Market Data

October 20, 2019

SMU Market Trends: Where's the Bottom for Steel Prices?

Written by Tim Triplett

Except for a brief uptick this summer, steel prices have been on the decline since March and breached the $500 per ton level in mid-October—a psychological line in the sand that leaves steel buyers wondering: Have prices hit bottom? Is it time to replenish inventories?

Flat rolled steel prices took a steep dive last month, with hot rolled coil dropping below $500 for the first time since early November 2016. Steel Market Update’s survey of the market placed the average price for spot orders of hot rolled at $480 per ton ($24.00/cwt) FOB the mill east of the Rockies with lead times of just 2-4 weeks. Similarly, cold rolled dropped to $670 per ton ($33.50/cwt) with lead times from the mills of 3-8 weeks. The benchmark price for 0.060-inch G90 galvanized steel declined to an average of $739 per ton delivered with lead times of 5-8 weeks. The price of steel plate was unchanged in October at an average of $675 per ton ($33.75/cwt) delivered to the customer’s facility within 4-6 weeks.

Several factors are weighing heavily on steel prices:

• Steel supplies that are outpacing the tepid demand heading into the fourth quarter.

• The lingering effects on the supply chain of the month-long strike at General Motors.

• Ferrous scrap prices that continue to decline.

• And political strife in Washington that only serves to deepen the market’s anxiety over trade issues and the health of the U.S. economy.

Ferrous scrap prices declined by $30-40/GT in both September and October. Scrap prices are at their lowest level in years after dropping eight out of the last 10 months. Scrap prices are a function of supply and demand. Demand is down as mills have begun to ease back on production in light of the low finished steel prices and weak pull-through from manufacturing. Weakness in economies overseas has made demand for U.S. scrap exports unpredictable. As a result, it’s more difficult for the mills to justify an increase in steel prices when their raw material costs are down.

President Trump’s decision to move U.S. troops out of Syria, clearing the way for Turkey’s assault on the United States’ Kurdish allies, prompted new trade sanctions against the Turkish government and its economy last month. One of those sanctions was a plan to raise the tariff on Turkish steel exports to the United States back to 50 percent from the 25 percent level to which it was lowered back in May. As analysts pointed out, Turkish steel exports to the U.S. have been near zero for the past year anyway, so the change in the tariff is likely to have little incremental impact on the Turkish economy—or on the pressure being applied to the Turkish government to moderate its brutality on the battlefield.

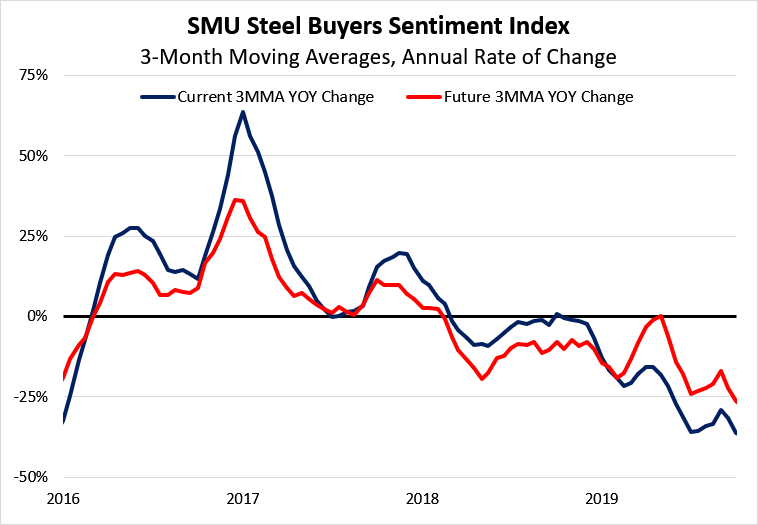

Steel Market Update’s Steel Buyers Sentiment Index has been trending downward since April and declined by 26 percentage points to a reading of +26 last month, reaching its lowest level since 2013. (Based on the annual rate of change in the three-month moving averages, both current and future sentiment have been trending downward since 2017, as shown in the chart below.) To put the latest figures in perspective, over the dozen years SMU has been tracking industry sentiment, readings have ranged from highs of +78 to lows of -85 during the Great Recession. Not counting the years prior to 2011 that were impacted by the historic recession and thus were highly anomalous, sentiment has generally moved within a 60-point range, from roughly +14 to +74. Therefore, the recent 26-point drop is significant and shows a troubling level of pessimism in the business community.

So, when will flat rolled prices reverse course? The answer to that question is unknowable—but SMU data and what history tells us about service center spot prices suggests a transition could be in the works.

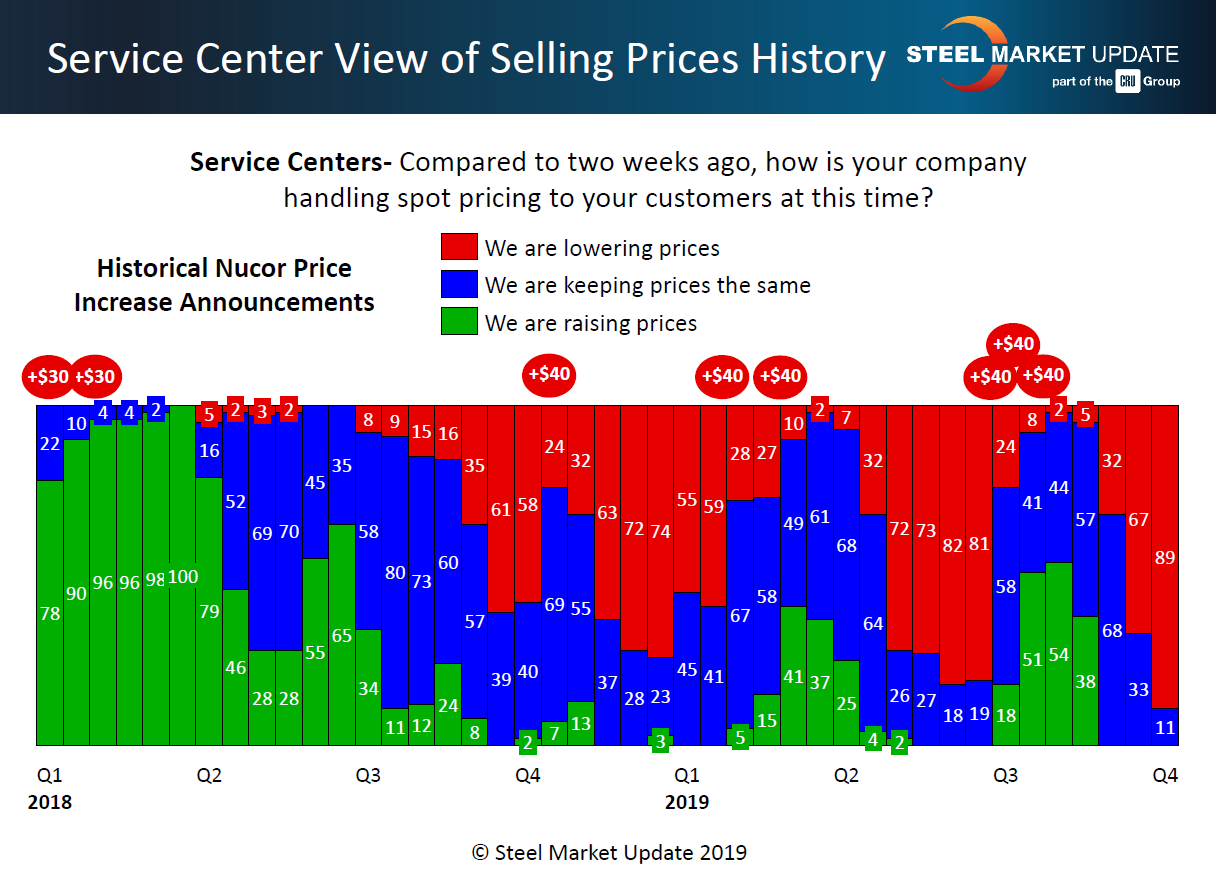

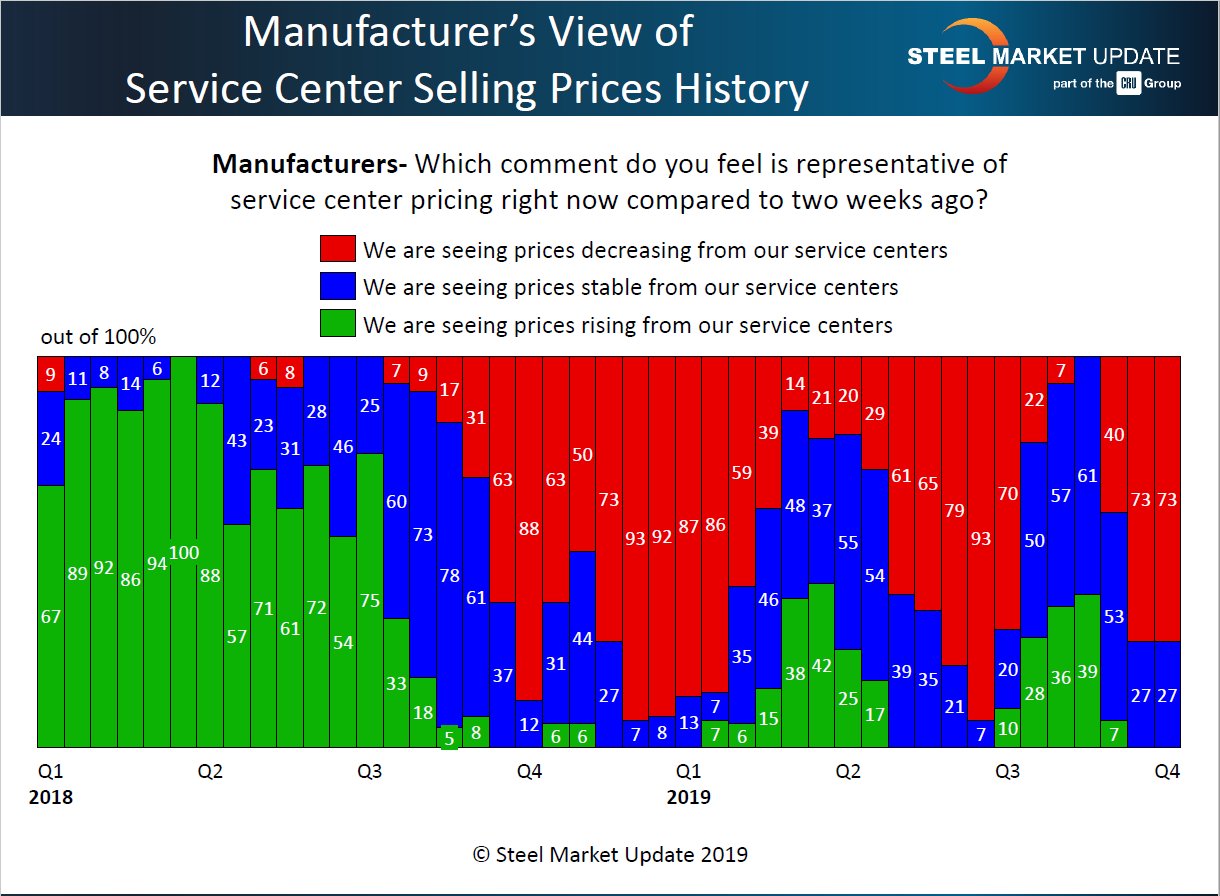

Seventy-three percent of the manufacturing companies responding to SMU’s questionnaire in early October reported their service center suppliers were lowering spot prices below levels seen just a couple weeks before.

Likewise, service centers reported deepening price cuts as 89 percent said their company was lowering spot prices. Thus, the steel distributors have moved beyond the SMU “capitulation” level, which historically has been 75 percent. That’s the level at which spot selling prices begin to create issues with inventory and profitability and service centers begin to consider higher prices rather than discounting to win orders. Service centers hit the 75 percent mark twice before in 2019. In both instances the mills announced price increases and achieved modest price recovery before prices began to slide once again. Much will depend on the timing of the next mill price increase and whether the service centers have suffered enough to support it.