Prices

January 9, 2020

Ferrous Scrap Prices Rise Another $20-30 Per Ton in January

Written by Tim Triplett

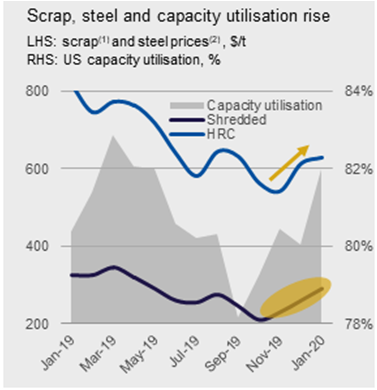

Ferrous scrap prices are up another $20-30/GT in January, on top of similar increases the prior two months, lending support to the finished steel price increases announced this week.

Sources put January scrap prices around the following: Shred, $315-330; HMS, $270-275; Bush, $320; and Plate, $285- $310 per ton.

Scrap prices typically rise in January as inclement weather slows scrap collection and tightens supplies. So far, this winter has been relatively mild in much of the country. Thus, the primary driver of higher scrap prices has been demand, said CRU Senior Analyst Ryan McKinley. “Demand from the mills amid rising capacity utilization rates, rising steel prices (see chart) and a strong, stable export market were really the factors that led to a $30 increase, as opposed to maybe a $10-20 increase,” he said.

DATA: CRU; AISI NOTES: (1) shredded scrap delivered Great Lakes, monthly; (2) HR Coil price FOB Midwest, monthly.

Even with the market seasonally tight in most regions, dealers sought to maximize their offered volumes so they could capture as much of the price upswing as possible. This led to greater competition among dealers late into the trade week, and buying interest at the $30 per ton level waned, McKinley said.

“Offers later in the trading cycle were made at less money as most participants feel January will be the high water mark,” agreed a dealer in the Northeast. “A big factor for February will be if the mills actually receive all that they bought. Dealers may not be able to buy all the tons sold. This question has most predicting scrap prices trending sideways to down by $10 in February.”

Overall, mill demand for scrap was stronger in January than in the fourth quarter, particularly from flat rolled mills. Demand from OCTG and structural mills was weaker, and rebar mill demand was seasonally soft, reported another source.

“While dealers’ scrap yard inventories are not particularly deep, most know the market is unlikely to be higher in February, so they offered more tons than they would normally. As a result, I think a good number of ‘paper’ offers were made, making it seem like supply was increasing and outweighing demand. But, ultimately, that may not turn out to be the reality. Inflows have improved, but have yet to really pick up in a way that reflects the increase in prices since October. So, unlike in the two previous months, mills were able to sit back and let the offers come to them and did not buy too aggressively. Whether all the scrap that dealers have sold is really shipped in January is uncertain,” explained the scrap executive.

Export demand is the big question, he continued. “Turkish mills are having trouble raising rebar prices, which is really crimping metal margins. The 80/20 CIF pricing remains around $300/MT, plus or minus, leaving them around a $140/MT metal margin, which is well under the $170 breakeven. The Turks do need to buy more cargos for February shipment. But I think something has to give sooner or later on scrap and/or rebar prices. I don’t really think scrap prices will drop dramatically until springtime flows improve. Accordingly, I would not be surprised to see mills try to lower domestic scrap prices for February, but unless flows dramatically improve I think that ability will be limited.”

Looking ahead, CRU also sees limited upside for February scrap prices assuming this year’s winter remains mild. Over the past 10 years, scrap prices on average have declined by $19 per ton from January to February, though there has been more stability in recent years.

“A total increase of $80 per ton since October has enabled scale prices to rise, and there is a risk that too much material will become available for the shortest melting month of the year,” said McKinley. “Dealers’ rushing to send material into the market this month may put downward pressure on prices if much of the available tons are not placed and scrap overhangs the market.

“That said, finished steel prices are on the rise and mills are positioning to push prices even higher. As a result, they may be reluctant to force scrap prices lower even if the market is well supplied. Additionally, should winter this year become less mild, scrap collection and transport may keep the market tight and support prices,” McKinley added.

Pig Iron Market Stronger

The pig iron markets are stronger, but buyers have been tight-lipped about purchases, so information is suspect, said another SMU source. “There is a general belief that a Russian cargo traded at approximately $340/MT CFR NOLA. Others are now saying the offers are at $350/MT since the U.S. scrap markets rose by $30/MT. Back when scrap prices were falling, pig iron producers insisted on decoupling pig iron from scrap. Now they want to recouple. Expect resistance from U.S. buyers on pig iron.”