Market Data

October 27, 2019

Steel Mill Negotiations: Hint of Tightening?

Written by Tim Triplett

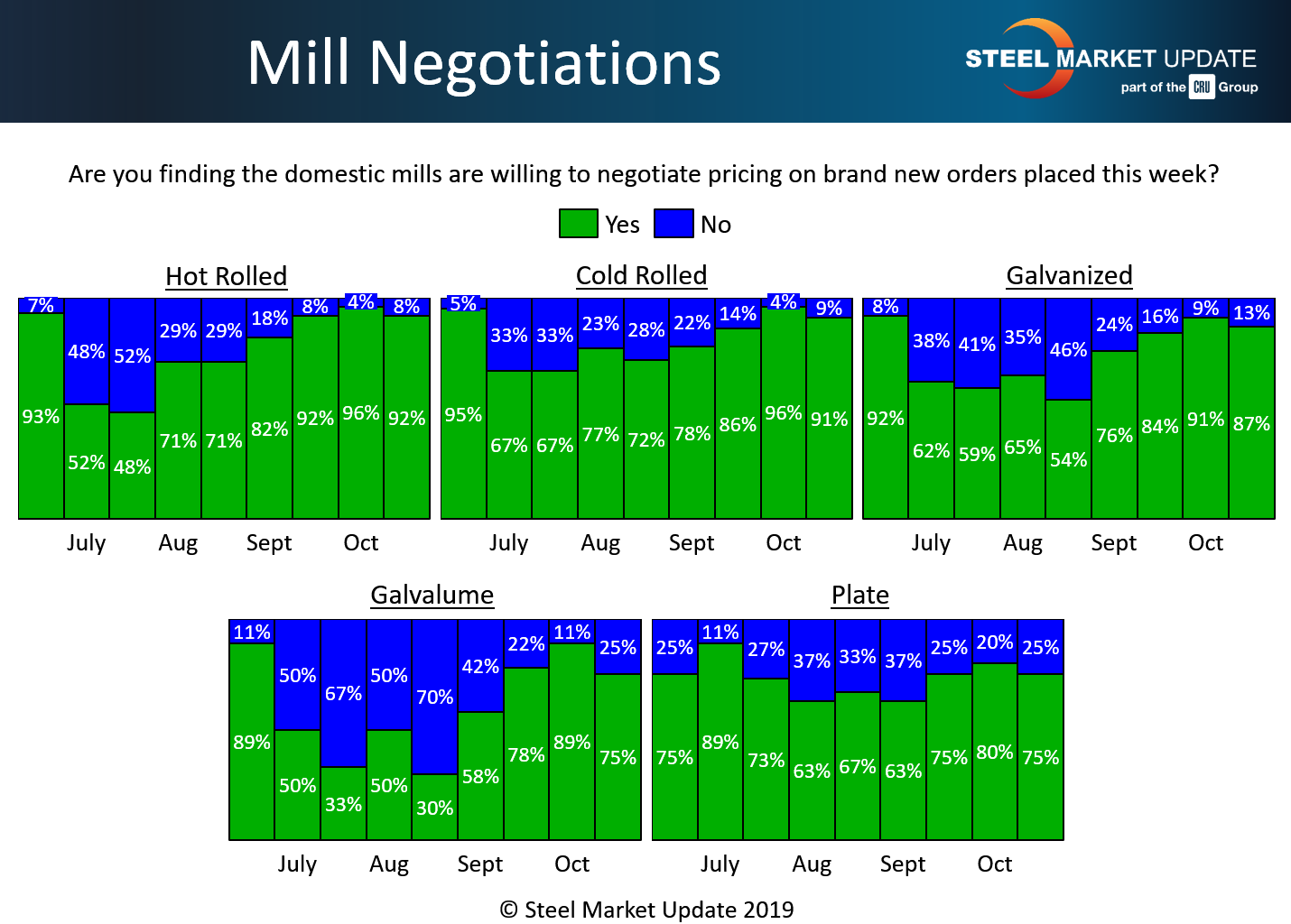

Steel Market Update’s negotiations data showed just a hint of tightening in price talks between the mills and their customers this past week, perhaps in anticipation of the $40 price increase on flat rolled steel announced by the mills on Thursday and Friday. The data, gathered by SMU prior to the price increase announcements, shows a slightly higher percentage of respondents reporting mills holding firm on prices.

Nevertheless, more than nine out of 10 steel buyers still said the mills were willing to negotiate spot prices on hot rolled and cold rolled steel products to secure the orders. The percentage is almost as high for coated products and plate.

In the hot rolled segment, 92 percent of respondents said the mills were open to price talks on HR, down from 96 percent in early October. Just 8 percent said their mill suppliers were holding the line on prices.

In the cold rolled segment, 91 percent said the mills were negotiating, down from 96 percent in early October, while 9 percent said the mills were now standing firm.

In coated steels, 87 percent said their galvanized suppliers were willing to deal, down four percentage points from early in the month. About 13 percent of respondents reported galvanized mills declining to compromise on price. Seventy-five percent said the mills were also open to price talks on Galvalume, down from 89 percent in the last poll.

Seventy-five percent of buyers now report the plate mills open to negotiation, while 25 percent said plate is nonnegotiable.

Steel Market Update’s negotiations data reflects the weak steel pricing in the market. Benchmark hot rolled steel prices have declined from around $700 per ton at the beginning of the year to about $470 per ton in SMU’s latest data. But with the flat rolled mills now working to collect a price increase and reverse the slide, look for negotiations to tighten significantly in the coming weeks.

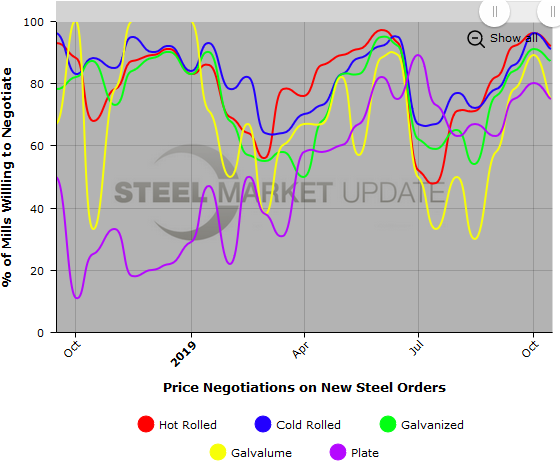

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (example below), visit our website here.