Market Data

November 2, 2019

CRU: Fed Rate Cut Will Enable Consumers to Continue to Drive U.S. Growth

Written by Lisa Morrison

By CRU Principal Economist Lisa Morrison

On Oct. 30, the Fed cut rates by 25bp as was widely anticipated (including by us), lowering the Federal Funds rate to a range of 1.50 percent-1.75 percent. Based on the Fed statement and comments during Chair Powell’s press conference, the Fed seems pleased with where monetary policy is, calling it “in a good place.” They perceive the risks from trade and Brexit to have diminished since the last meeting in September, though weak global growth was cited as remaining a concern.

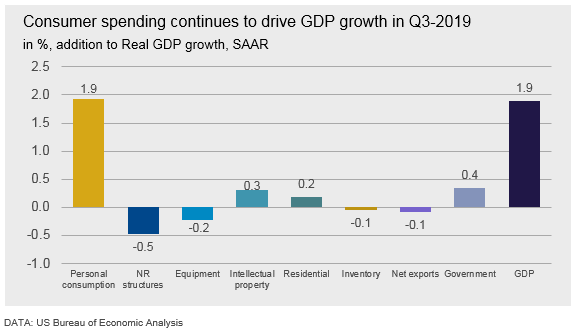

This dovetails nicely into a discussion around the first release of GDP for Q3 2019, which reported annualized growth of 1.9 percent. This is down slightly from Q2 annualized growth of 2.0 percent and well below the Q1 2019 result of 3.1 percent.

Q3 came in a little better than what we have in our base case forecast for 2019, but we continue to expect 2.2 percent GDP growth this year.

The chart below shows the contributions to the total percent change in GDP. At the far right is the GDP growth rate. All the bars to the left of it, when added together, equal that figure.

As you can see, consumer spending remains the main contributor of growth, with government spending the next largest.

Intellectual property investment is still what’s driving total private fixed investment, but there was a small positive contribution from residential last quarter. As the IP numbers (and the metals shipment numbers) would indicate, both structures and equipment investment were drags on growth.

Bottom line: Strong consumer spending is the main driver of GDP growth right now. We will therefore be watching the confidence and employment indicators carefully since they will be the first things to tell us the potential for a pull-back.