Distributors/Service Centers

October 31, 2019

Ryerson’s Q3 Results Reflect Weak Steel Prices

Written by Tim Triplett

Results for Ryerson Holding Corp., the Chicago-based processor and distributor of industrial metals, suffered from declines in steel prices and demand during the third quarter, but company executives are hopeful for improved margins in the coming quarters.

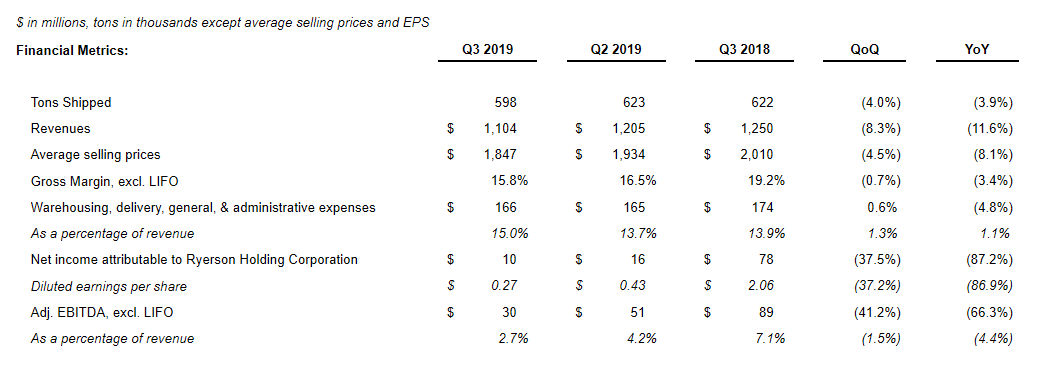

Ryerson reported third-quarter revenues of $1.10 billion, a decrease of 11.6 percent compared to $1.25 billion in third-quarter 2018, with average selling prices down 8.1 percent and with tons shipped down 3.9 percent. Net income totaled $10.1 million in the third quarter, down from $77.5 million in the prior-year period.

“The quarter was characterized by protracted and deepening industrial metals deflation, particularly across the carbon steel spectrum, as well as recessed manufacturing demand consistent with reported macro indicators such as the 47.8 Purchasing Managers Index printed in September,” said Eddie Lehner, Ryerson President and CEO, in remarks to analysts and investors on Wednesday. “Although the road of getting average costs in inventory below replacement cost has been a long and winding one, after five quarters of steep carbon price deflation, we believe the industry is transitioning to improved pricing fundamentals as well as better adjusting inventory levels to current and anticipated demand.”

The turnaround underway at Central Steel & Wire, which Ryerson acquired in July 2018, is progressing well, Lehner said, although the declining price of steel has impacted CS&W disproportionately because it has an 85 percent exposure to carbon products, “which has amplified the persistent and acute gross margin compression throughout the year.

“We have seen a nice synergy between Ryerson and Central in terms of Ryerson being able to tap the Central inventory to enhance its product offering across the Ryerson network. With Central, the real key is to modernize their systems to get their costs close to the Ryerson benchmarks,” he said. Ryerson is still working to absorb Central and other recent acquisitions and is not currently looking for new buying opportunities.

Looking ahead, Ryerson expects improvement in the fourth quarter. “In the long deflationary price environment that has unfolded since July of 2018, most notably in carbon steel products, the inventory holding losses and customer hedge mark-to-market losses are subsiding. We expect average inventory costs per ton to align closer to current lower replacement costs and therefore expect gross margin to expand in the fourth quarter as we move through an industrial metals cyclical trough,” Lehner said.

Ryerson’s revenues in the first nine months of 2019 totaled $3.54 billion, an increase of 9.0 percent compared to the first nine months of 2018, as tons shipped increased 8.8 percent on relatively flat average selling prices. Net income attributable to Ryerson Holding Corp. was $56.0 million in the first nine months, down from $105.4 million for the same period of 2018.

For the fourth quarter of 2019, Ryerson anticipates revenues of $960 million to $1.0 billion with tons shipped down 6 to 9 percent compared to the third quarter of 2019, due to normal seasonality patterns compounded by slowing industrial growth and trade uncertainty. Ryerson executives noted the consensus view is for carbon prices to bottom in the fourth quarter and “there is more potential upside than downside.”