Market Data

January 12, 2020

Steel Mill Negotiations: Mixed Messages

Written by Tim Triplett

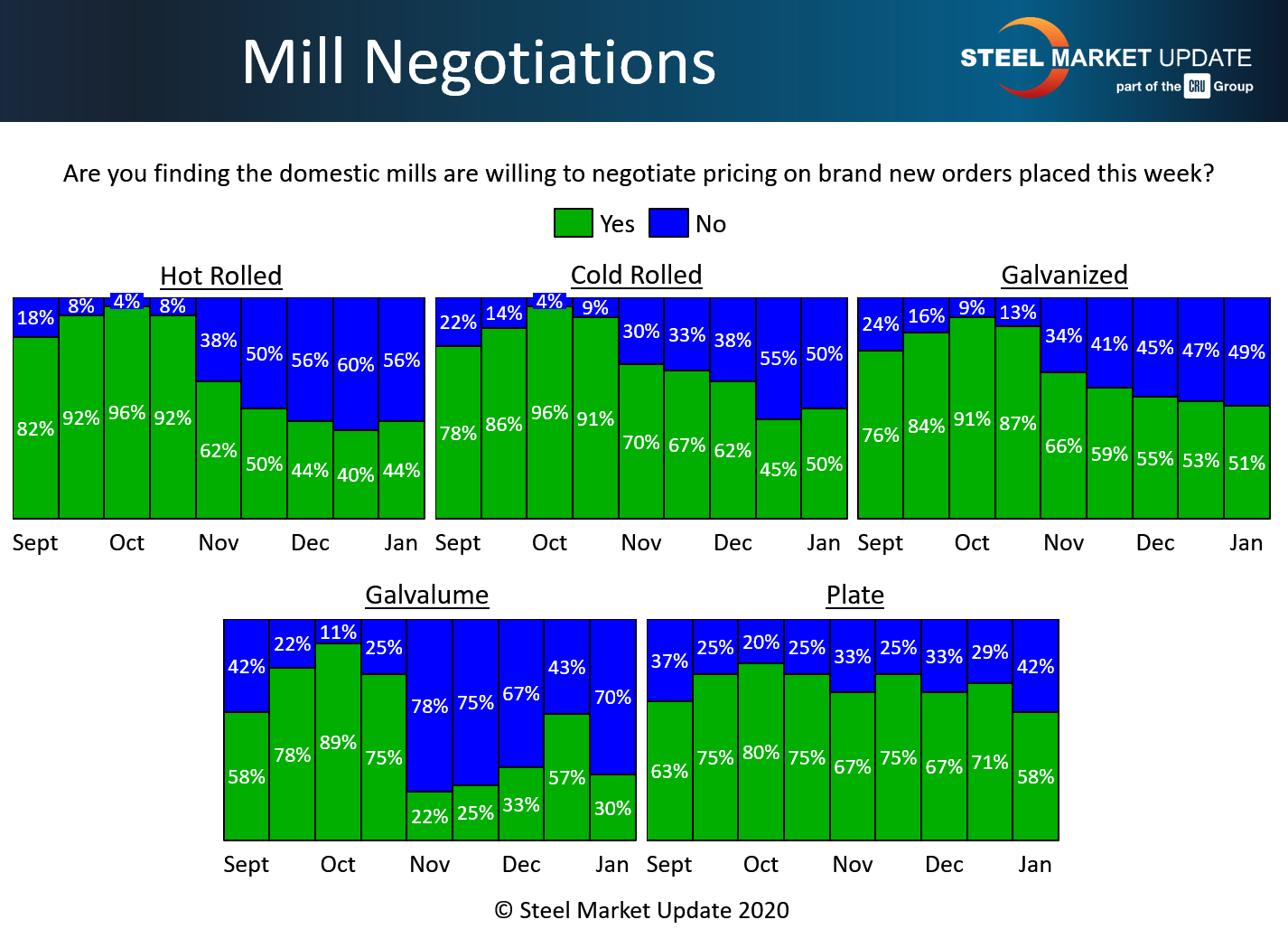

Negotiations between steelmakers and steel buyers were mixed in early January, depending on the product. Responses to Steel Market Update’s market trends questionnaire this week indicate that talks over price have tightened considerably for plate, while loosening slightly for hot rolled and cold rolled orders.

In the hot rolled segment, the majority of buyers (56 percent) said the mills are still unwilling to negotiate prices on HR, but that’s down from 60 percent two weeks ago. The percentage reporting mills open to price talks rose to 44 percent from 40 percent in the last poll.

The cold rolled segment saw a similar, 5-point swing toward more negotiation, making it a 50-50 likelihood that a buyer will find a mill willing to bargain on CR to win the order.

In galvanized, a slight majority of buyers (51 percent) still report the mills as flexible when it comes to pricing. Considerably more Galvalume buyers (70 percent) report the mills holding the line.

Perhaps the most notable change has been in plate negotiations. Two weeks ago, more than 70 percent of respondents said the plate mills would discount to secure an order. That figure declined by 13 points in the last canvass. Today, 42 percent report the plate mills standing firm, the highest percentage since April 2019. SMU sources expect plate producers to announce another increase soon as they work to reverse last year’s downturn in plate prices.

Benchmark hot rolled steel prices have increased by more than 25 percent in the past 12 weeks. SMU data shows the current HR price at $590 per ton, up from $470 in mid-October. Price increases by the mills don’t necessarily curtail negotiations, but rather set a new, higher starting point from which the negotiations begin.

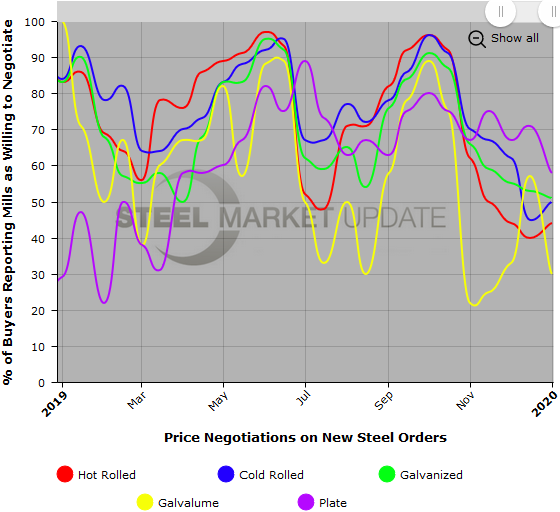

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (example below), visit our website here.