Market Data

November 12, 2019

Service Centers Reach "Capitulation" and Begin to Support Higher Prices

Written by John Packard

Flat rolled steel prices are on the way up following two recent rounds of price increases. Steel Market Update has been anticipating the turnaround in prices as the market has been near the point of “capitulation” for several weeks. Capitulation is the point when 75 percent or more of our service center survey respondents are reporting their company as lowering spot pricing to their end customers compared to what they were doing just two weeks prior. The stress on inventory values and margins puts distributors at a psychological point where they will support price increase announcements when made by the domestic steel mills. What we are seeing, having reached the point of capitulation over the past six weeks, steel mills raised prices and now the service centers are beginning to support higher prices. However, our data does not suggest full support – yet….

The data shown in the graphics below come from last week’s SMU Flat Rolled and Plate Steel Market Trends survey. We invited 460 steel people to provide their insights into the flat rolled and plate steel markets, and what factors are influencing steel prices, demand, supply, etc.

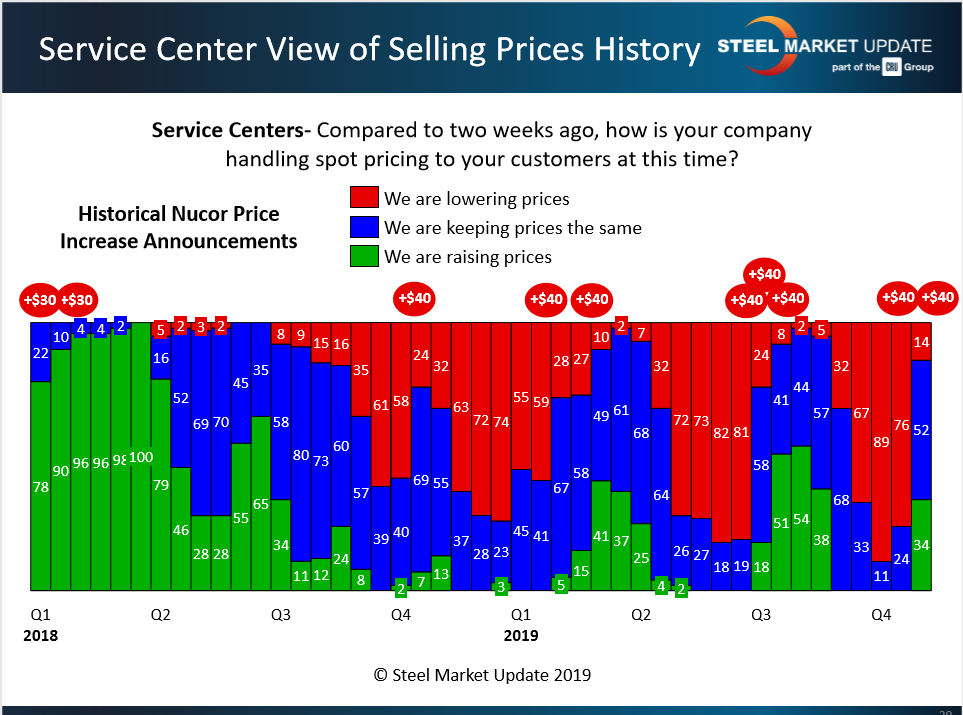

The chart below (Service Center View of Selling Prices History) shows the two $40 price hikes by market leader Nucor, one in late October and the other in early November, which were matched by most other mills. Data gathered by SMU today indicates that at least part of the $80 in increases is sticking. The average benchmark price for hot rolled steel is now around $520 per ton, up from $470 per ton in mid-October.

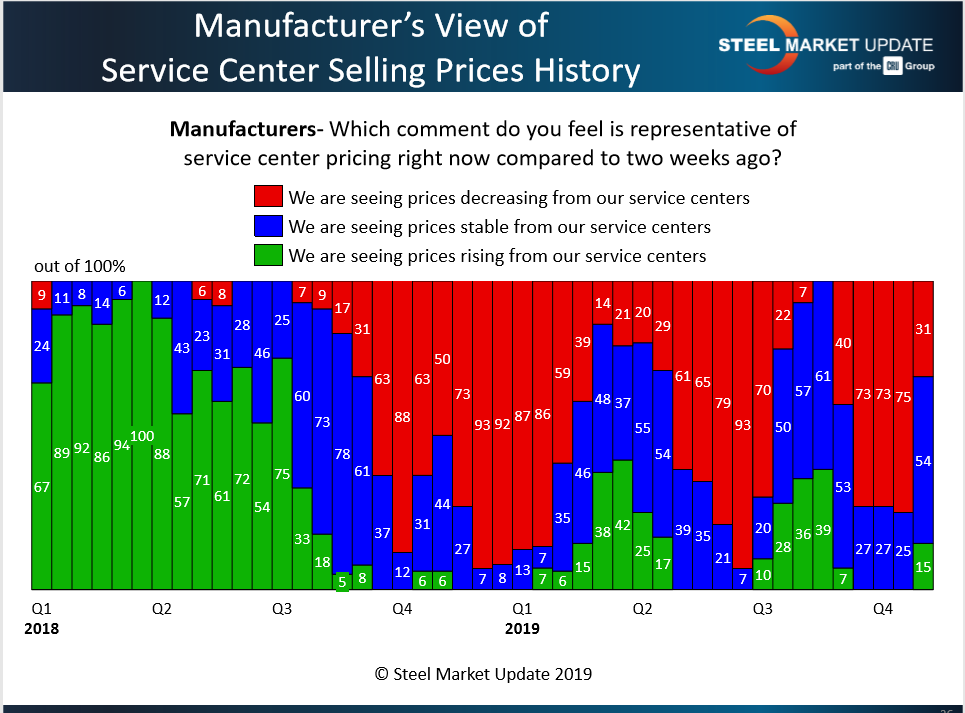

Since the beginning of October, as many as 89 percent of service centers have reported lowering spot prices to their customers. Nearly the same percentage of manufacturers, 73-75 percent, confirmed the price cutting by their distributor sources (see Manufacturers View of Service Center Selling Prices History chart below).

In tight, competitive market conditions, service centers often discount spot prices to win orders, even though they know reducing prices erodes the value of their inventories. History has shown that when at least 75 percent of the service centers have been lowering prices, and the mills announce a price increase, the service centers will “capitulate” and begin to support higher prices in pursuit of better margins.

What the data does not show is how much support the mills will receive from distributors as they attempt to collect higher prices or how long before the service centers begin to discount once again. Perhaps predictive of the staying power of the latest price hike, only about one-third of the service centers polled last week said they were actively raising prices, while the majority were keeping prices the same.