Prices

December 19, 2019

Hot Rolled Futures: Market Extremely Active

Written by Gaurav Chhibbar

SMU contributor Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Gaurav’s previous role, he was a trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. You can learn more about Metal Edge at www.metaledgepartners.com. Gaurav can be reached at gaurav@metaledgepartners.com for queries/comments/questions.

The steel futures market has been extremely active in the past few days. Large parts of the activity are coming in the second half of 2020. The sudden change of tune, as well as the size of volume transacting, is attracting increased interest of bystanders who are busy trying to get insights as to “what really is happening?” This writeup will try and provide some color to help explain.

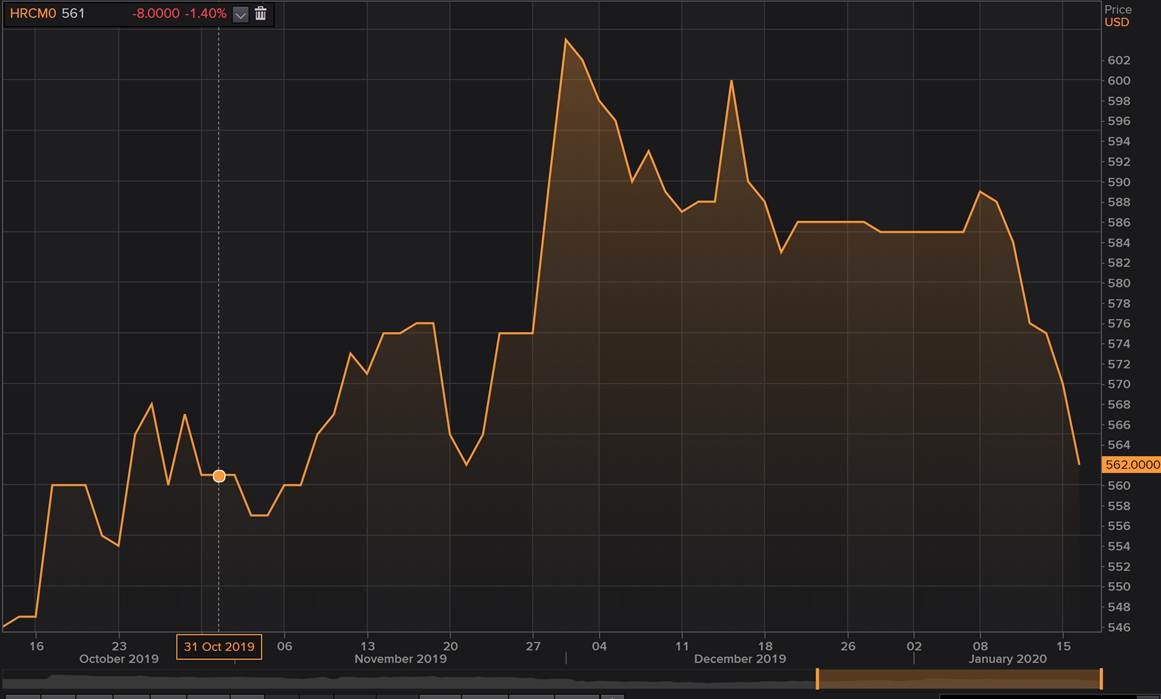

As we all know from previous weeks, the futures had been reflecting the bullish view that was held by the mills. As new price increases were rolled out, the forward curve had taken a jump. The chart below shows the movement of the March 2020 contract, the prices for which peaked in the low $600s before moving lower to $580 on settlement today.

This move lower is a bit more prominent in the second half of 2020. Looking at the June contract, prices have come down $40 from their peak.

Although in my mind the question to ask is, “why are the prices falling so rapidly?” a friend of mine had a different question in mind. A pertinent one for those living in the realm of physical steel. He simply asked, “why did they go that high when the index was not anywhere close?” To answer simply, the futures reflect the expectation where buyers and sellers believe prices will be at any given moment, given the information and the market view that they have. Two weeks ago the market was hearing about strong scrap, operational issues at integrated mills, low inventories and stable international markets.

Some, if not all of those things, have changed. Scrap forecasts are calling for a softer Feb., mills seem to be able to do a good job making tons available in the market for Feb., and lastly buyers don’t seem to be very concerned about supply all of a sudden.

This behavior or view of the market has led to a change in the shape of the curve as reflected in the chart below. I apologize for the rather small font, but I’ll try and get the point across. The chart below is the difference in the 6th month HR contract (contract trading in the 6th month from today) and the 2nd month HR contract (contract trading in the 2nd month from today). The yellow line is the average (near zero) and the blue and green lines are 1 standard deviation from the mean.

This chart shows the extent of backwardation and carry (steepness) in curve. We were in a period of contango (when futures prices are higher than spot) and are now reversing back to a decent backwardation (futures prices below spot). This cyclical trend is important to note because it also explains the behavior of those trading today. As more spreads trade and positions get rolled from 1H 2020 to Q320 and Q420, the back half will logically move lower and the backwardation will increase. Needless to say, the more that we doubt or give up on hope of this rally to sustain, the more the back end moves lower. Welcome to 2020!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.