Market Data

November 21, 2019

Steel Mill Negotiations: More Room to Negotiate?

Written by Tim Triplett

Pricing from the mills is considerably tighter than it was a month ago, when virtually every deal was open to negotiation. Yet Steel Market Update data indicates the flat rolled mills are still surprisingly flexible when it comes to spot prices even as they work to collect two $40 price increases announced in the past month.

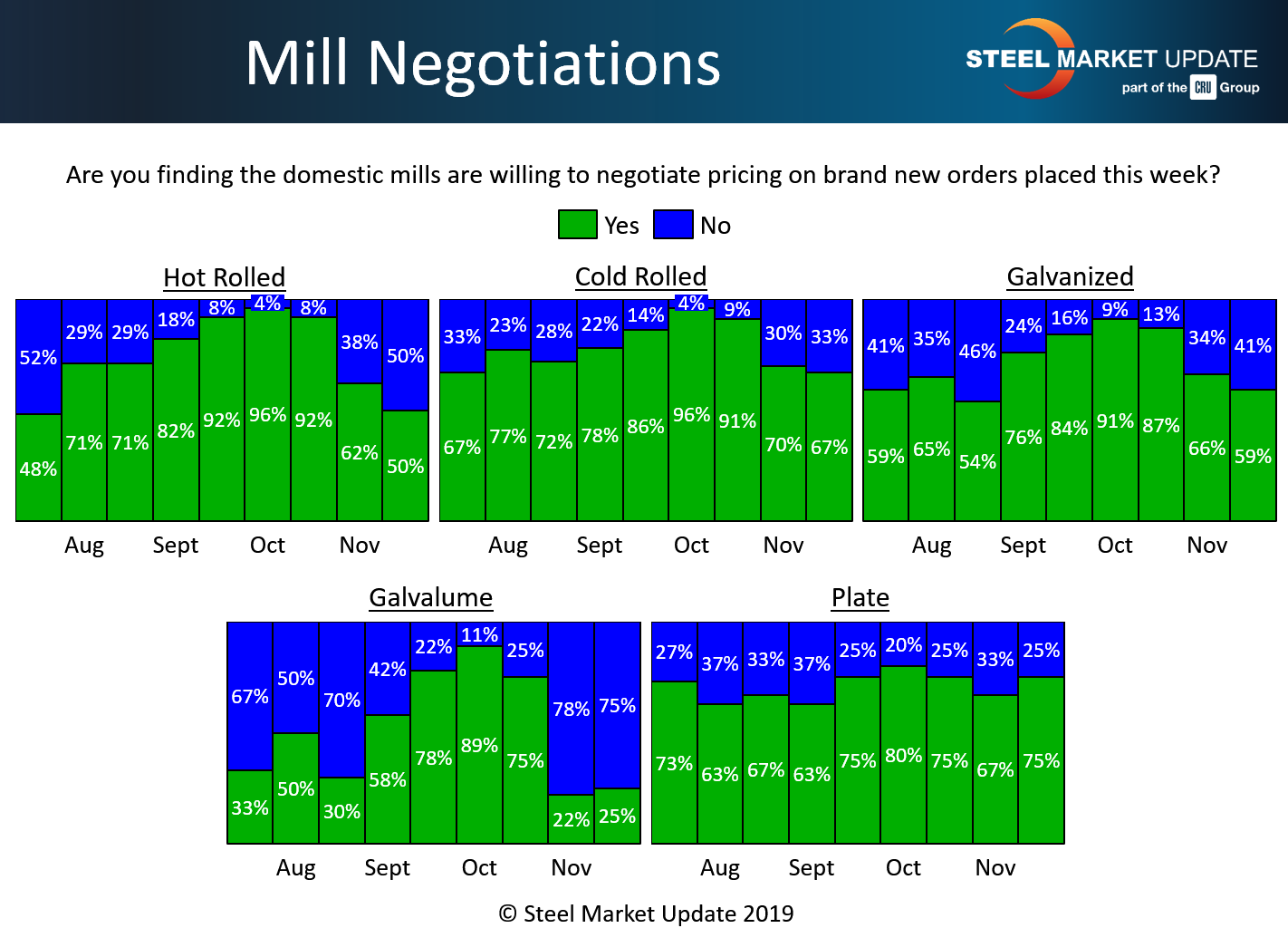

In the hot rolled segment, it’s a 50-50 proposition whether a buyer will find a mill willing to negotiate prices on HR. Half of those responding to SMU’s questionnaire this week said the mills were still open to price talks, while the other half said the mills were holding the line. That’s down more than 40 points from the 92 percent in mid-October who said prices were fully in play.

In the cold rolled segment, two out of three respondents still say spot prices are negotiable, reporting little change in the tone of negotiations over the past two weeks.

Likewise, the majority of galvanized steel buyers (59 percent) report the mills are still flexible when it comes to pricing galv orders. Galvalume is the opposite, however, with the majority (75 percent) reporting mills unwilling to deal.

There’s been little movement in negotiations over plate in the past month, despite the mills announcing a $40 price hike in early November. Three out of four buyers responding to SMU’s poll said the mills are still discounting prices to win spot orders of plate steel.

Steel prices have increased by nearly 14 percent since the mills first announced increases a month ago. SMU data shows a current benchmark hot rolled price of $535 per ton, up from $470 in mid-October.

Why are the mills still so willing to compromise if they are trying to collect higher prices? The upward price trend suggests it’s the new, higher price from which they are compromising. Thus, the announced price increases have not curtailed negotiations, but rather given them more room to negotiate.

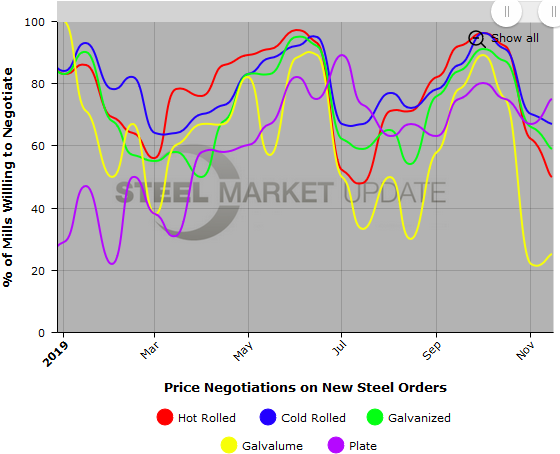

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (example below), visit our website here.