Market Data

December 19, 2019

WSA: 2018 a Big Year for U.S. Steel Production

Written by Peter Wright

Steel Market Update is pleased to share this Premium content with Executive-level subscribers. For information on how to upgrade to a Premium-level subscription, email Info@SteelMarketUpdate.com.

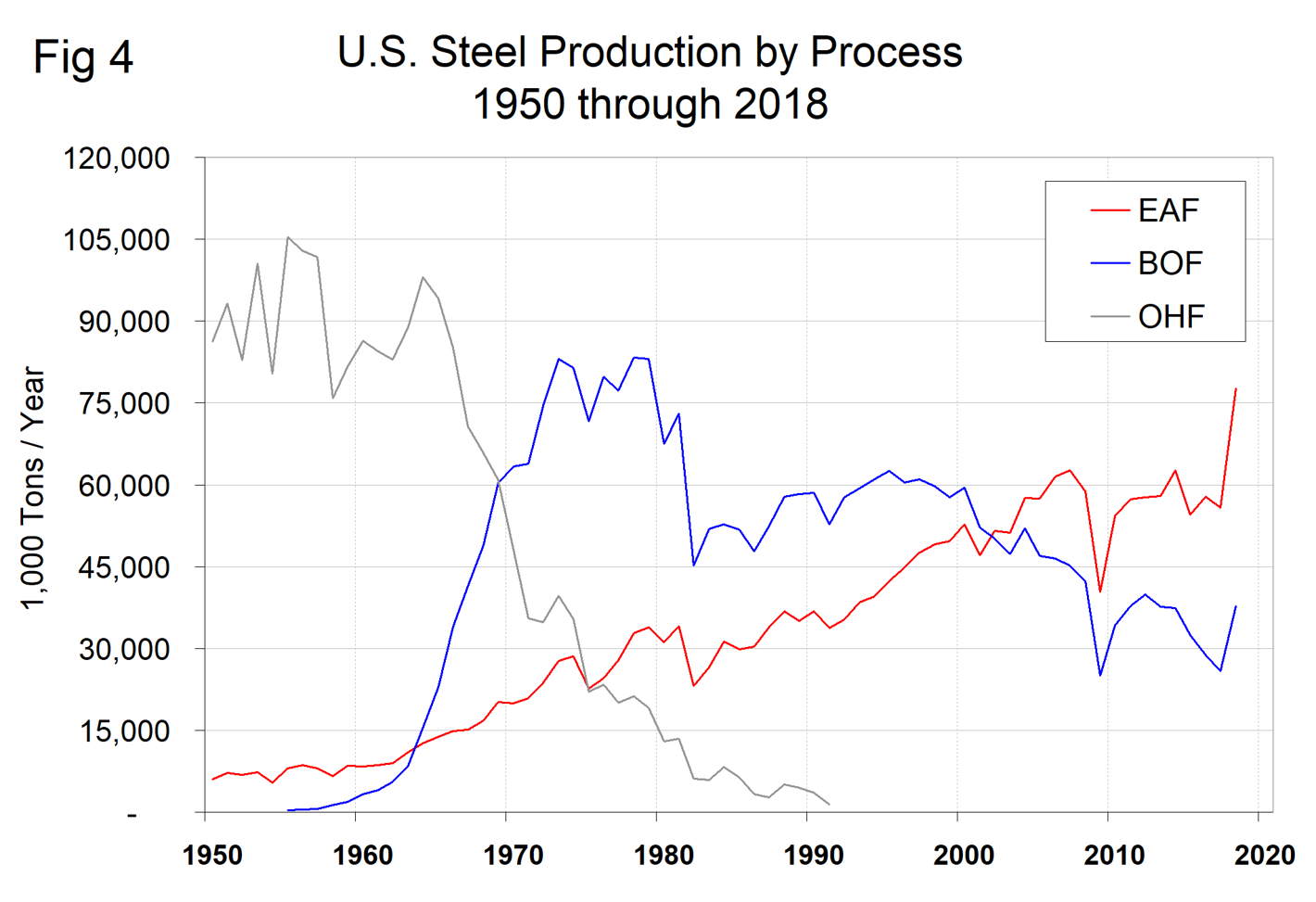

Steel production in the U.S. in 2018 was the highest since 1981, according to the World Steel Association, which released its statistical yearbook for 2018 on Dec. 16. Crude steel production in the U.S. hit 115,386,000 metric tons last year, the highest output in 37 years and the first year to exceed 100 million metric tons since 2008.

Figure 1 shows the history of U.S. steel production since 1880.

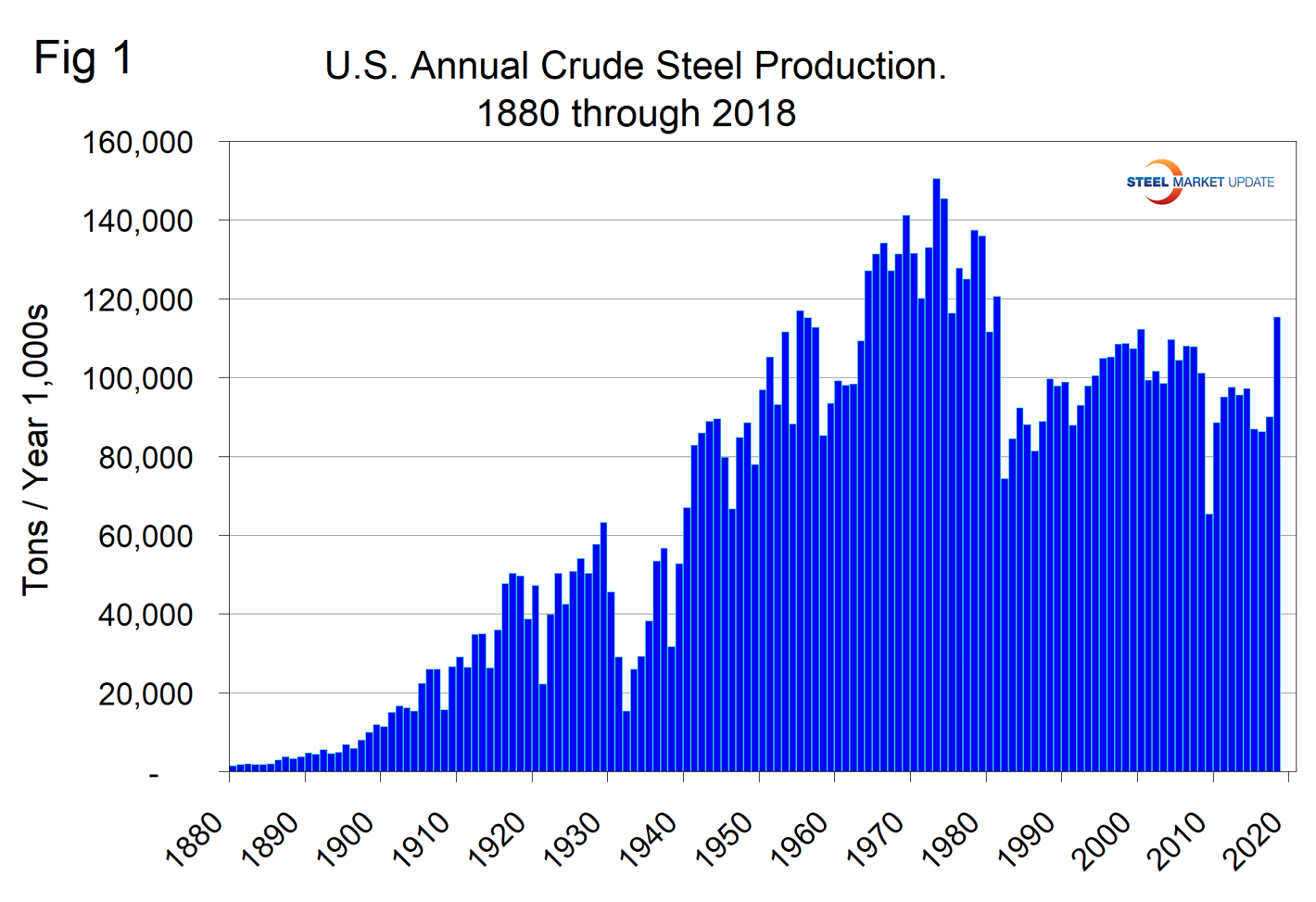

Minimills produced about two-thirds of the steel in 2018 as the electric arc furnace process continued to gain greater market share over basic oxygen furnaces. Last year, 67.3 percent of U.S. steel production was by the EAF process and 32.7 percent by the BOF (Figure 2).

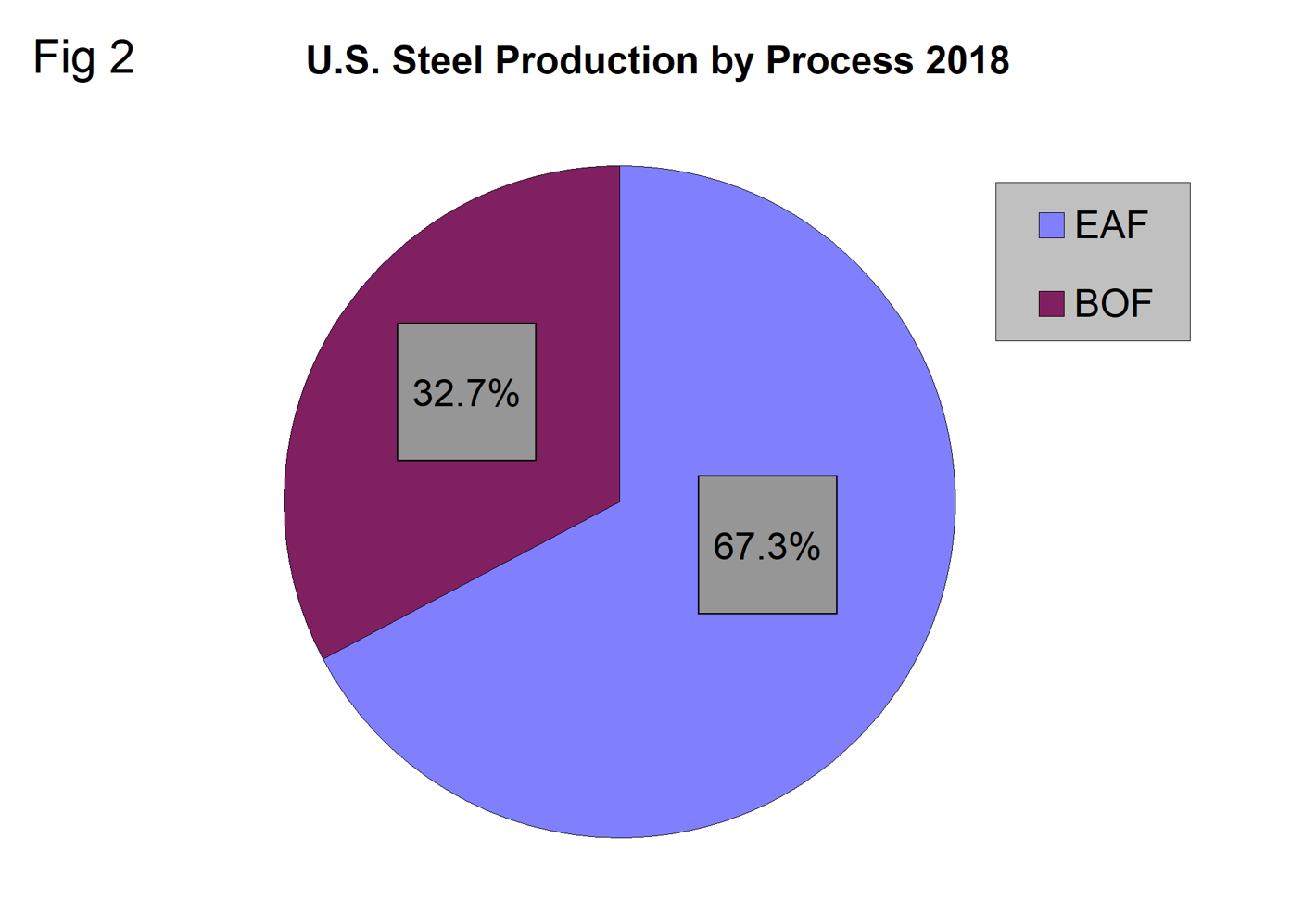

Looking back at history, 1955 was the first year for steel to be produced using the basic oxygen process. This was such a revolutionary improvement in energy efficiency and productivity that in the subsequent 36 years the BOF completely replaced the open hearth process as a producer of commercial steel products. In the U.S., 1991 was the last year for steel to be produced in an open hearth (Figure 3).

The evolution of manufacturing technology has continued to this day. EAFs were introduced in the late 1960s to recycle scrap into concrete reinforcing bars. By 1997, the EAF had captured a 100 percent share of the market for all long products. The last holdout for BOF production of long products was wide flange beams at Bethlehem Steel’s Steelton plant. In 1989, Nucor began production of sheet steel at their greenfield Crawfordsville, Ind., plant, which introduced the thin slab casting process. In 2003, the EAF became the predominant process for steel manufacture in the United States.

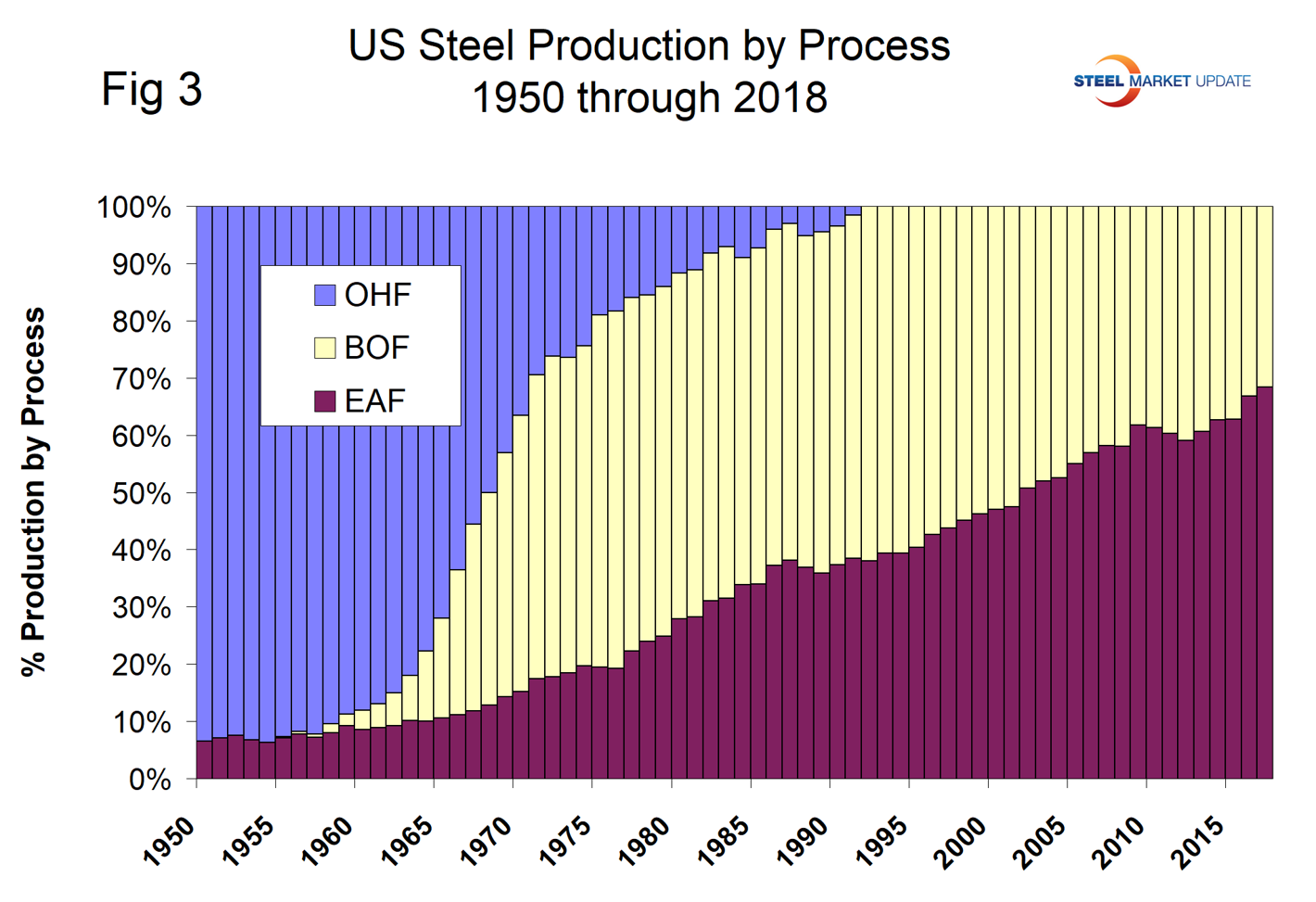

Based on announced capacity increases, this trend will continue for the foreseeable future (Figure 4).