Market Data

November 10, 2019

Steel Mill Negotiations: Mills Still Willing to Deal?

Written by Tim Triplett

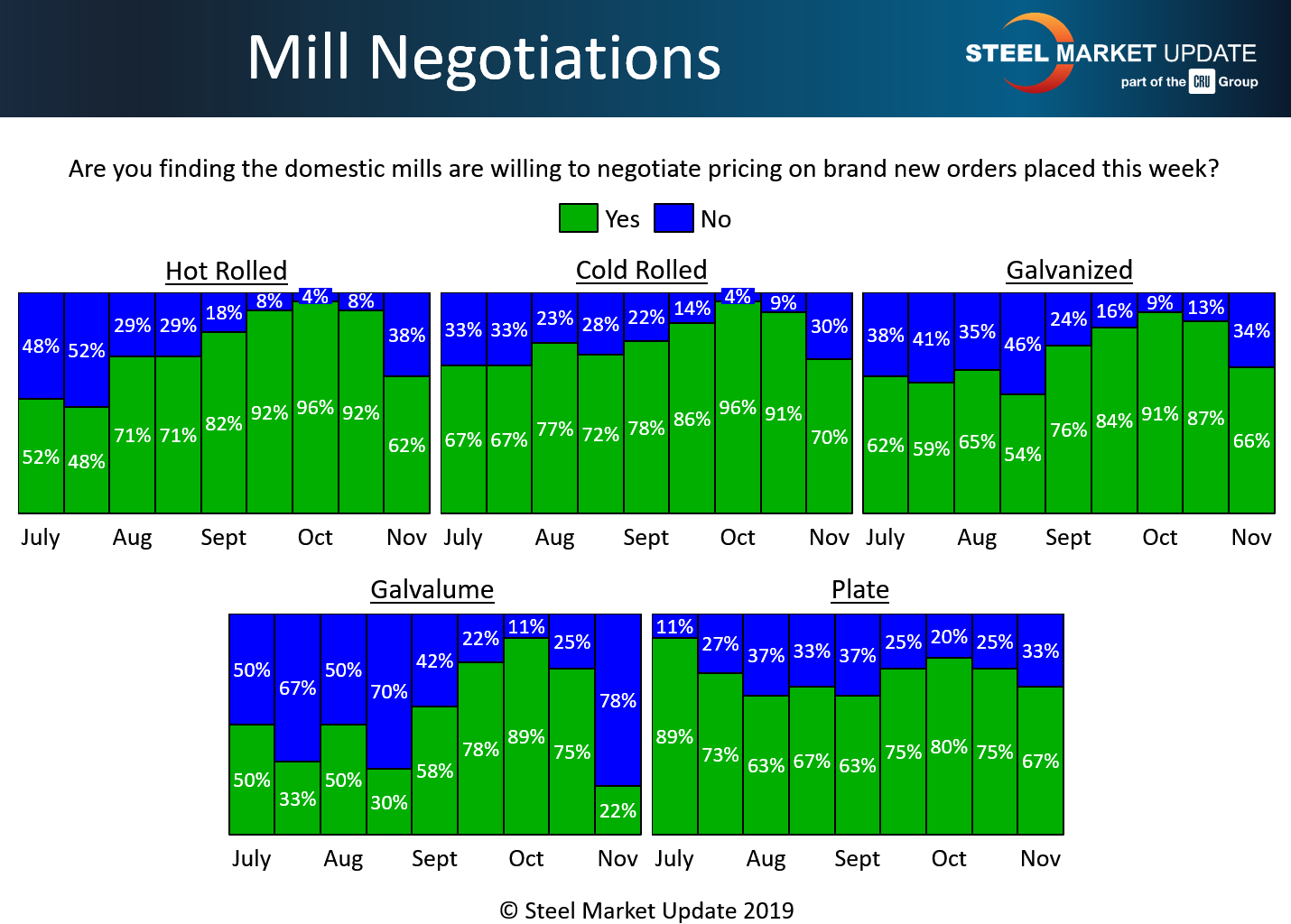

Not surprisingly following the mills’ $40 price increase announcements Oct. 24-25, negotiations between steelmakers and steel buyers have tightened somewhat. What is surprising is that roughly two out of three buyers still report mills actively negotiating spot prices on hot rolled, cold rolled and galvanized, as well as plate.

In the hot rolled segment, 62 percent of those responding to Steel Market Update’s questionnaire this week said the mills were still open to price talks. While that’s down 30 points from 92 percent in mid-October, that still means only 38 percent report their mill suppliers now holding the line on prices.

In the cold rolled segment, only 30 percent said the mills are now standing firm on price, while 70 percent said the mills were still negotiating.

Similarly, in coated steels, just 34 percent reported galvanized mills declining to compromise on price, while the other 66 percent said their galvanized suppliers were still willing to deal. Galvalume is the exception, with 78 percent reporting that the mills are now holding the line.

Just 33 percent said plate prices are now nonnegotiable, while 67 percent of buyers still report the plate mills as flexible on pricing.

Steel prices have seen some initial signs of a turnaround since the increase was announced. SMU data shows the current benchmark hot rolled price at $490 per ton, up from $470 in mid-October. But with the majority of buyers still reporting mills actively discounting to win orders, this data casts doubt on how much of the price increase the mills will be able to collect.

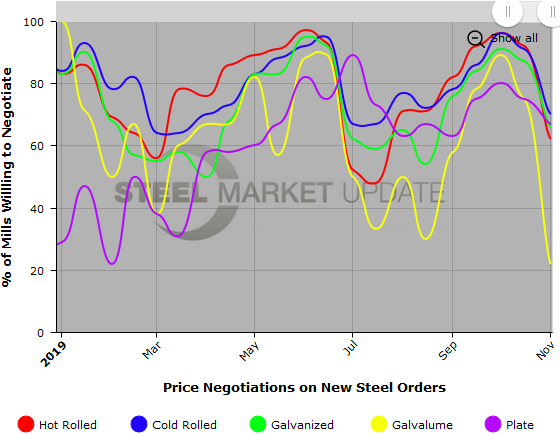

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (example below), visit our website here.