Market Segment

October 17, 2019

SDI Excited About New Mill in Texas

Written by Sandy Williams

Steel Dynamics CEO Mark Millett enthusiastically spoke of the new steel mill planned for Sinton, Texas, during the company’s third-quarter earnings call.

“We are excited about our Sinton, Texas, flat roll steel mill project, and the associated long-term value creation it will bring through geographic and value-added product diversification. This facility is designed to have product size and quality capabilities beyond that of existing electric-arc-furnace flat roll steel producers, competing even more effectively with the integrated steel model and foreign competition,” said Millett. “We have targeted regional markets that represent over 27 million tons of relevant flat roll steel consumption, which includes the growing Mexican flat roll steel market. This facility is located and designed to have a meaningful competitive advantage in those regions.”

Millett stressed that the new mill will be producing differentiated products for an area that is underserved and currently importing materials that are not produced in the U.S. The location in Texas will open markets in Mexico, the Gulf and West Coast. SDI expects Mexican steel demand will outpace supply due to a surge in manufacturing.

The new EAF mill will have 3 million tons of annual production capability including a 550,000-ton galvanizing line and 250,000-ton paint line. The mill will be able to produce coils up to 52.5 tons in widths from 38-48 inches and gauges from 0.047-1.00 inch.

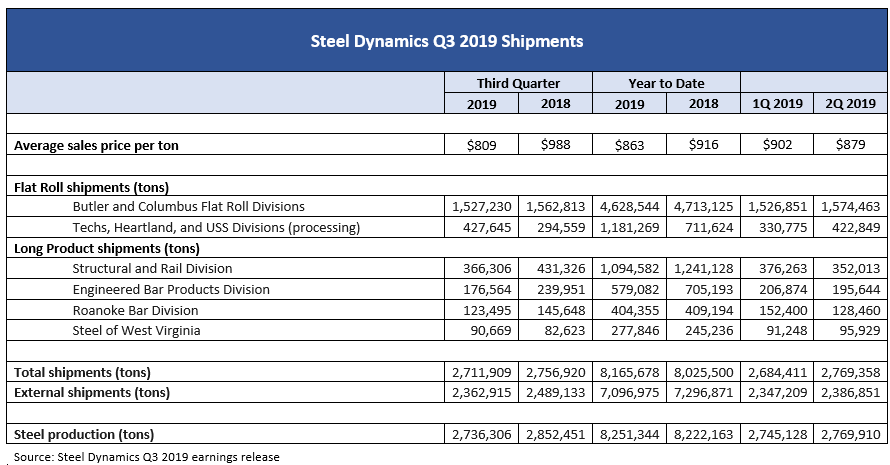

Steel Dynamics reported a profitable quarter although sales and net income were lower than the previous quarter and year. Net sales were $2.5 billion and net income $151 million for the third quarter compared to second-quarter sales of $2.8 billion and net income of $194 million and Q3 2018 sales of $3.2 billion and net income of $398 million. Third-quarter 2019 consolidated operating income was $228 million and adjusted EBITDA $315 million.

“The team delivered a solid third-quarter performance in a challenging steel pricing environment, as average steel pricing declined in the quarter more than offsetting the benefit of lower scrap costs,” said Millett. “Steel customer inventory destocking has subsided and underlying domestic steel demand remains principally intact for the primary steel consuming sectors, with particular strength in construction, as supported by our continued seasonally strong steel fabrication backlog.”

Passage of the USMCA, with its higher U.S. auto content, will benefit steel demand for the entire industry, said SDI, as will an eventual infrastructure bill.

Millett noted that the nation’s growing energy independence is understated and will be a huge economic growth driver for the U.S.

In the flat roll segment, SDI shipped 800,000 tons of hot rolled coil, 197,000 tons of cold rolled and 958,000 tons of coated products.

Scrap shipments were down 10 percent from a year ago to 1.17 million tons, mostly due to lower volume in nonferrous scrap. Ferrous scrap prices have declined eight out of the last 10 months. SDI expects scrap prices to stabilize moving into the winter months.

The GM strike contributed to a reduction of prime scrap, but is expected to have marginal effect over the next few months. Weakening scrap prices caused hesitation in steel purchases as clients waited for further declines in steel prices, SDI said.