Market Segment

November 5, 2019

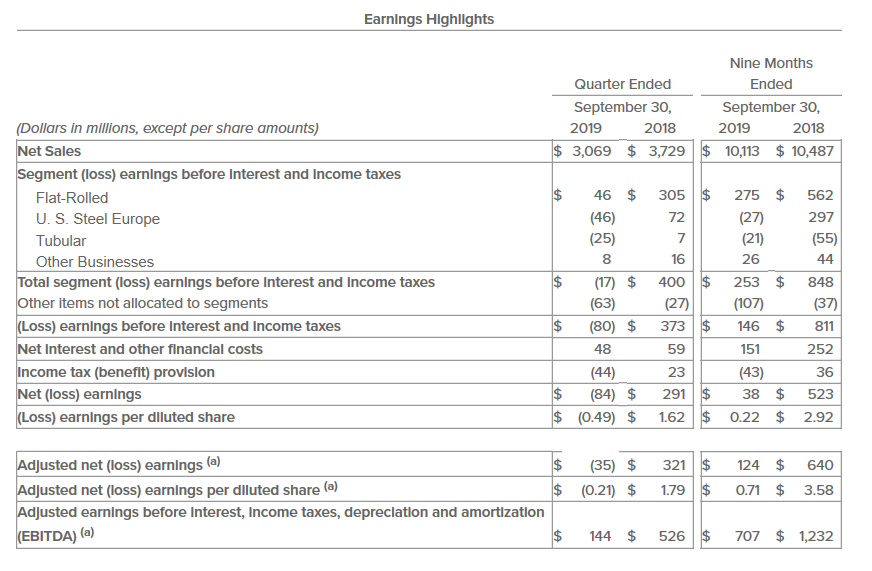

U.S. Steel Reports $84 Million Loss in Q3

Written by Tim Triplett

United States Steel Corp. reported a net loss of $84 million in the third quarter due to declining steel prices and weaker market conditions—down sharply compared with third-quarter 2018 yet better than analysts’ expectations. The steelmaker earned $291 million in last year’s third-quarter.

“The team delivered better than expected results from solid cost performance and higher than forecasted shipments in flat-rolled,” said U.S. Steel President and CEO David Burritt during the company’s quarterly conference call last week. “While market headwinds persist, we continue to focus on what we can control, including re-scoping our asset revitalization investments and reducing fixed costs.”

Pointing to U.S. Steel’s purchase last month of a 49.9 percent stake in EAF-based Big River Steel, Burritt said the company is now focused on a “best of both” strategy—making the best of both its integrated and minimill assets. “Ultimately, acquiring 100 percent of Big River is our number one strategic priority because minimills make money in the trough and we need the ability to do the same,” he said.

The Pittsburgh-based steelmaker shipped 2.65 million tons of flat-rolled in the third quarter, nearly as much as last year. But its results were impacted by the low steel prices and the 40-day strike at General Motors, among other market headwinds, said company executives.

In addition to its investment in Big River, U.S. Steel has a 2020 capital spending budget of approximately $950 million to be focused on finishing the new EAF at U.S. Steel Tubular, the Endless Casting and Rolling project at U.S. Steel Mon Valley and asset revitalization at the Gary Hot Strip Mill.

Looking ahead, Burritt noted there are reasons for optimism. “The end of the UAW strike at GM removes a significant steel demand gap that existed in the market. Lead times have extended, our flat-rolled order rates have materially improved and scrap prices are expected to increase by approximately $20 a ton providing support for steel selling prices. All of these factors give us confidence that the market is poised to improve from here,” he said.