Market Data

November 27, 2019

Conference Board: Signs of Weakening in Consumer Confidence

Written by Peter Wright

The Conference Board’s September-November reports on consumer confidence show an increased weakening of people’s expectations.

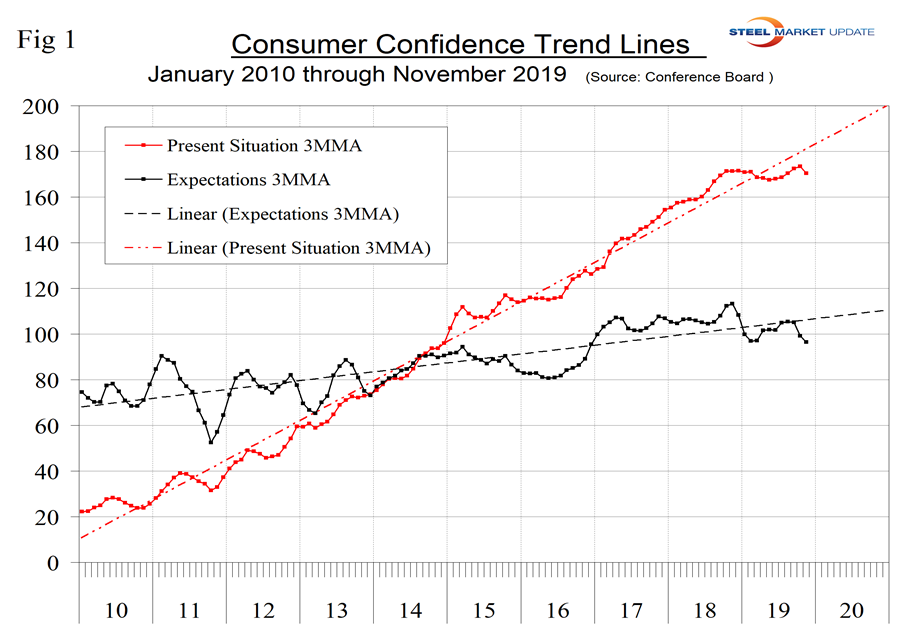

Consumer confidence as reported by The Conference Board is quite a volatile indicator; therefore, we prefer to smooth the data with a moving average to reduce monthly variability. The composite value of consumer confidence in November was 125.5 with a three-month moving average (3MMA) of 126.0. The 3MMA has decreased from 132.1 in September. The composite index is made up of two sub-indexes: the consumer’s view of the present situation and his or her expectations for the future. In November, both consumers’ view of the present situation and their expectations were below the nine-year trend line (Figure 1).

We have a high regard for Moody’s Analytics analyses, but on this subject in November find we have drawn different conclusions. Moody’s summarized as follows: “U.S. consumers remain upbeat despite a dip in November. The Conference Board’s consumer confidence index declined to 125.5 from a revised 126.1 in October (previously 125.9). Expectations rose from 94.5 to 97.9. Consumers’ assessment of current conditions slumped, dropping from 173.5 to 166.9. The labor market differential, or the difference between the share of respondents saying jobs are hard to get minus those saying jobs are hard to find, weakened. Buying plans were mixed. Fundamentals remain solid for consumers, and they will be the key cog for the economy.”

The difference between our conclusions arises because SMU considers three-month moving averages over an extended time frame. Moody’s takes a shorter view of single month-on-month results. It is true that both the present and expectation components are historically high, but it’s also true that expectations are 16.9 points down from where they were last November.

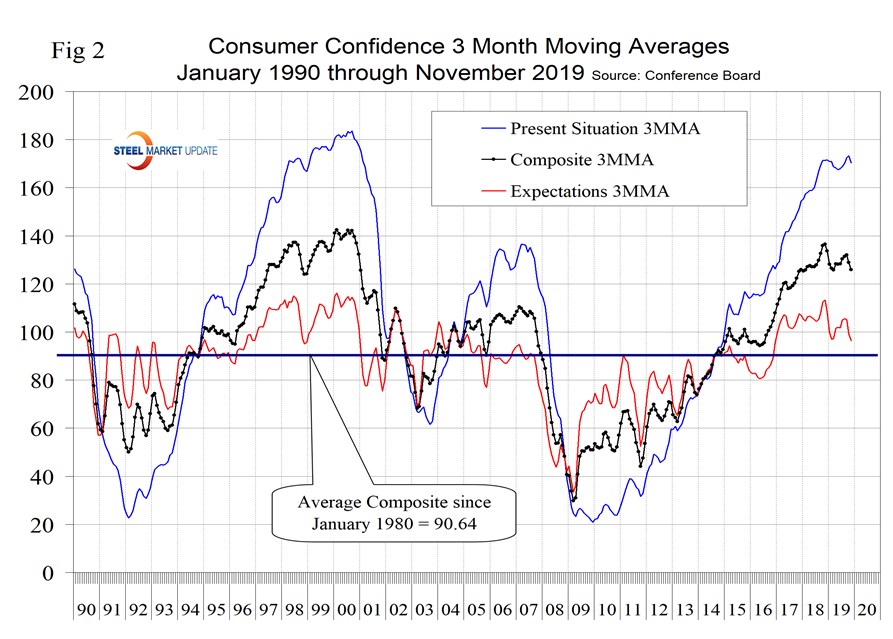

The consumer’s view of the present situation in August at 176.0 was the highest since December 2000. November saw a decline to 166.9 with a 3MMA of 170.3. The 3MMA of expectations in November was 96.4, down from 105.5 in August. The historical pattern of the 3MMA of the composite, the view of the present situation and expectations since January 1990 are shown in Figure 2.

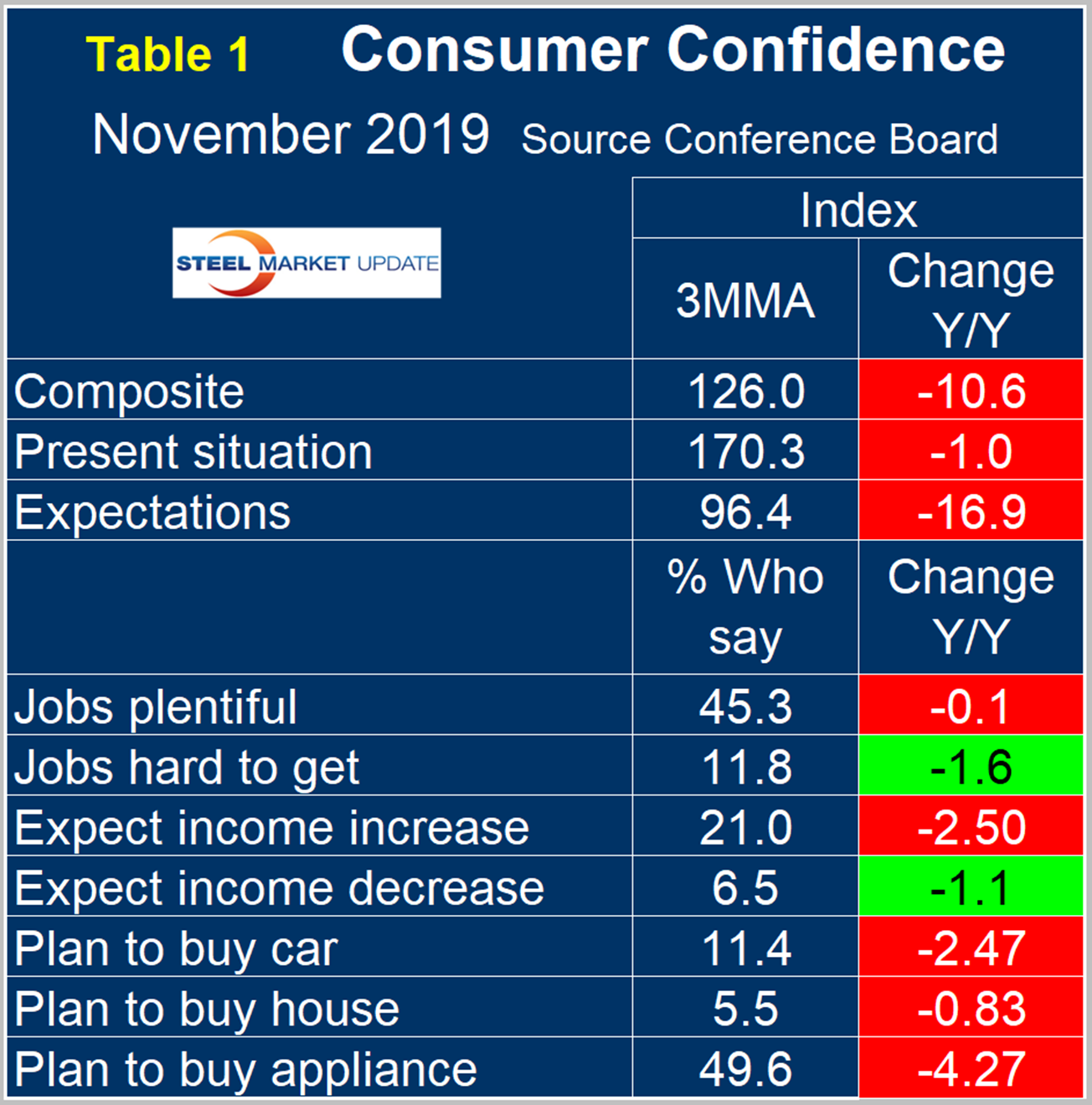

On a three-month moving average basis comparing November 2019 with November 2018, the 3MMA of the present situation was down by 1.0 point and expectations were down by 16.9 points (Table 1). The color codes show improvement or deterioration of the individual components in Table 1. July and August 2019 were the first months for the table to be all green since January 2018. By this measure there was an increasing deterioration in September, October and November.

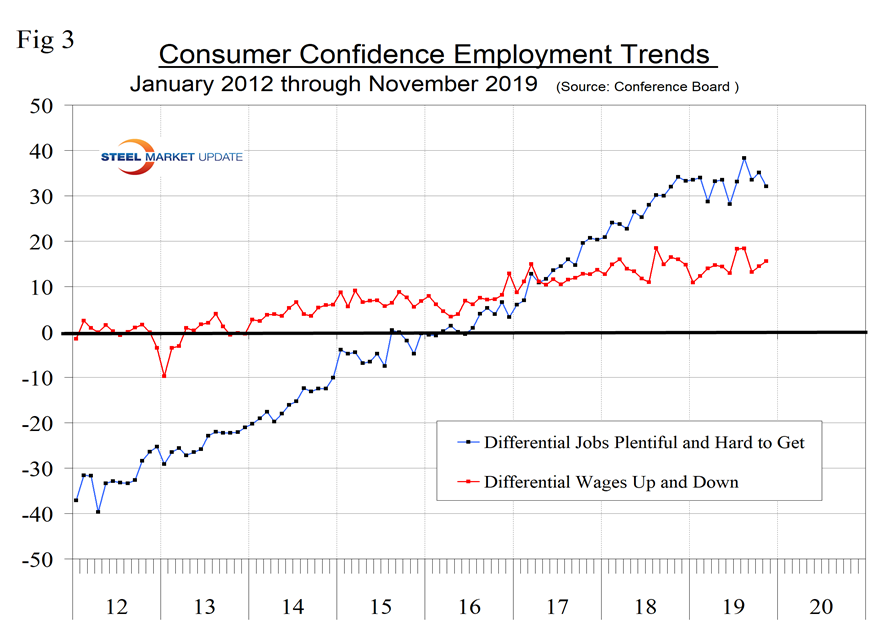

The consumer confidence report includes employment data that is still encouraging as 44.8 percent of respondents reported jobs to be plentiful and 11.8 percent reported jobs hard to get. Expectations for wage increases were also positive, with 21.8 percent expecting an increase and 6.2 percent expecting a decrease.

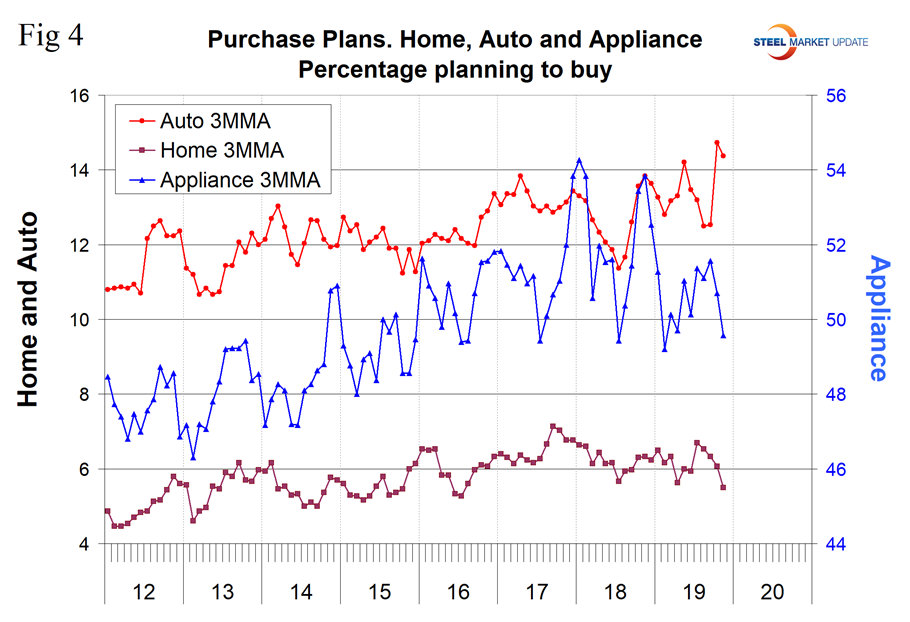

Consumer spending attitudes in November indicated that year-over-year plans to buy a car on a 3MMA basis declined to the lowest level since December 2015. Plans to buy an appliance declined substantially in October and November and plans to buy a house have declined in each of the last four months (Figure 4).

SMU Comment: The Conference Board Consumer Confidence Index is a volatile measure and must be reviewed as a three-month moving average to obtain a realistic view of trends. The consumer’s view of the present situation is still good, but based on Table 1, the September through November results show an increased weakening of confidence year over year led mainly by worsening expectations. Purchase plans for autos, houses and appliances all declined in November.

Steel demand is dependent on the growth of GDP, which in turn is strongly influenced by consumer confidence, disposable income and a willingness to spend, therefore this is a report that should be on our radar screens.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.