Analysis

December 20, 2019

North American Automotive Production Through November

Written by Peter Wright

All the laid off auto workers were back on the job at the beginning of November following the GM strike and restarts at the auto plans reportedly went smoothly.

This analysis is based on data from LMC Automotive for automotive assemblies in the U.S., Canada and Mexico. The breakdown of assemblies is “Personal” (cars for personal use) and “Commercial” (light vehicles less than 6.0 tonnes gross vehicle weight rating). Heavy trucks and buses are not included. In this report, we will briefly describe light vehicle sales in the U.S. before reporting in detail on assemblies in the three regions of North America.

U.S. Vehicle Sales

Economy.com summarized November’s vehicle sales as follows: “U.S. unit vehicle sales regained speed in November, increasing to 17.1 million annualized seasonally adjusted units. Light truck and SUV sales led the way, increasing 2.3%, or 281,000 annualized units, to 12.4 million annualized units. Car sales also increased, jumping 4.2% to 4.7 million annualized units. November vehicle sales were slightly above the 2019 average through October of 17 million annualized units. Still, sales for November came in 1.8% below 2018 numbers. With November numbers coming in above average for 2019, the weak October sales figures look to be more noise than signal. Once again, the U.S. consumer has proven resilient, powering the ongoing economic expansion despite headwinds from slowing global growth and a multifront trade war.”

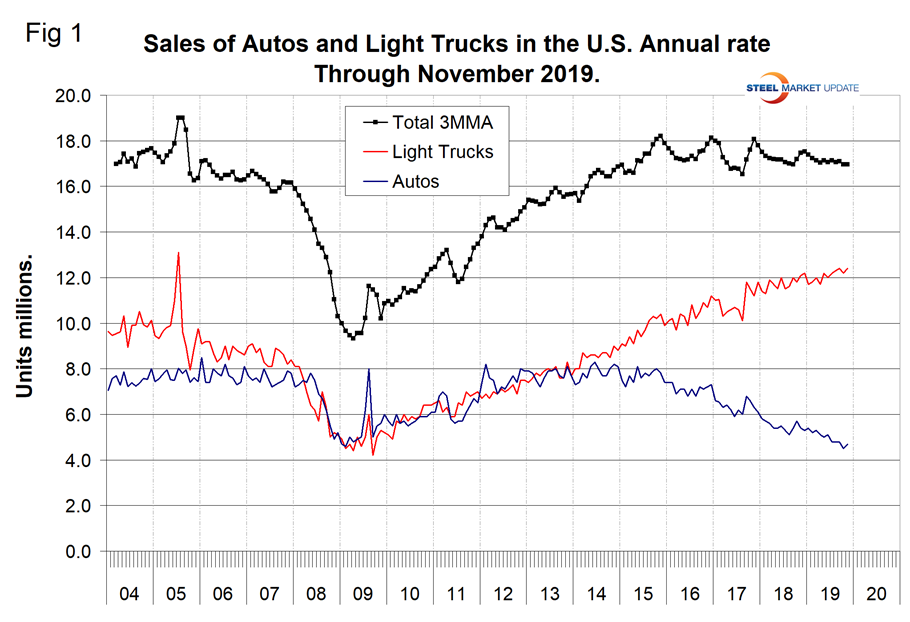

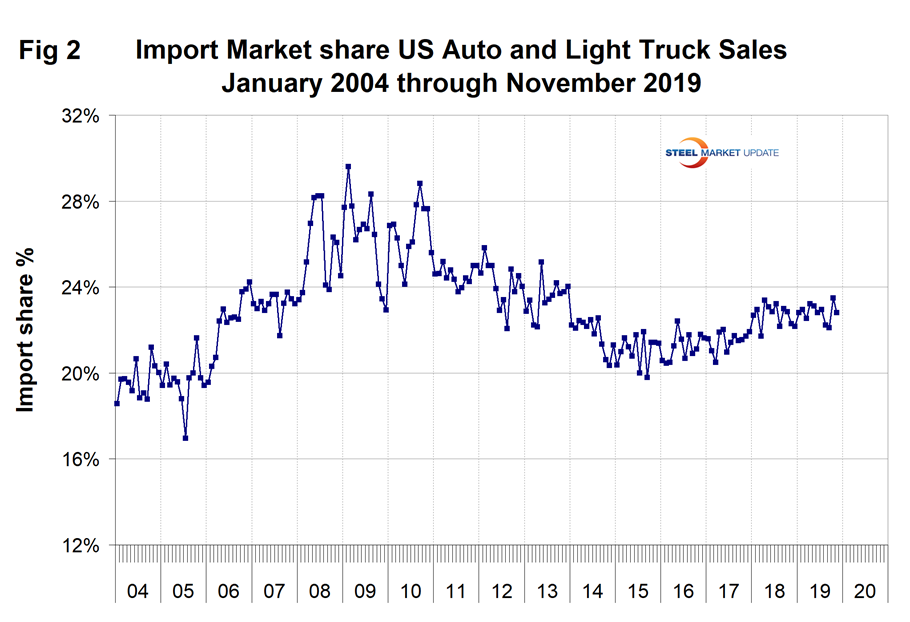

Figure 1 shows auto and light truck sales since January 2004. In November, total sales were down by 2.9 percent on a three-month moving average (3MMA) basis year over year. Light trucks that include pickups, SUVs and crossovers have been surging at the expense of cars for four years. In November, the mix was 72.5 percent light trucks and 27.5 percent autos. In 2019, import market share had a high of 23.5 percent in October and declined to 22.8 percent in November as shown in Figure 2.

North American Assemblies

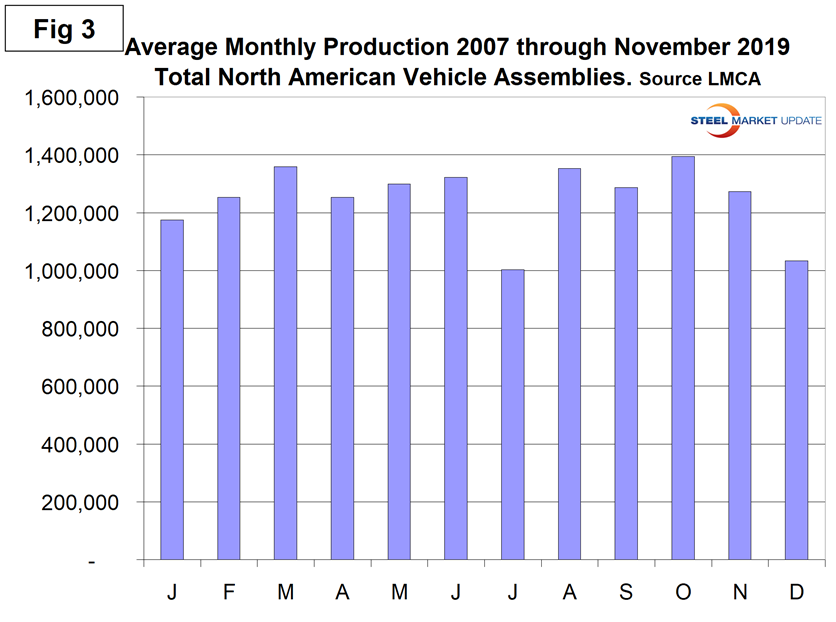

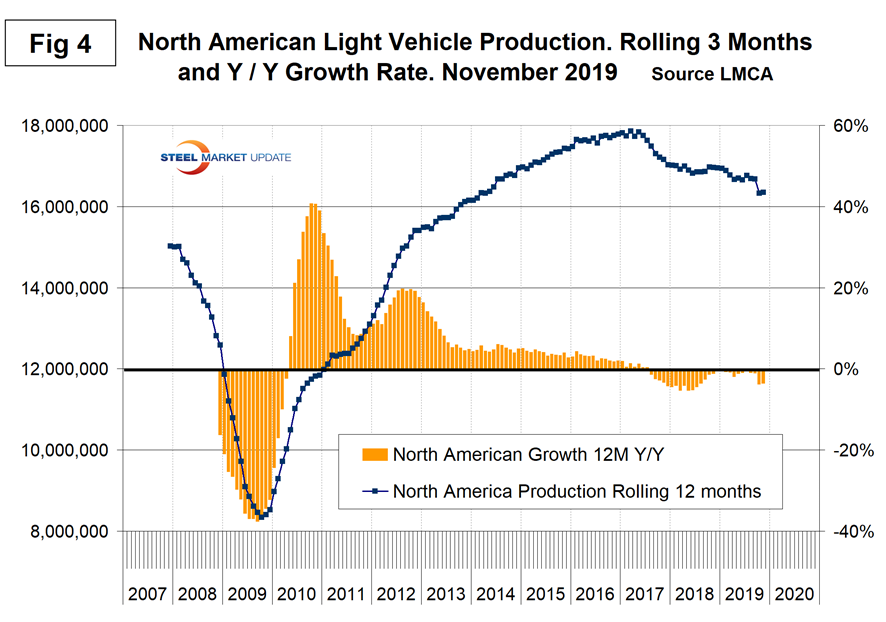

The United Auto Workers strike against General Motors began on Sept. 16 and lasted for 40 days, affecting more than 48,000 workers. By the beginning of November, all these people has been re-employed. The strike closed 34 GM plants across the U.S., forced suppliers to idle workers and disrupted operations in Mexico and Canada. Total light vehicle (LV) production in North America in November was at an annual rate of 17.2 million units, up from 15.1 million in October. On average since 2007, November’s production has been down by 8.7 percent from October. This year production was up by 14.2 percent as plants came back on stream. Figure 3 illustrates the seasonality of production on average since January 2007. On a rolling 12-months basis, total North American assemblies were down by 3.6 percent year over year through November. Note that production numbers are not seasonally adjusted; the sales data reported above are seasonally adjusted.

There has been a gradual slowdown in production since November 2017, which prior to the strike had almost stabilized as indicated by the brown bars in Figure 4.

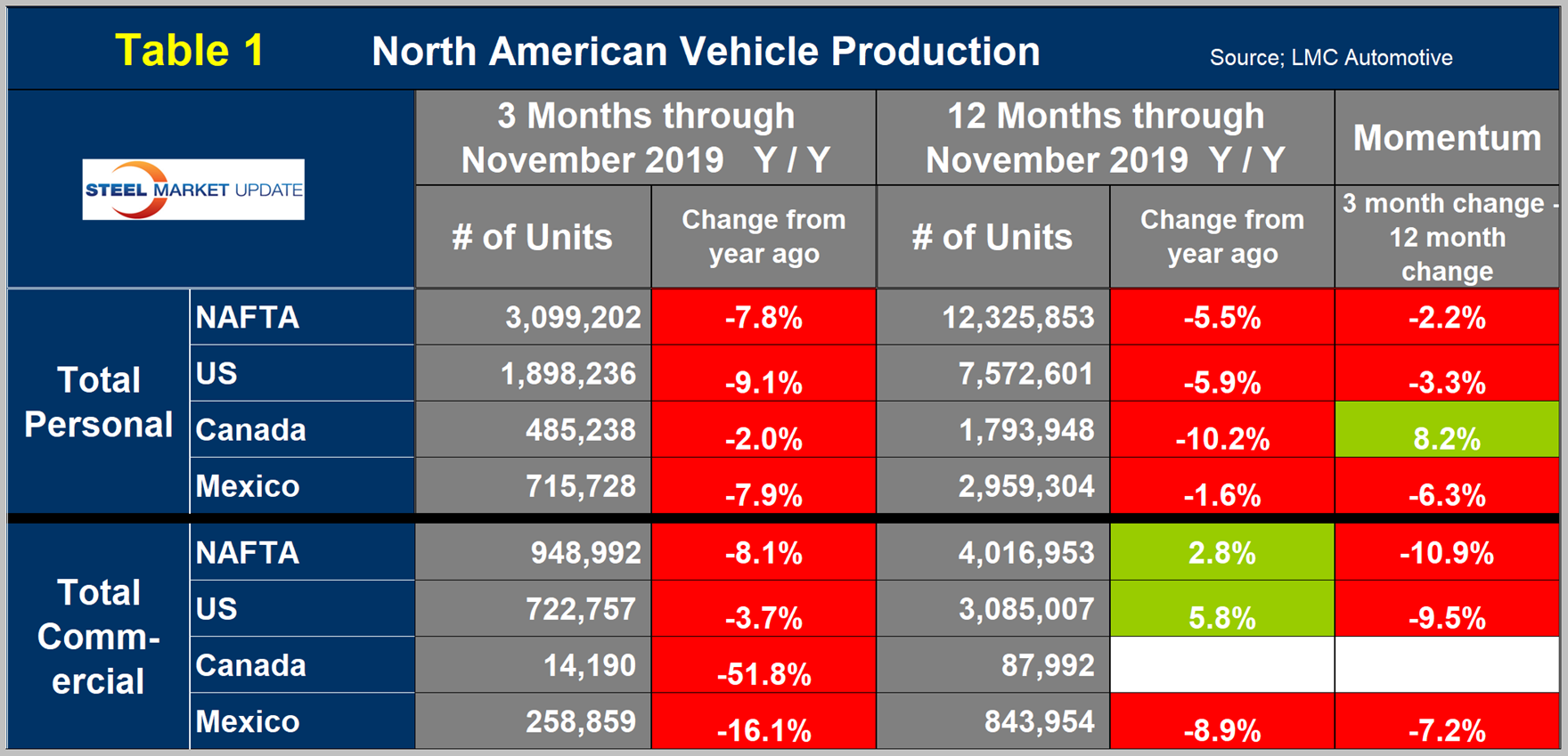

Table 1 is a short-term snapshot of assembly by nation and vehicle type. It breaks down total North American personal and commercial vehicle production into the U.S, Canada and Mexican components and the three- and 12-month growth rate for each. At the far right it shows the momentum for the total and for each of the three nations. In three months through November, assemblies of both personal and commercial vehicles were down in all three nations. We don’t know the magnitude of the strike effect on total assemblies, but as far back as January this year and since then the total of NAFTA assemblies was negative on a 3MMA basis year over year. Note, there are blank cells for Canadian commercial production in Table 1; see explanation below.

The longer-term picture is shown in the following charts by vehicle type and nation.

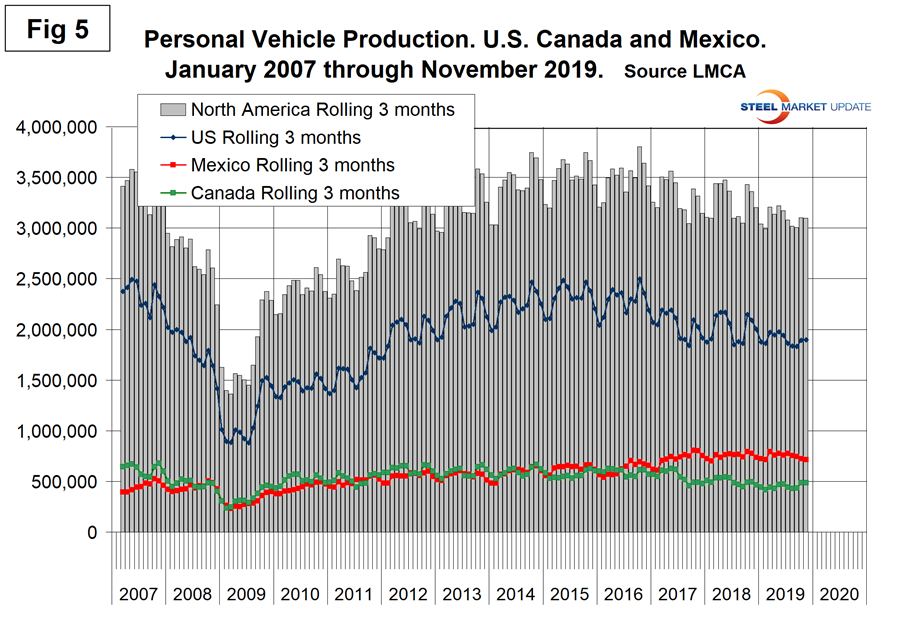

Figure 5 shows the total personal vehicle production for North America and the total for each nation.

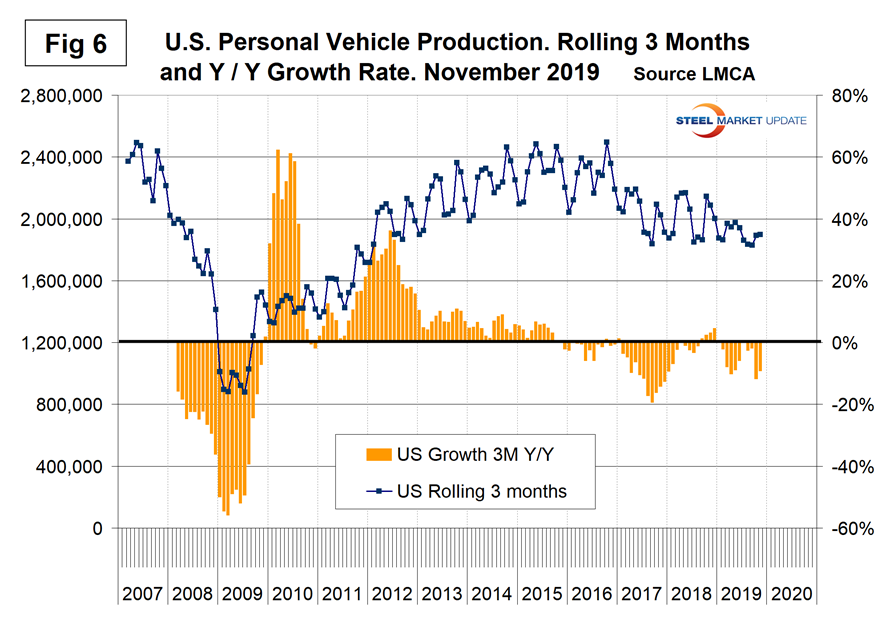

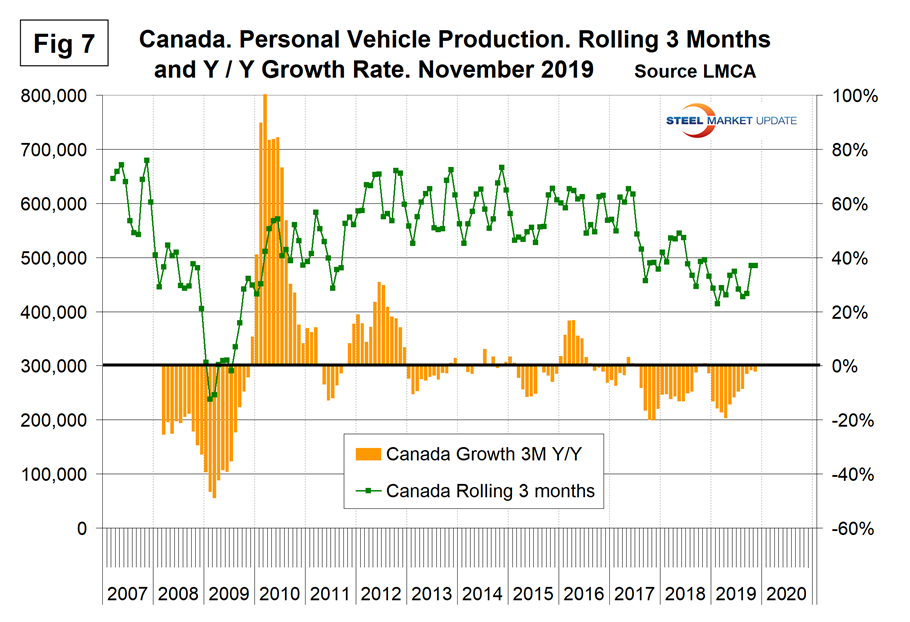

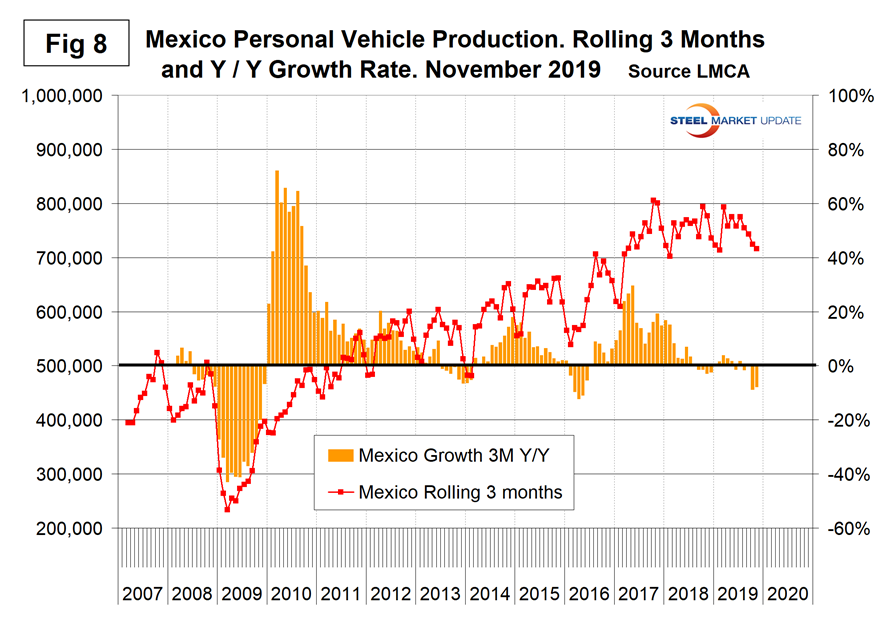

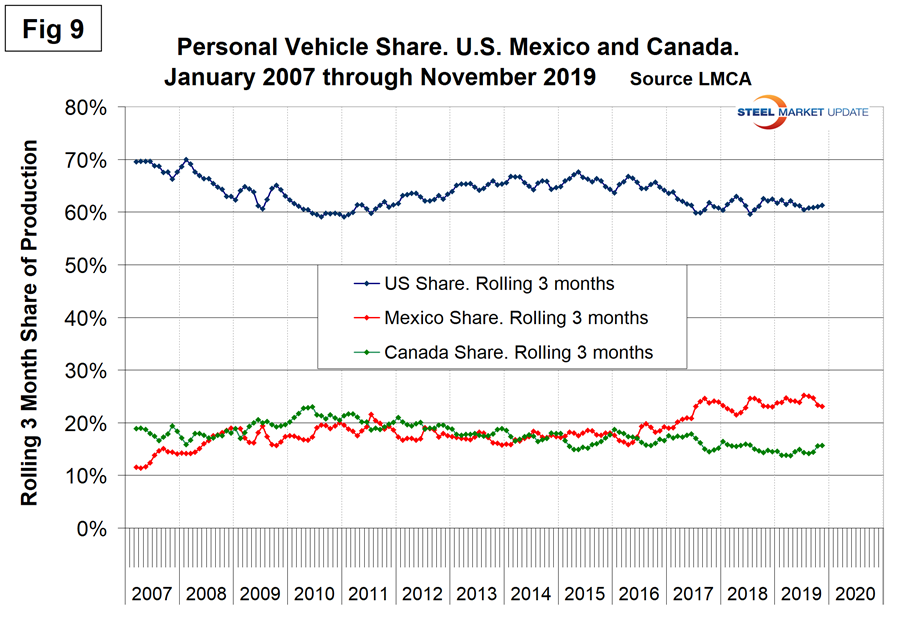

Figures 6, 7 and 8 show the production of personal vehicles by nation and the year-over-year growth rate for each. Figure 9 shows the production share for each nation. Production in the U.S. and Canada has declined since 2015 as Mexico has increased. The Mexican share rose from 17.2 percent in late 2014 to 25.2 percent in July 2019 before falling back to 23.1 percent in November.

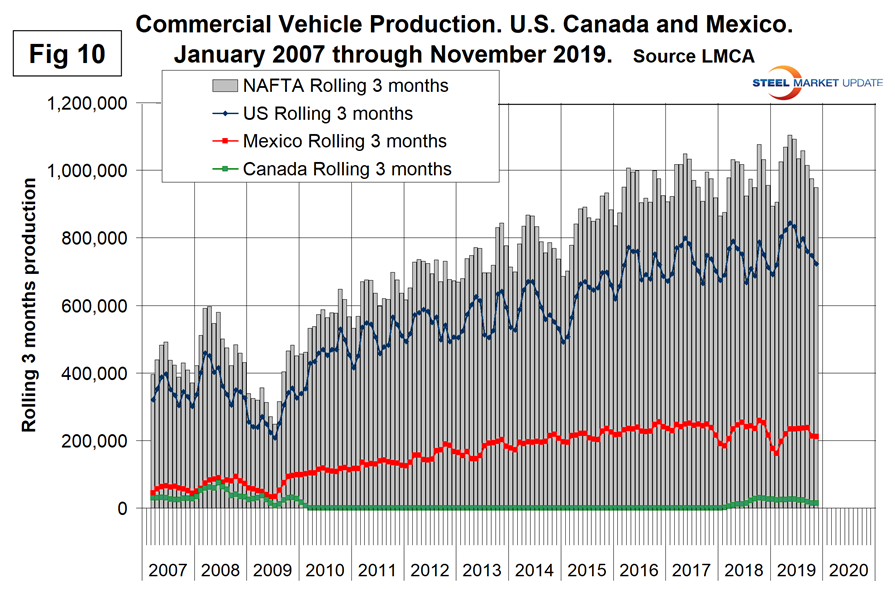

Figure 10 shows the total commercial vehicle production for North America and the total for each nation. The U.S. has held its ground much better in commercial vehicles than in the personal segment.

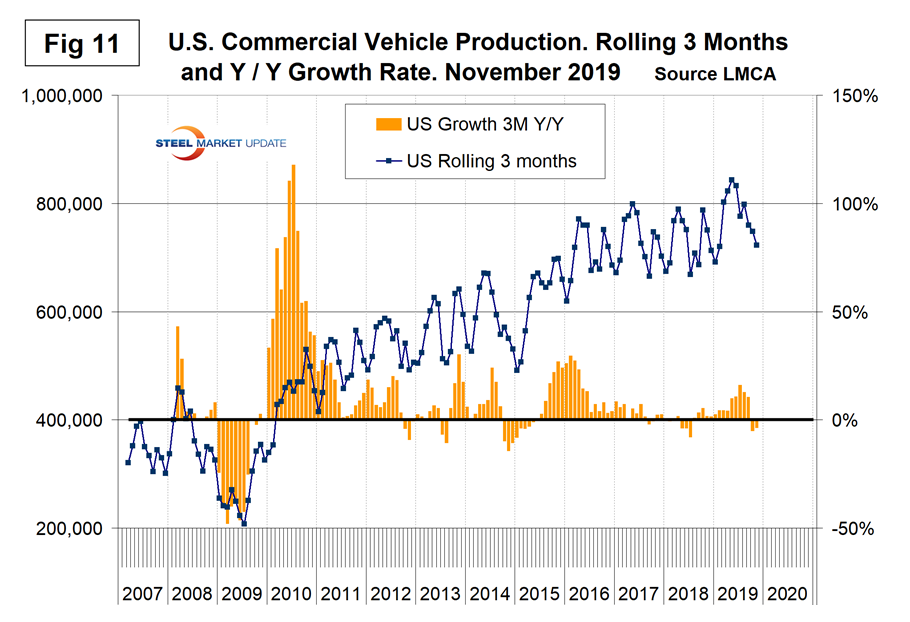

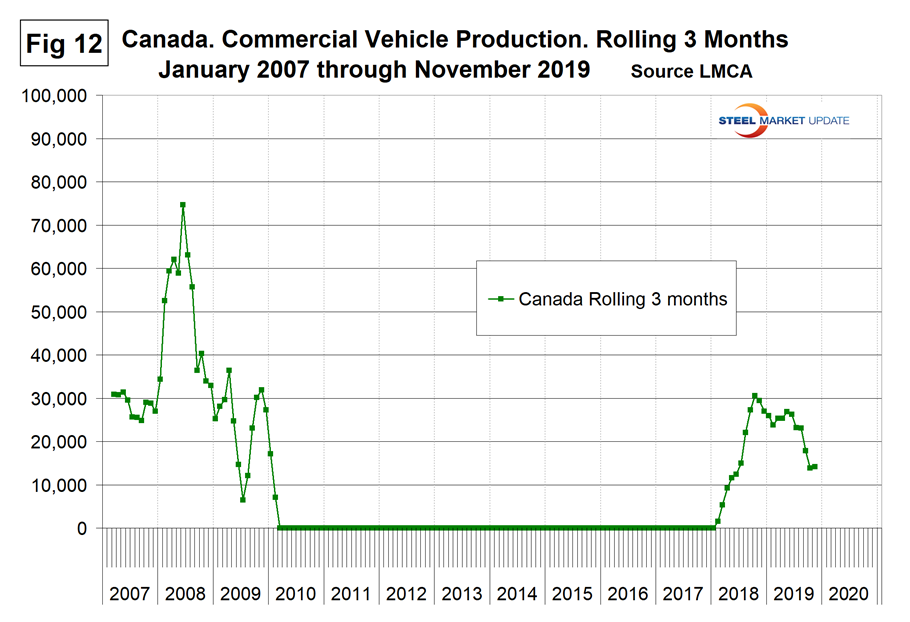

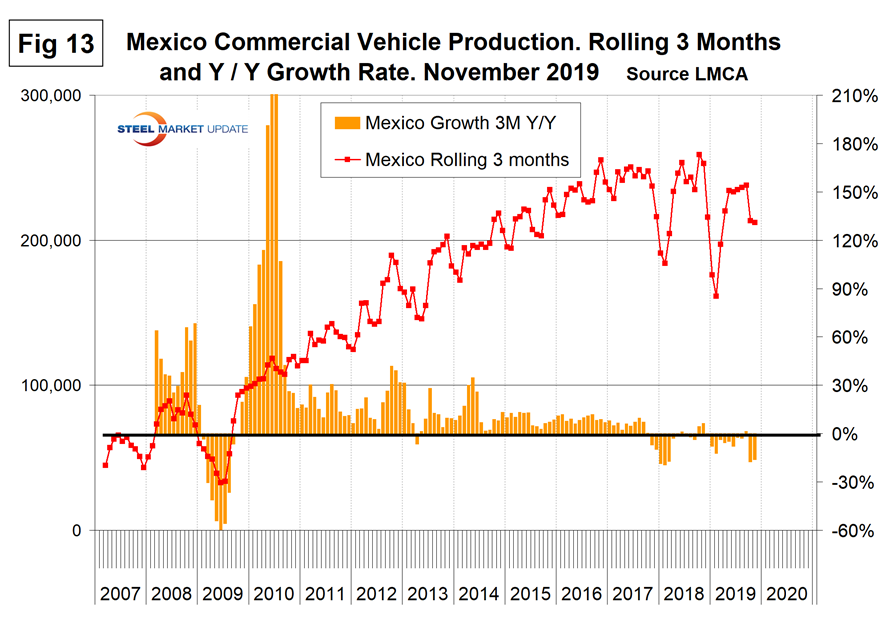

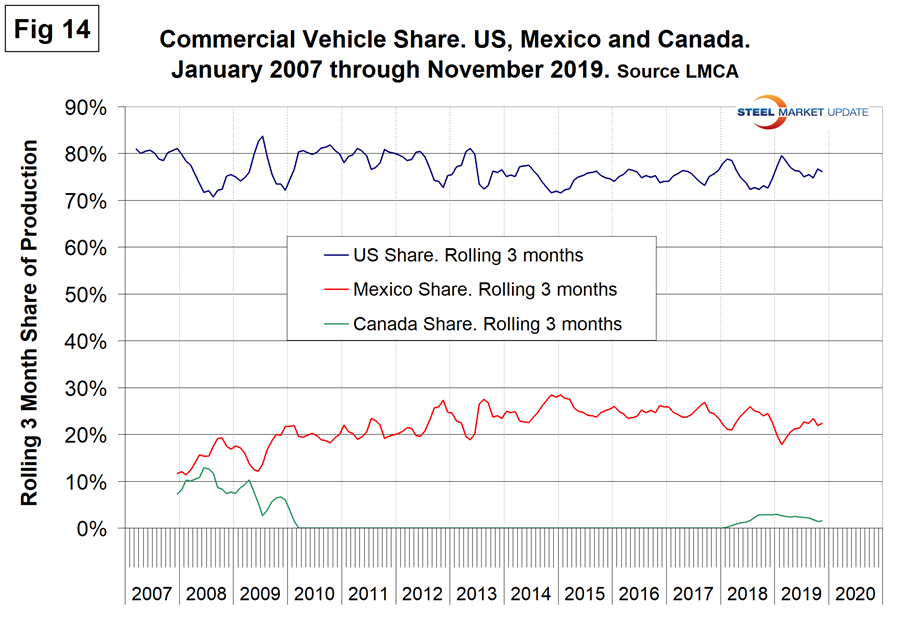

Figures 11, 12 and 13 show the production of commercial vehicles by nation and the year-over-year growth rate for each. Figure 14 shows the production share for each nation. Commercial vehicle production in Canada was zero from January 2010 through January 2018. The only Canadian plant making commercial vehicles in the past couple of decades was in Oshawa. At the end of 2009, they shifted their production from Silverados to the Chevy Camaro. That changed again in February 2018 when the Oshawa plant shifted away from the Equinox (personal vehicle) and again began to produce the Silverado and Sierra (both commercial vehicles). GM has declared their intention to permanently close the Oshawa plant.

Both the U.S. and Mexico have achieved strong growth in commercial vehicle assemblies since the recession and their production shares have been stable and almost a mirror image of each other in the short term. Mexico currently exports about 80 percent of its light vehicle production with the U.S and Canada as the highest volume destinations.

SMU Comment: The GM strike negatively affected assemblies in North America in the second half of September and most of October. This November report reflects the end of the labor action. However, regardless of the strike, there is no doubt that assembly volume in North America is declining. On a year-over-year basis, growth has been negative every month since July 2017.