Market Segment

October 24, 2019

Nonresidential Construction Boosts Reliance Steel

Written by Sandy Williams

Reliance Steel & Aluminum Co. did better than anticipated in the third quarter, generating net sales of $2.69 billion. Shipments were higher than expected due to strength in Reliance’s largest segment, nonresidential construction, slipping just 2 percent compared to a typical seasonal decline of 4-6 percent. Demand for carbon structural and tubing products helped boost sales and is expected to remain strong in the fourth quarter. The company posted net income of $162.7 million, down 11.1 percent sequentially but 9.7 percent higher year-over-year.

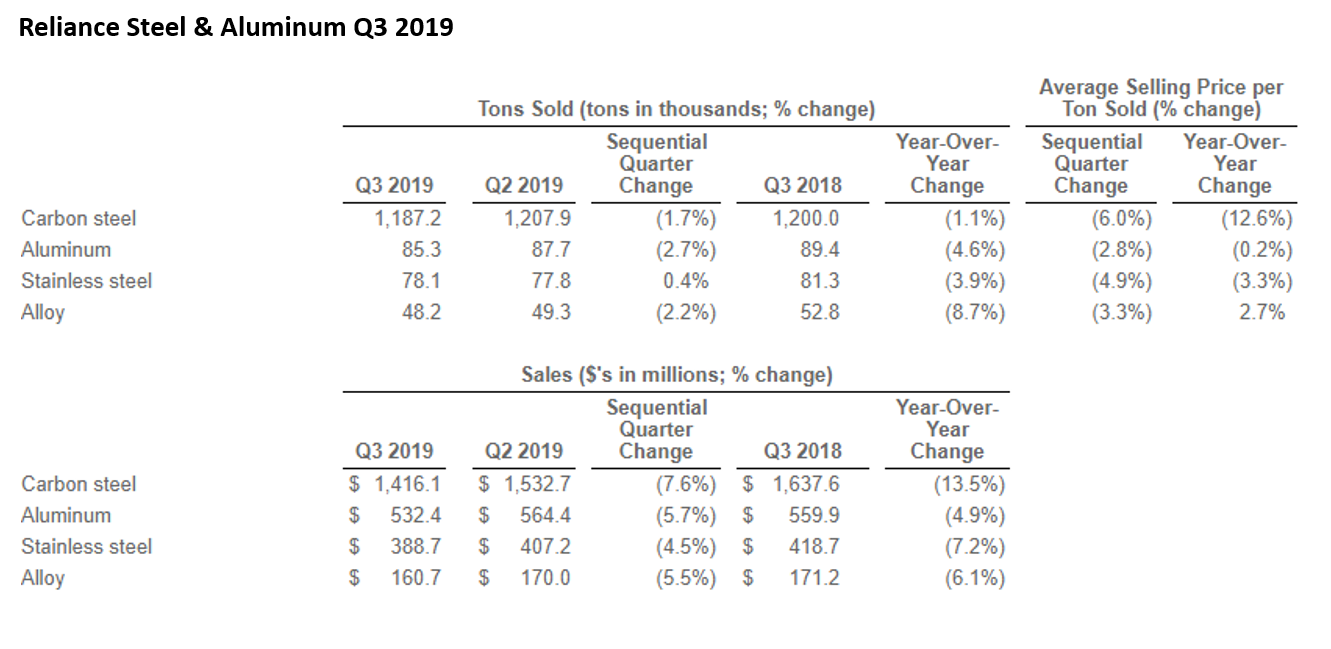

Carbon steel sales totaled $1.4 million, a 7.6 percent decline sequentially. Steel shipments were down 1.7 percent and 1.1 percent from Q2 and Q3 2018, respectively.

Metals prices were weaker than expected, causing an overall 5.1 percent decline in average selling price. Average selling price for carbon steel declined 6 percent from the previous quarter and 12.6 percent from a year ago.

Reliance toll processing operations saw strong demand in the U.S. and Mexico automotive sectors. Reliance expects increasing demand for aluminum and value-added products will add to further improvement in the auto sector. The General Motors strike had some impact on sales near the end of Q4.

Demand in heavy industry, agricultural and construction equipment declined during the quarter and is expected to be flat in the fourth quarter, along with slower activity in oil and natural gas.

CEO Jim Hoffman noted that there remains pent-up demand in construction due to weather concerns across North America that caused delays in shipments.

CFO Karla Lewis said there was a focus on inventory reduction during the year. Reliance, like other companies, bought a little heavy in 2018 but has made good progress on inventory reduction. Although they are not at their inventory turn goal yet, Reliance inventory is in good shape, Lewis said.

Looking forward to the fourth quarter, Reliance expects end demand will remain relatively steady, excluding normal seasonal patterns due to holidays and fewer shipping days. Tons sold are expected to decline 4-7 percent compared to the third quarter. Pricing is expected to remain near current levels with the average selling price for Q4 declining 2-3 percent sequentially. Earnings per diluted share are expected in the range of $1.60 to $1.70.