Market Data

December 17, 2019

Service Centers Increasingly Support Mill Increases with their Spot Pricing

Written by John Packard

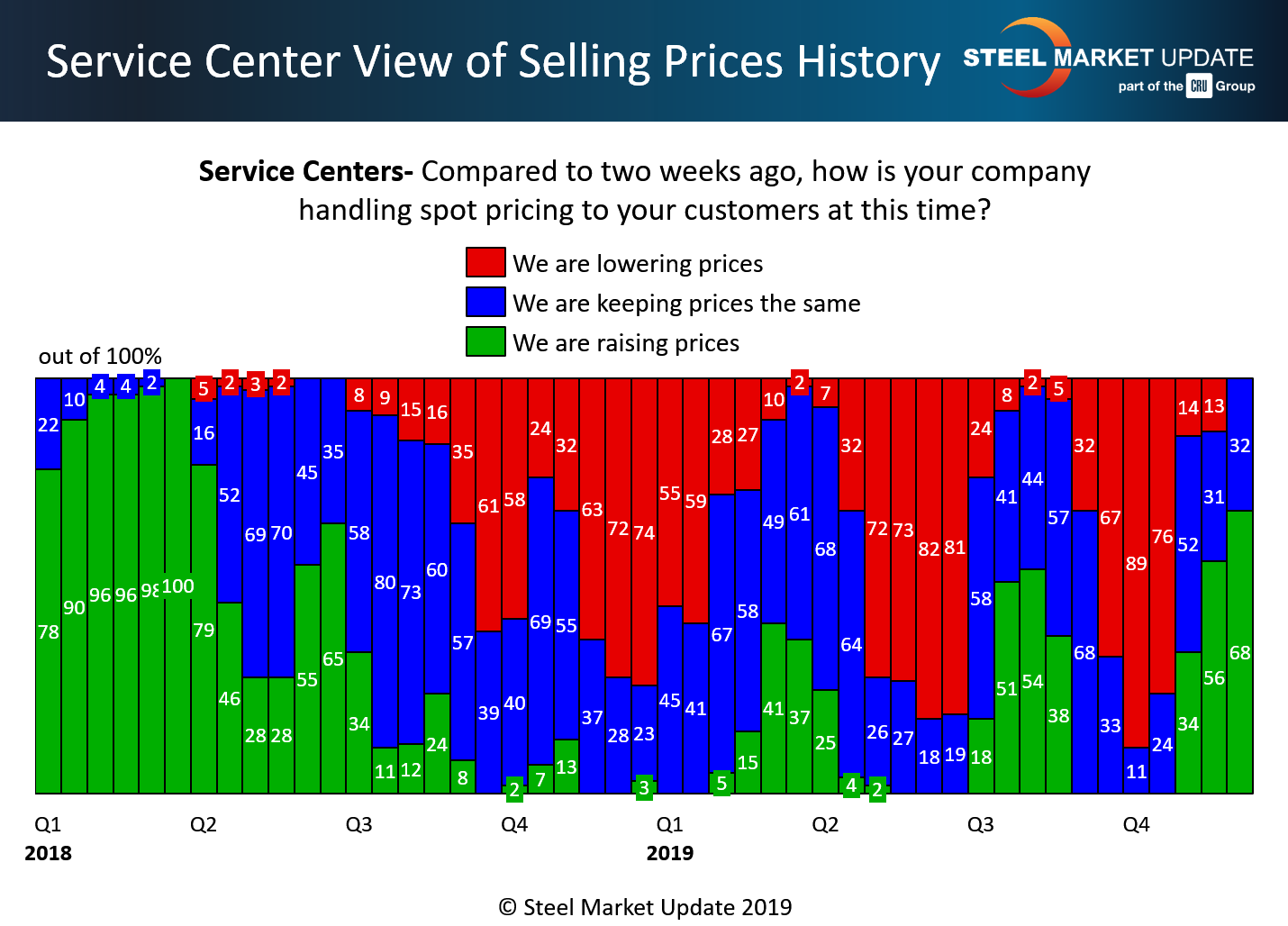

Steel Market Update conducts two flat rolled and plate steel market trends surveys every month. Our early December analysis indicates the flat rolled distributors are raising spot prices to their end-user customers, and in the process supporting at least a portion of the four recent price increases totaling $150 per ton ($7.50/cwt). Whether the mills are successful in collecting these increases comes down to many factors. One key factor identified by Steel Market Update is how service centers are handling spot pricing to their flat rolled end-user customers.

The data we collected a couple of weeks ago is providing a foundation for successful collection of the price increases. By successful we mean better than what transpired earlier this year when we saw two attempts to move prices higher that were not supported by the domestic distributors and ultimately failed.

Let’s review the data to see what is different than the previous two attempts to move pricing.

A higher percentage of steel distributors responding to our flat rolled and plate steel market trends questionnaire reported flat rolled spot prices as being increases compared to where they were two weeks ago (remember, this survey was completed on the 8th of December and we have another survey in process this week). We saw 68 percent of those responding to this question reporting moving spot prices higher. This is up from 56 percent measured during the middle of November, and is the highest level seen since early second-quarter 2018.

What is also encouraging is the lack of companies reporting any erosion of spot prices. This is important, especially when considering we are at the end of the calendar year when taxes, inventories and cash flows are important to steel distributors.

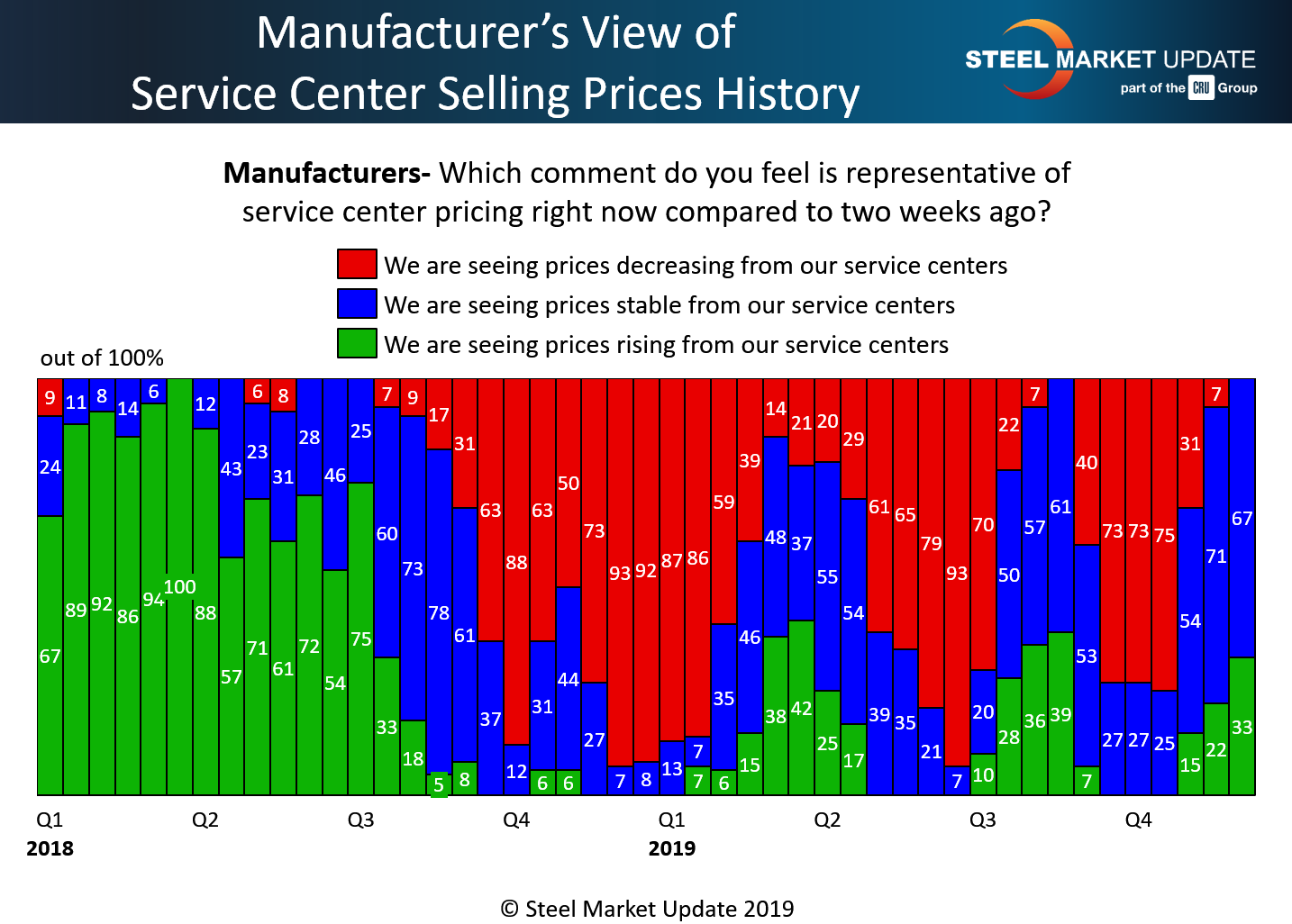

The only possible negative seen at the beginning of this month was only 33 percent of the manufacturing companies reported higher spot prices out of their service center suppliers. This is in line with the results captured during the two previous attempts to raise prices in first-quarter 2019 and again during the third quarter.

However, the manufacturing companies did agree with the service centers in that there was no one lowering spot prices.

On Sunday, we will publish the results we are collecting from the questionnaire we have ongoing right now.