Market Segment

October 29, 2019

Dismal Quarter for Mexican Steelmaker AHMSA

Written by Sandy Williams

Mexican steel maker Altos Hornos de México, S.A.B. de C.V. (AHMSA) earnings in the third quarter of 2019 declined across the board due to unfavorable steel market conditions.

AHMSA EBITDA plummeted 149.6 percent from 3Q 2018 for a loss of $40.4 million. EBITDA in the steel segment plunged 132.1 percent for a loss of $31 million compared to positive EBITDA of $96.6 million a year ago.

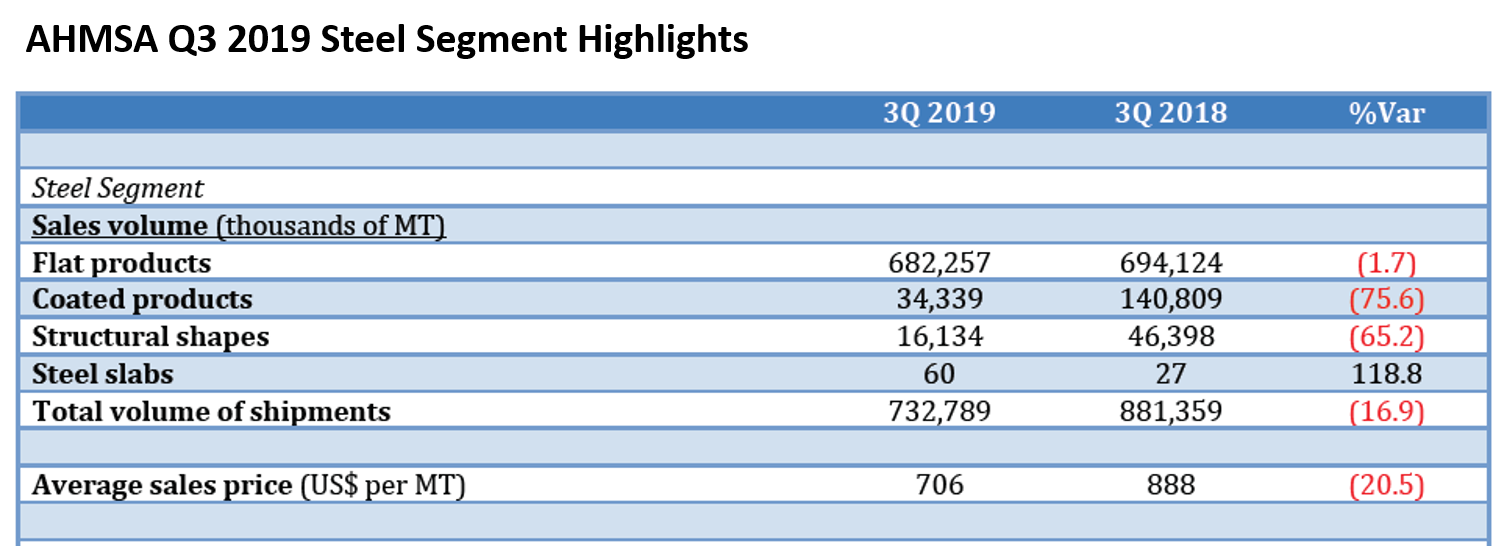

Net sales fell 34 percent driven by lower prices and weaker demand for core products. Shipments slid 16.9 percent to 733,000 metric tons year-over-year. Cost of sales decreased by 19 percent due to lower production volumes.

In an effort to reduce expenses, the company imposed strict cost control measures during the quarter, including selling properties, aircraft, vehicles and other assets not required for AHMSA operations.

“AHMSA is exploring various capitalization options and/or associations with a variety of industrial and financial groups; there is, however, no agreement at this time,” wrote AHMSA in a press release.