Market Data

January 2, 2020

Conference Board: High Level of Stability in Consumer Confidence

Written by Peter Wright

Steel Market Update is pleased to share this Premium content with Executive-level members. For more informtion on upgrading to a Premium-level subscription, email Info@SteelMarketUpdate.com.

The December report of Consumer Confidence from the Conference Board shows stability at a high level based on 10 years of history.

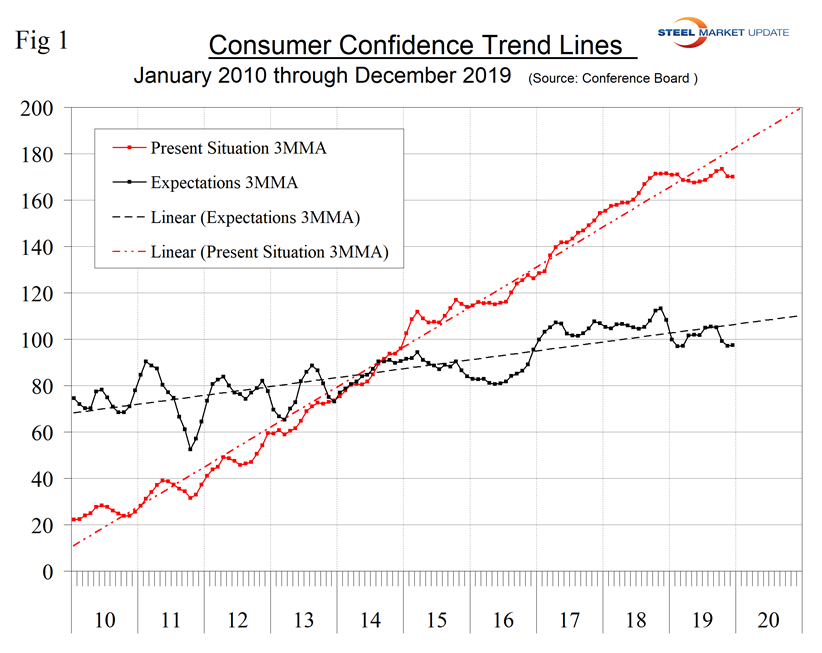

Consumer confidence as reported by the Conference Board is quite a volatile indicator, therefore we prefer to smooth the data with a moving average to reduce monthly variability. The composite value of consumer confidence in December was 126.5 and the three-month moving average (3MMA) was also 126.5. The 3MMA has decreased from 132.1 in September, but was up by a tenth of a point in December. The composite index is made up of two sub-indexes: the consumer’s view of the present situation and his or her expectations for the future. In December, both the consumers’ view of the present situation and their expectations were below the 10-year trend line (Figure 1).

Moody’s Analytics summarized as follows: “The Conference Board Consumer Confidence Index unexpectedly slipped in December but there isn’t an immediate cause for concern, as sentiment remains solid. The Conference Board index fell from a revised 126.8 in November (previously 125.5) to 126.5 in December. Expectations dropped while consumers’ assessment of present conditions improved in December. The labor market differential, or the difference between the share of respondents saying jobs are plentiful and those saying jobs are hard to find, widened. Buying plans were generally better than in November, including for autos and homes.”

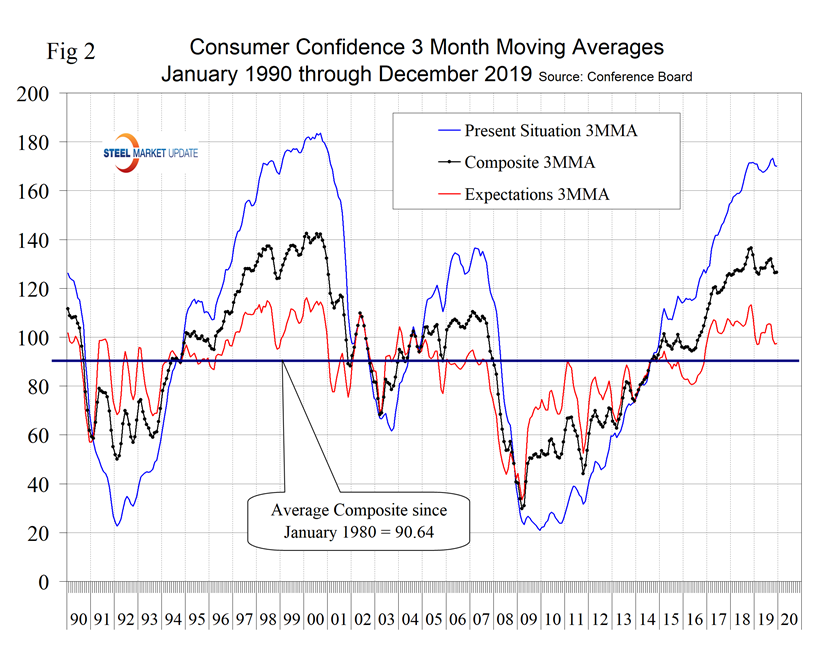

The consumer’s view of the present situation in August at 176.0 was the highest since November 2000. The December value was 170.0, which was up from 166.6 in November. The 3MMA in December decreased from 170.2 to 170.0. The 3MMA of expectations in December was 97.4, down from 105.5 in August. The historical pattern of the 3MMA of the composite, the view of the present situation and expectations since January 1990 are shown in Figure 2.

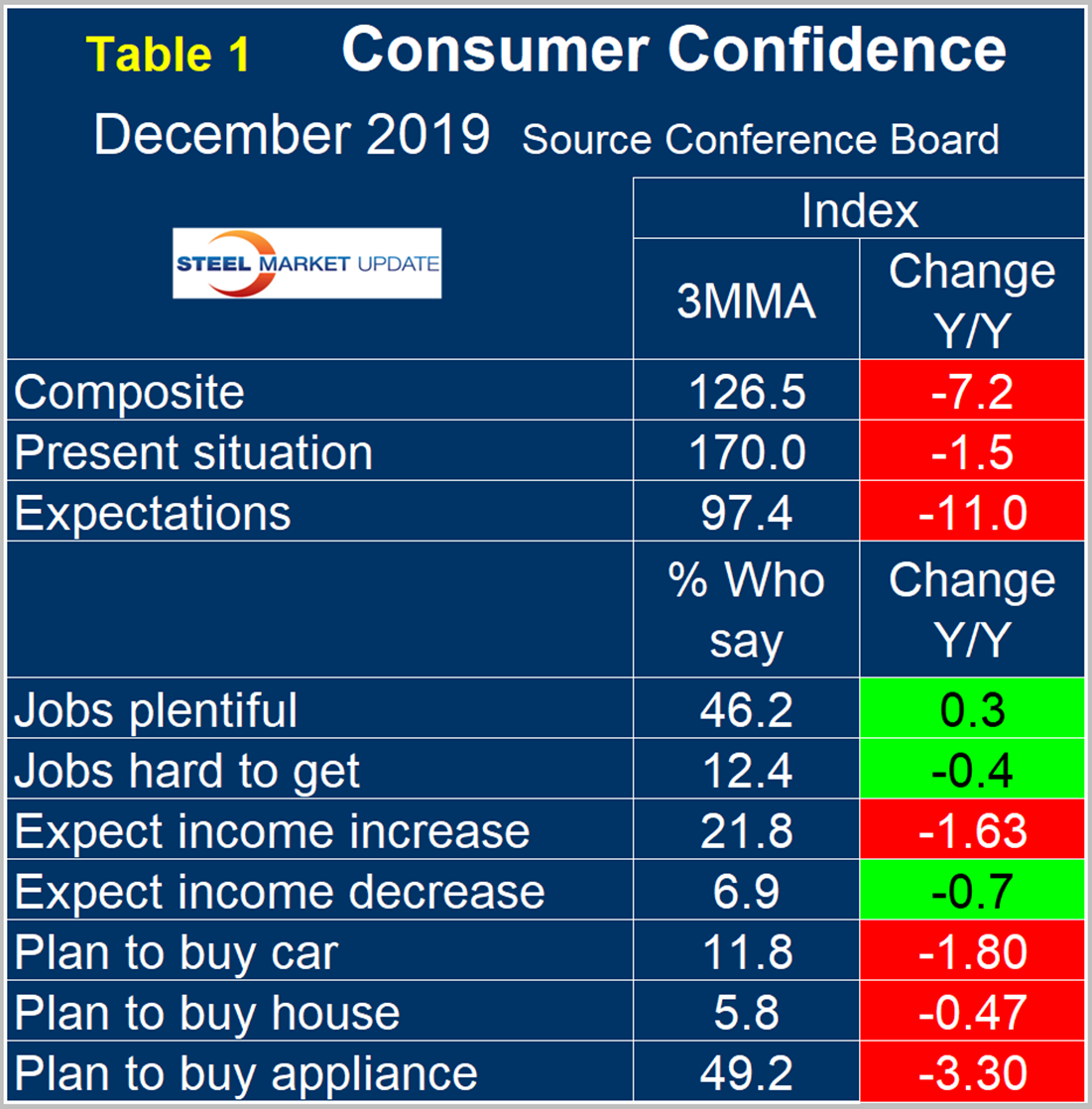

On a three-month moving average basis comparing December 2019 with December 2018, the 3MMA of the present situation was down by 1.5 points and expectations were down by 11.0 points (Table 1). The color codes show improvement or deterioration of the individual components in Table 1. In July and August 2019, the table was all green for the first time since January 2018.

The consumer confidence report includes employment data that is still encouraging as 47.0 percent of respondents reported jobs to be plentiful and 13.1 percent reported jobs hard to get. Expectations for wage increases were also positive, with 21.1 percent expecting an increase and 7.7 percent expecting a decrease. Figure 3 shows the differential between the positive and negative statistics for employment and wages.

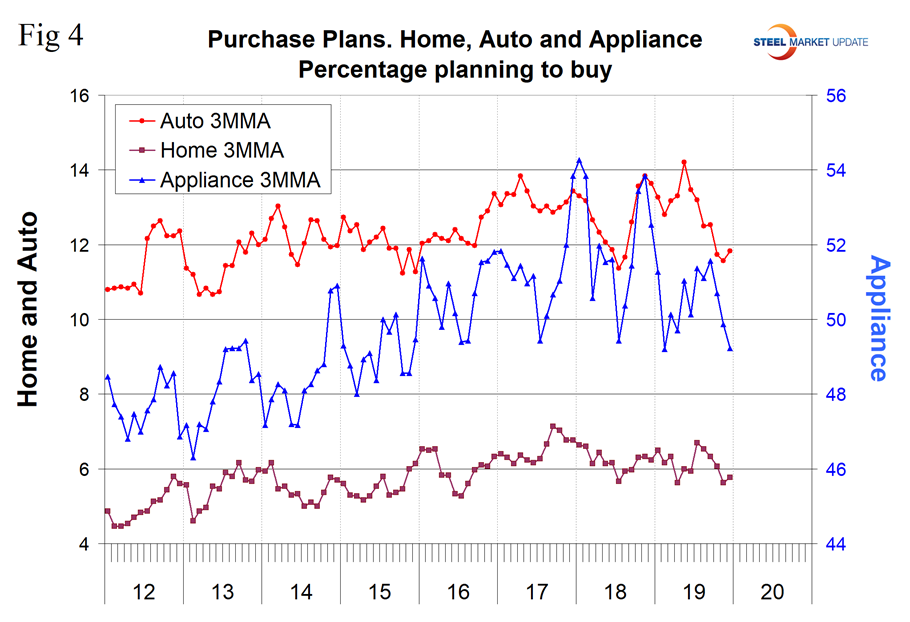

Consumer spending attitudes in December indicated that plans to buy a car, a house or an appliance on a 3MMA basis were all down year over year (Figure 4).

SMU Comment: Our view of this consumer confidence report is mixed. Both components of the composite Conference Board Consumer Confidence Index are below their 10-year trend line. The consumer’s view of the present situation is one of SMU’s recession monitors and shows no sign of a sustained decline, and overall consumer confidence is higher than at any time since the end of 2000. Purchase plans for autos, houses and appliances were all down year over year. Therefore, we conclude that the consumer’s attitude is in a holding pattern. Steel demand is dependent on the growth of GDP, which in turn is strongly influenced by consumer confidence, disposable income and a willingness to spend, thus this is a report that should be on our radar screens.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.