Market Data

December 9, 2019

SMU Steel Buyers Sentiment Index: Optimism Leveling Off?

Written by Tim Triplett

Steel buyers sentiment, which had been trending up for the past several weeks right along with steel prices, showed the first signs of leveling off this week. Both the Current and Future Sentiment readings had only a 1 point change in the latest data.

The goal of the index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today (Current Sentiment Index), as well as three to six months into the future (Future Sentiment Index). Results from SMU’s market trends questionnaire this week are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend.

As a single data point the Current Sentiment reading of +46 is down a point from two weeks ago. Nevertheless, the current reading is still 20 points higher than in early October when the index hit its lowest point since June 2013. While indicating considerably more optimism about current market conditions, the reading is still 14 points below the level at this time last year.

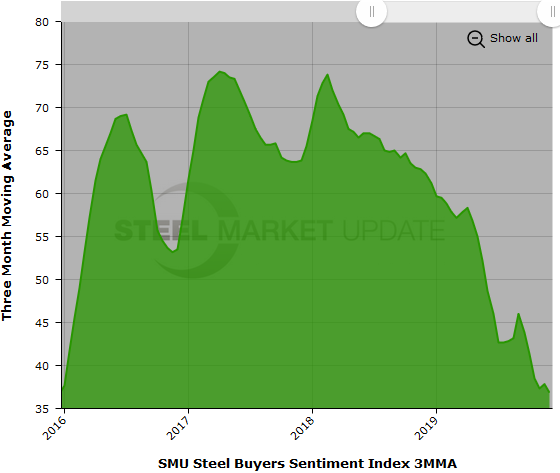

Measured as a 3MMA, Current Sentiment is at +36.83, down slightly from mid-November and at its lowest level in four years. At this time last year, the Current 3MMA was 62.33.

Future Sentiment

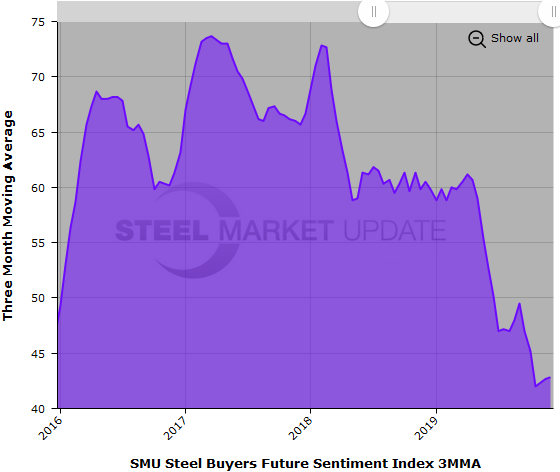

Future Sentiment as a single data point registered +52 in the latest data, up a point from mid-November. The Future Sentiment 3MMA is +42.83, showing a small improvement over the last few weeks, but still less than a point above its lowest reading since July 2013. At this time last year, the Future Sentiment 3MMA registered 60.50.

All the current readings are above zero and on the optimistic half of SMU’s scale, therefore more positive than negative, but they remain far short of the readings at this time in 2018.

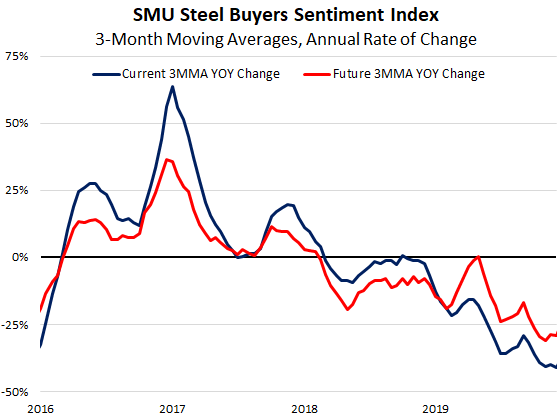

Steel buyers sentiment has been trending downhill since 2017, as shown by the chart below tracking the annual rate of change in the three-month moving averages. This week’s data suggests the recent upturn may be short-lived.

What Respondents Had to Say

“Demand has been lackluster this fall compared to normal years. Customers continue to scale back inventory and run much leaner.” Manufacturer/OEM

“Costs for steel and aluminum are being artificially raised by trade tariffs applied at the whim of a tweet, creating non-uniform costs for some producers like slab converters and their customers. The environment is very challenging.” Trading Company

“It would be excellent if everyone would sell off either their new higher replacement costs or actual costs on hand, and not the lowest new price that WAS available.” Service Center/Wholesaler

“There’s too much uncertainty driven by the current U.S. government trade action—or lack of action in the case of U.S.-China.” Trading Company

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 500 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 40 percent were manufacturers and 44 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.