Analysis

December 18, 2019

Existing Home Sales Edge Down in November

Written by Sandy Williams

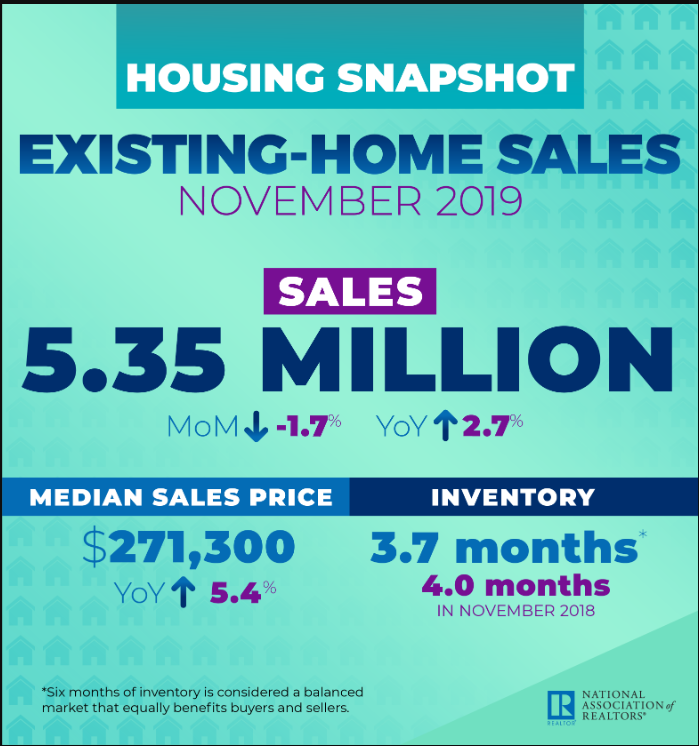

Existing home sales slipped in November after making gains in October, according to the latest report from the National Association of Realtors. Completed transactions fell 1.7 percent to a seasonally adjusted annual rate of 5.35 million last month, but were up 2.7 percent from a year ago.

Inventory totaled 1.64 million units, a decrease of 7.3 percent from October and 5.7 percent from November 2018. At the current sales rate, there is a 3.7-month supply of homes for sale, down from 3.9 months in October.

Prices increased in all regions during November with the median existing home price up 5.4 percent to $271,300. Price gain was highest in the West, gaining 7.1 percent.

Single-family home sales were at a SAAR of 4.79 million in November, down from 4.85 million in October, but up 3.5 percent from a year ago. The median existing single-family home price was $274,000 in November 2019, up 5.4 percent from November 2018.

Existing condominium and co-op sales were down 5.1 percent from October and 3.4 percent lower than a year ago at a SAAR of 560,000 units. The median existing condo price increased 4.5 percent from a year ago to $248,200 in November.

Compared to October, sales increased 1.4 percent in the Northeast and 2.3 percent in the Midwest. Sales declined 3.9 percent in the South and 3.5 percent in the West.