Market Data

October 27, 2019

SMU Steel Buyers Sentiment Index: Still at Low Levels

Written by Tim Triplett

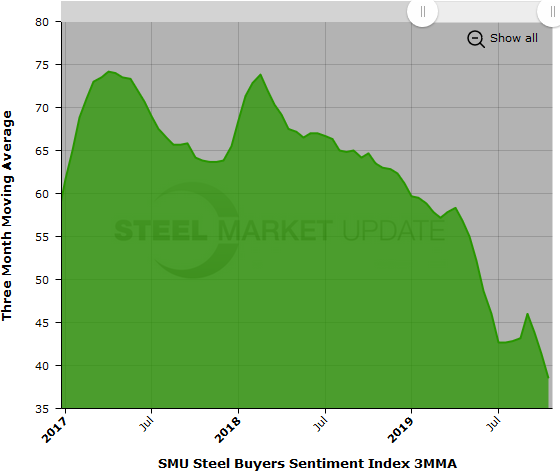

Steel Market Update’s Current and Future Buyers Sentiment Indexes inched up a few points this week, but remain near their lowest levels in six years.

The goal of SMU’s Buyers Sentiment Index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today (Current Sentiment Index), as well as three to six months into the future (Future Sentiment Index). Results are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend.

The Current Sentiment reading of +32 is up from +26 in early October, but nearly 30 points below levels at this time last year. Measured as a 3MMA, Current Sentiment is at +38.50, its lowest reading since January 2016.

Future Sentiment

Buyers feel only slightly more positive about their prospects three to six months in the future. Future Sentiment as a single data point registered +38 in the latest data, up from +35 two weeks ago, but down 15 points from this time last year. The Future Sentiment 3MMA is +42.00, its lowest since July 2013.

All the current readings are above zero and on the optimistic half of SMU’s scale, therefore more positive than negative from a historical view that saw readings as low as -85 during the Great Recession. Not counting the recessionary years, however, the current readings in the low to mid +30s are well below the typical readings in the +60s and +70s seen over the last several years. The prevailing market sentiment is clearly more pessimistic than in 2017 and 2018.

It should be noted that SMU polled readers prior to the mill price increase announcements this week.

Steel buyers sentiment has clearly been trending downhill since 2017, as shown by the chart below tracking the annual rate of change in the three-month moving averages.

What Respondents Had to Say

“Too much competition in the distribution chain is willing to have a race to the bottom with regards to margins. There’s seemingly a complete disregard for profit and only focusing on tons. I guess they are students of the old ‘I’m losing money on every deal but I will make it up on tons’ mantra. End users are loving the lunacy.” Service Center/Wholesaler

“The trade environment is too uncertain. Traditional partners are being shunned for political gains. A 25 percent tariff on Turkey for steel, now 50 percent, oh wait, now back to 25 percent. It’s hurting our manufacturers longer term making our producers higher to world markets.” Trading Company

“Demand is there for the sectors we service. Just a lot more competition, so margins will be squeezed.” Trading Company

“Very concerned about the large volume of below-market deals being made by mills today that will keep selling prices for service centers depressed throughout the first quarter even if index prices are going up.” Service Center/Wholesaler

“Slow fourth quarter. Hopeful for a quick rebound in the first quarter.” Manufacturer/OEM

“Not feeling much love out there.” Service Center/Wholesaler

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 500 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 40 percent were manufacturers and 44 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.