Analysis

December 19, 2019

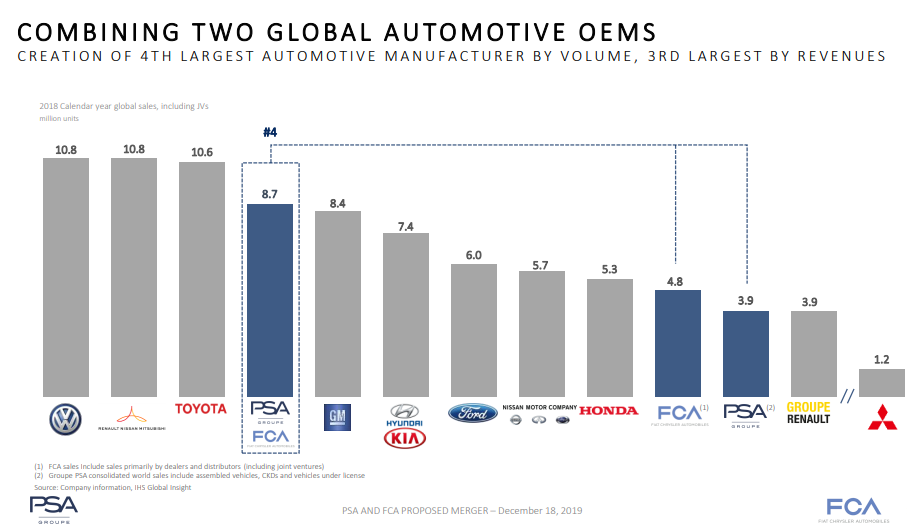

Merger of Fiat Chrysler and Peugeot Forms Fourth Largest Automaker

Written by Sandy Williams

FCA and PSA Peugeot signed a binding agreement on Dec. 18 providing for a 50/50 merger to create the fourth largest global auto manufacturer by volume and third largest by revenue.

The combined company will have annual unit sales of 8.7 million vehicles and expected revenue of nearly $189 billion, based on 2018 results. The merger will expand the group’s geographic balance with 46 percent of revenues derived from Europe and 43 percent from North America. The group expects to have positive free cash flow in the first year and annual synergies of $4.1 billion without any plant closures. Eighty percent of savings are expected to be achieved by year four.

“With its combined financial strength and skills, the merged entity will be particularly well placed to provide innovative, clean and sustainable mobility solutions, both in a rapidly urbanizing environment and in rural areas around the world,” said the FCA and PSA in a press release. “The gains in efficiency derived from larger volumes, as well as the benefits of uniting the two companies’ strengths and core competencies, will ensure the combined business can offer all its customers best-in-class products, technologies and services and respond with increased agility to the shift taking place in this highly demanding sector.”

The new group plans to offer luxury, premium and mainstream passenger cars as well as SUVs, trucks and light commercial vehicles. Two-thirds of production will be concentrated on just two platforms (small and compact/midsize), each producing approximately three million cars annually.

The combined companies will be governed by a Board of Directors comprised of 11 members. FCA and PSA will nominate five members each and, upon closing, the board will also include two members representing FCA and PSA employees.

Carlos Tavares will be group CEO for an initial term of five years and will also be a member of the board. John Elkann will serve as Group Chairman.

“Our merger is a huge opportunity to take a stronger position in the auto industry as we seek to master the transition to a world of clean, safe and sustainable mobility and to provide our customers with world-class products, technology and services,” said Tavares. “I have every confidence that with their immense talent and their collaborative mindset, our teams will succeed in delivering maximized performance with vigor and enthusiasm.”

Mike Manley, CEO of FCA, added: “This is a union of two companies with incredible brands and a skilled and dedicated workforce. Both have faced the toughest of times and have emerged as agile, smart, formidable competitors. Our people share a common trait–they see challenges as opportunities to be embraced and the path to making us better at what we do.”

The merger is expected to be completed within 12-15 months subject to customary closing conditions by European and American regulators.