Analysis

December 16, 2019

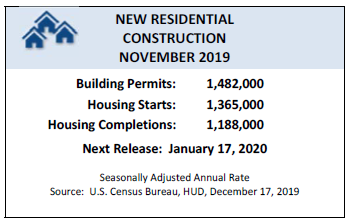

Housing Starts Increase in November

Written by Sandy Williams

November housing starts increased 3.2 percent from October and 13.6 percent from November 2018, indicates the latest report from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

“On a year-to-date basis, single-family starts are just 0.4 percent lower than the first 11 months of 2018,” said National Association of Home Builders Chief Economist Robert Dietz. “NAHB’s forecast, and the forward-looking HMI, suggest that future data will show modest monthly gains due to lower mortgage interest rates. Indeed, the rate of single-family permits has been increasing since April as the home construction rebound continues. We expect additional single-family growth as areas beyond the exurbs respond to for-sale housing demand and healthy labor markets.”

Building permits, a measure of future construction, rose 1.4 percent from October and 11.2 percent from a year ago. Multi-family authorizations outpaced single-family permits, gaining 4.4 percent versus 0.8 percent.

Authorizations jumped 18.1 percent in the Northeast, 15.1 percent in the Midwest and 1.3 percent in the West. Permit authorizations fell 4.7 percent in the South.

According to NAHB data, as of November 2019, there were 526,000 single-family homes under construction. There are currently 644,000 apartments under construction, up 5 percent from a year ago and marking a post-Great Recession high.