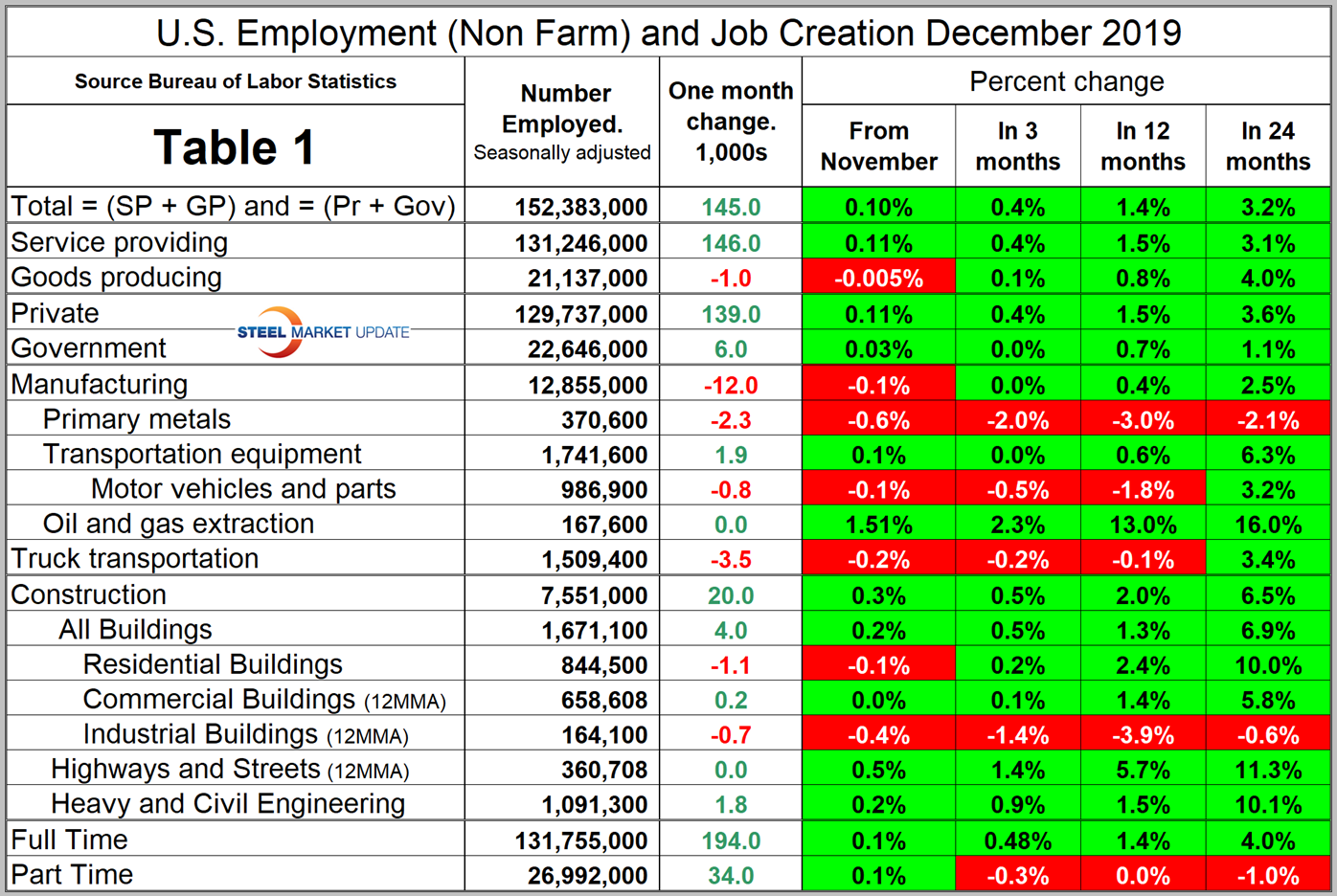

Table 1 breaks total employment down into service and goods-producing industries and then into private and government employees. Most of the goods-producing employees work in manufacturing and construction and the components of these two sectors of most relevance to steel people are broken out in Table 1.

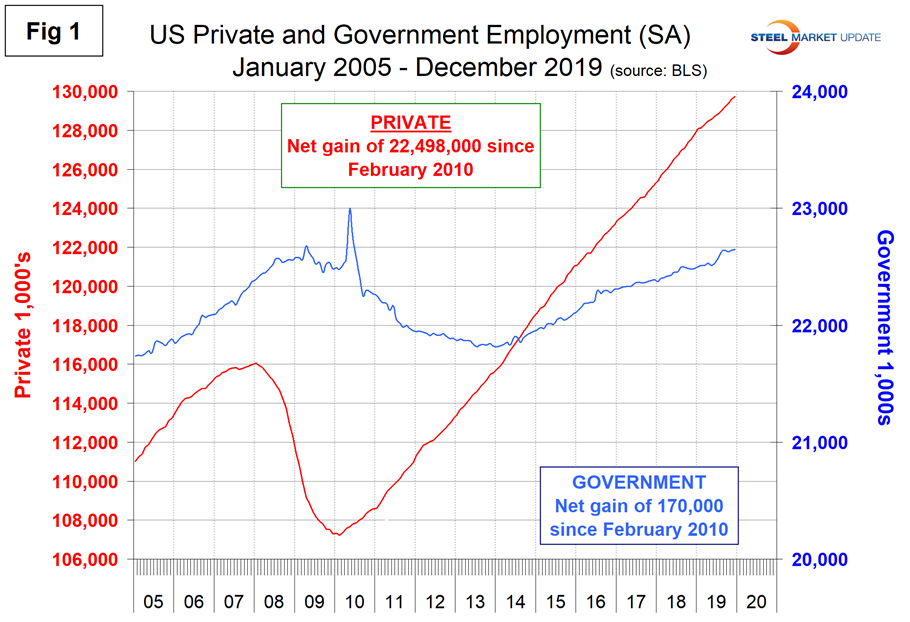

In December, the number employed by the federal government was unchanged. State government employment declined by 8,000 and the local level increased by 14,000. Since February 2010, the low point of total nonfarm payrolls, private employers have added 22,498,000 jobs as government has gained 170,000 (Figure 1).

In December, service industries expanded by 146,000 as goods-producing industries, which are mainly involved in construction and manufacturing, lost 1,000 jobs (Figure 2). Since February 2010, service industries have added 19,158,000 and goods-producing 3,510,000 positions. This has been a drag on wage growth since the recession as service industries on average pay less than goods-producing industries such as manufacturing. In the last 12 months on a percentage basis the rate of job creation in service industries has been almost double that of goods-producing industries.

Construction was reported to have gained 20,000 jobs in December (on a seasonally adjusted basis). Since and including January 2018, construction has added 458,000 jobs and manufacturing 310,000. Despite staffing challenges, contractors are optimistic, on balance, regarding their hiring plans and the volume of work available in 2020 for nonresidential and multifamily construction according to a survey by the Associated General Contractors of America. Figure 3 shows the history of construction and manufacturing employment since December 2005. Construction has added 2,051,000 jobs and manufacturing 1,402,000 since the recessionary employment low point in February 2010.

Note, the subcomponents of both manufacturing and construction shown in Table 1 don’t add up to the total because we have only included those with the most relevance to the steel industry.

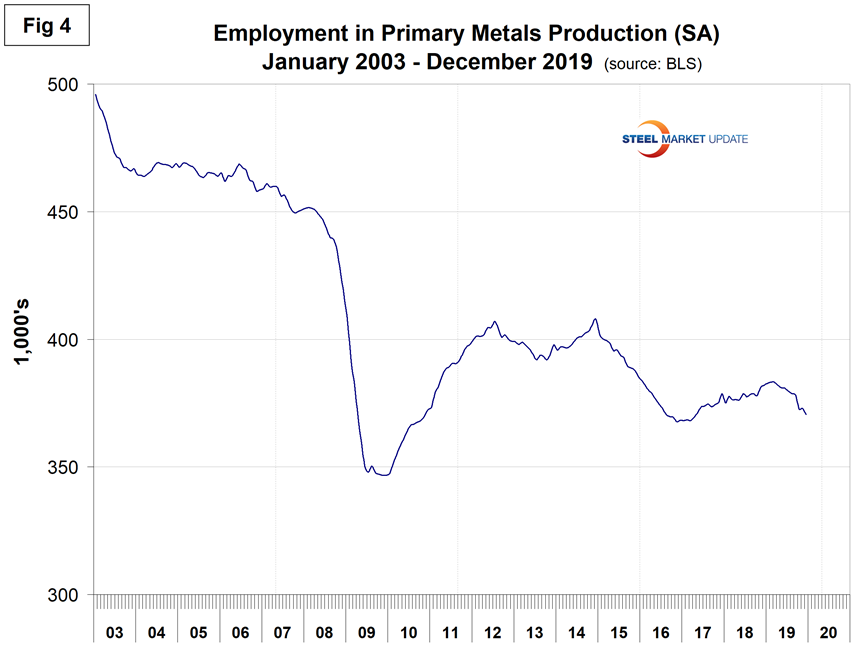

Table 1 shows that primary metals lost 2,300 jobs in December and has seen employment declines in eight of the last nine months. Figure 4 shows the history of primary metals employment since January 2003. The primary metals industries lost 11,400 jobs in 2019.

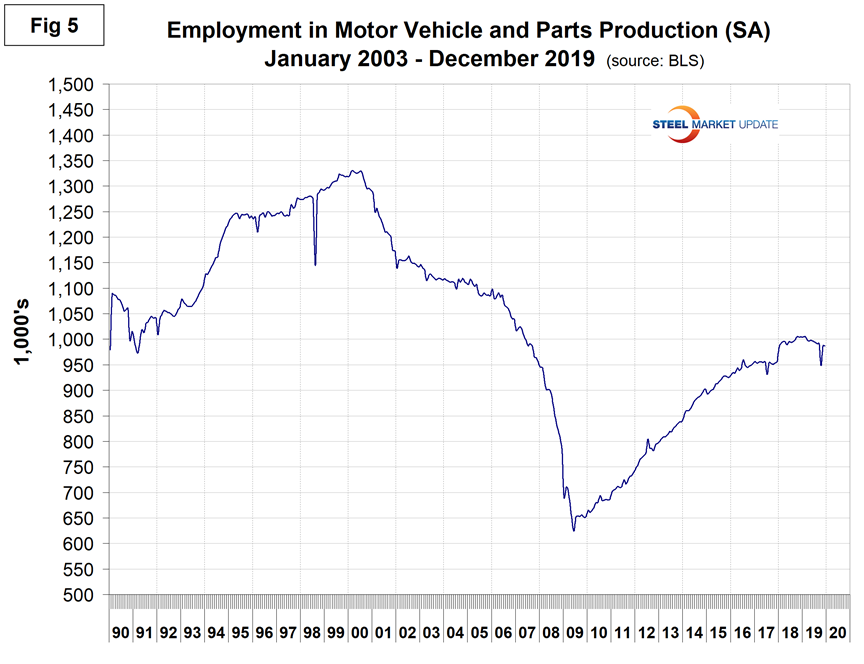

Motor vehicles and parts industries were reported to have lost 800 jobs in December and to have lost 18,000 jobs in 2019 as a whole. Figure 5 shows the history of motor vehicles and parts job creation.

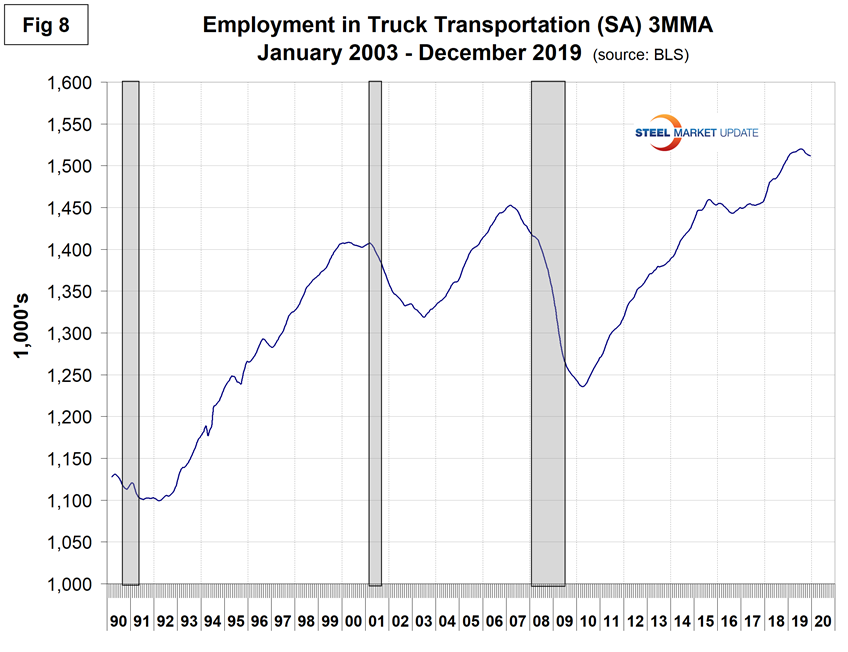

Trucking lost 3,500 jobs in December and has lost 11,500 jobs in the last six months. Employment in truck driving is one of SMU’s recession monitors and Figure 8 shows that at this time there is beginning to be a significant decline.

SMU Comment: This was a lackluster report after the excellent result for November. There is no doubt that employment growth in 2019 was lower than in 2018. In 2018, manufacturing job creation was 264,000. This declined to 46,000 in 2019. The primary metals industries are now in the ninth month of decline. From a future steel consumption in manufacturing point of view, 2019 was a disappointment and there is no sign of a turnaround.

Explanation: On the first or second Friday of each month, the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. The BLS employment database is a reality check for other economic data streams such as manufacturing and construction. It is easy to drill down into the BLS database to obtain employment data for many subsectors of the economy. The important point about all these data streams is the direction in which they are headed.