Market Data

December 16, 2019

Service Center Inventories and Shipments Report for November

Written by Estelle Tran

Steel Market Update’s analysis of flat rolled and plate inventories and shipments for the month of November:

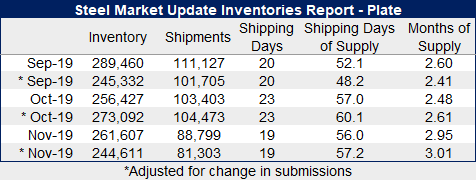

Flat Rolled = 51.1 Shipping Days of Supply

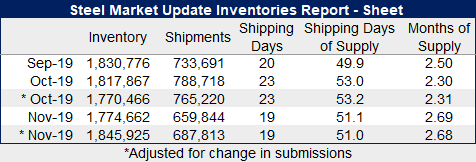

Plate = 56 Shipping Days of Supply

Flat Rolled

Sheet steel inventories increased in November, and the SMU Service Center Inventories Report shows that service centers have an abundance of material on order, too.

At the end of November, service centers carried 51.1 shipping days of supply on hand, down from 53.2 days. This number is slightly skewed because November had 19 shipping days compared with October’s 23. This elevated the daily shipping rate. In terms of months on hand, service centers carried 2.69 months of sheet inventory on hand at the end of November, up from 2.3 in October.

Adjusted inventories in November represent a 1.5 percent increase month on month. The adjusted November data aligns with the October data. The adjusted on-order volumes also increased 10.5 percent month on month.

Looking ahead, we expect the elevated inventory levels to persist in the near term, as demand drops off in December and service centers take possession of inventory on order. On-order volumes priced with index-minus contracts will be at significantly lower levels than current spot prices. This may create pressure on mill pricing, as they try to enforce their price increases.

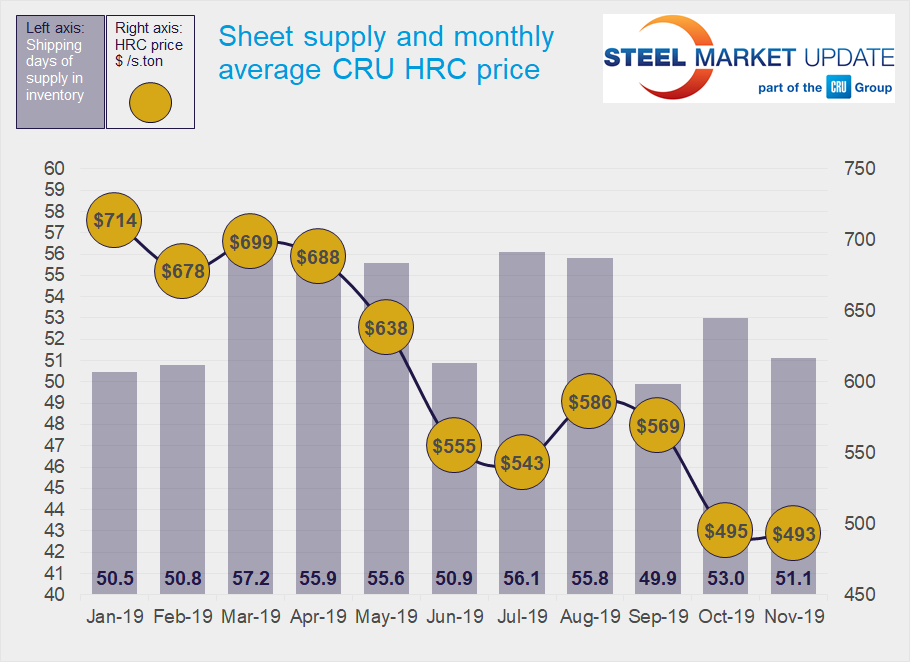

Plate

Adjusted plate inventories in November edged down 4.6 percent month on month, though inventories calculated as days of supply were flat.

Service centers carried 56 days of plate supply in November, compared to 57 in October. In terms of months of supply on hand, service centers carried 2.95 months of plate supply at the end of November, up from 2.48 months in October.

The adjusted daily shipping rate went down 4.8 percent, even with four fewer shipping days in November. This shows how anemic service center plate shipments have been.

The on-order volumes increased; however, they have not yet risen to a point that would signal a high level of confidence in pricing. There was only a 4.9 percent month-on-month increase in on-order volumes in November on an adjusted basis.

The November service center data shows some moderate restocking by service centers, as mills push to raise prices. We expect inventories to build further as service centers gain confidence in plate pricing stability and business slows down in December.