Market Data

November 5, 2019

Global Manufacturing Expands After Bottoming in July

Written by Sandy Williams

The global manufacturing downturn showed some signs of easing in October. The J.P. Morgan Global Manufacturing PMI posted 49.8, still in contraction but rising for the third consecutive month.

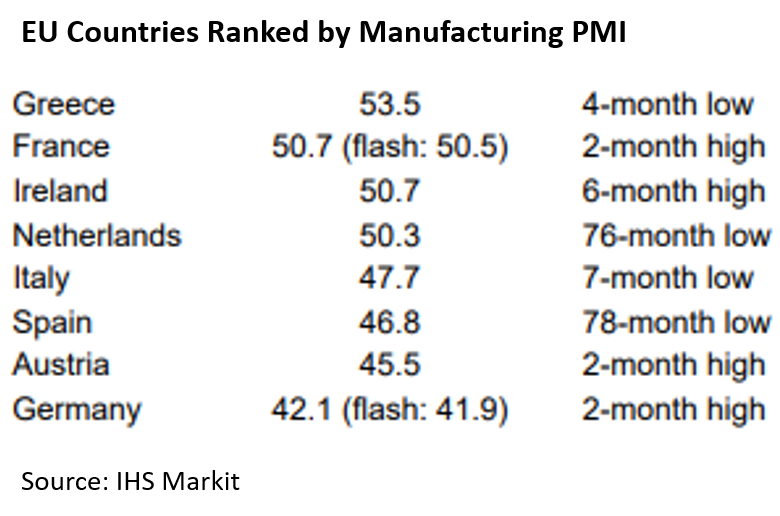

The intermediate goods sector fell to a three-month low of 48.8, but PMIs for consumer and investor goods saw expansion in October. The Eurozone remained in contraction for the most part, with Germany posting the lowest PMI of the 32 countries covered in October. Global manufacturing production was higher for the second month in a row as orders for new work stabilized after five months of contraction.

“Global trade flows continued to weigh on manufacturing, however,” said J.P. Morgan. “New export business declined for the 14th month in a row. Among the larger exporting nations covered by the survey, Germany and Japan saw new export orders decline – with the downturn especially steep in Germany. The U.S. and China both registered growth.”

The Eurozone PMI edged up 0.2 points to 45.9 in October, but showed continued weakness in output new orders and pricing.

The Eurozone PMI edged up 0.2 points to 45.9 in October, but showed continued weakness in output new orders and pricing.

“Eurozone manufacturing remained stuck in its steepest decline for seven years in October, meaning the goods-producing sector is on course to act as a severe drag on GDP again in the fourth quarter,” said Chris Williamson, chief business economist at IHS Markit. “The survey data are consistent with industrial production falling at a quarterly rate in excess of 1 percent. Geopolitical concerns, ranging from Brexit to U.S. trade policy, continue to create uncertainty, further dampening demand both at home and in export markets.”

China manufacturing had its strongest improvement in operating conditions since February 2017. The Caixin China General Manufacturing PMI rose to 51.7 in October from 51.4 in September. Production and new orders expanded as client demand improved at home and abroad. Sentiment for the one-year outlook was at its highest level since April.

“China’s manufacturing economy continued to recover at a relatively quick pace in October. New orders placed with companies improved substantially, and new export orders rose at the fastest pace since the Sino-U.S. trade war broke out,” commented Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis.” If the improvement in demand, including that generated by infrastructure projects and exports, is able to continue, the manufacturing sector can gradually build a foundation for stability.”

A marked decline in export orders led to further deterioration of the manufacturing sector in Russia. The IHS Markit Russia Manufacturing Purchasing Managers’ Index PMI registered 47.2 in October, up from 46.3 in September and its sixth month in contraction. Reductions in output and new orders led to reduced pressure on capacity and a drop in workforce numbers, said IHS Markit. Manufacturers, however, were strongly optimistic in the one-year outlook and looked forward to new product developments and investments in new machinery.

Manufacturing growth was modest in North America with the U.S. and Canada posting marginal PMI gains and Mexico pulling out of contraction for the first time since April.

Canada saw its sharpest rise in production volume since February as firms reported a modest uptick in demand, especially at home. Export orders remained sluggish as a result of weaker global trade conditions. Input prices rose during October but had little influence on factory gate charges. The October PMI rose to 51.2 from 51.0, the second month in a row above the 50.0 neutral point. Manufacturers looked forward to new product launches and improvement in trade conditions, resulting in the highest positive sentiment since July.

Mexico manufacturing conditions improved slightly in October due to rising sales and employment, but production contracted for the fifth consecutive month. Input purchasing was limited during October with some firms reporting destocking and weak demand. New orders increased marginally, but export orders were relatively flat.

“Registering 50.4 in October, the seasonally adjusted IHS Markit Mexico Manufacturing PMI was in expansion territory for the first time since April. The headline figure rose from 49.1 in September to its highest mark since February, but was indicative of only a marginal strengthening in the health of the sector,” said IHS Markit.

The United States manufacturing sector saw output and new business accelerate to six-month highs in October, price inflation softened, and employment rose at the quickest pace since May. Inventory destocking appeared over as rates of input buying increased. Overall, gains were modest. The U.S. Manufacturing PMI rose to 51.3 in October from 51.1 the previous month. Business optimism was at its highest level since June and was backed by an upturn in business investment.

“Tentative signs of renewed vigor are appearing in the U.S. manufacturing sector, with the survey’s production gauge having now risen for three successive months to suggest that the soft patch bottomed out in July,” said Williamson.

“However, while the outlook has improved, further growth is by no means assured. Survey respondents continue to report widespread concerns over issues such as tariffs, the auto sector’s ongoing malaise, a lack of pricing power amid weak demand and uncertainty about the economic and political situation over the coming year. While the survey data are moving in the right direction, the overall picture therefore remained one of only very modest growth and guarded optimism.”