Market Data

October 15, 2019

Service Center Spot at Capitulation (Again)

Written by John Packard

Steel Market Update has to admit 2019 has been an unusual year as we have seen two “dead cat bounces” already and we may be about to live through a third in the coming weeks. Why do we believe flat rolled prices are about to reverse course? Because of the data we have been gathering regarding service center spot prices and what history tells us when we get data at the levels seen this past week.

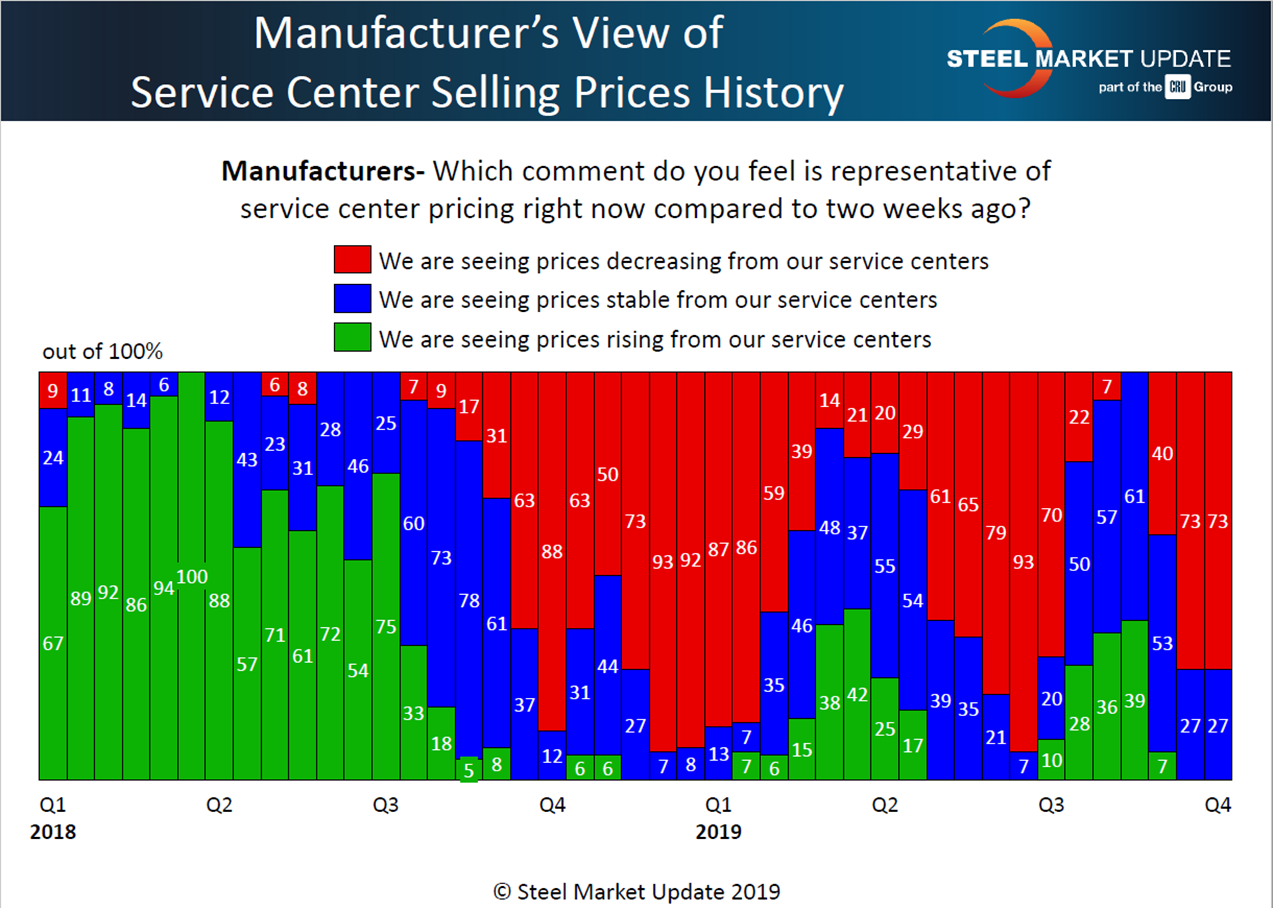

Seventy-three percent of the manufacturing companies responding to our questionnaire last week reported their service center suppliers as lowering spot prices below levels seen just a couple weeks before. This is the same level as reported in early October.

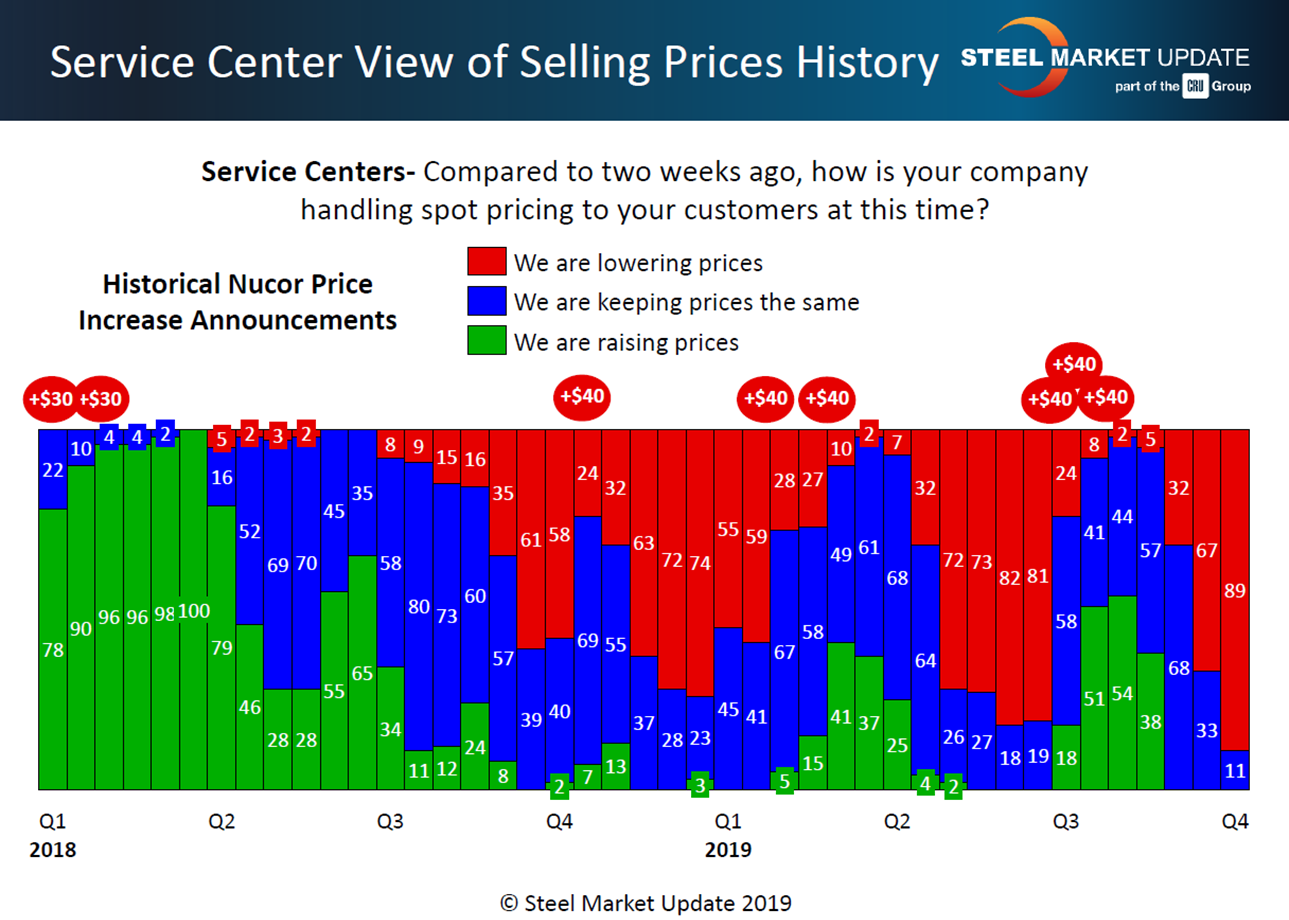

Service centers are reporting deepening price cuts as 89 percent of the distributors said their company is lowering spot prices compared to where they were just two weeks ago. The steel distributors have moved beyond the SMU “capitulation” level, which historically has been 75 percent. By capitulation we mean the point where spot selling prices are creating issues with inventory and profitability.

We saw service centers at about the 75 percent or higher level twice before during calendar year 2019. In both instances the mills announced price increases and achieved modest price recovery before prices began to slide once again.

SMU believes the service center spot data may encourage some of the mills to begin thinking about attempting to raise prices. We are hearing from some service center CEOs and steel buyers that they expect the mills to make a move on pricing, with some believing it could be as soon as this week.

Our opinion based on the data we are collecting is that the service centers have not yet suffered enough and there is too much supply available in the market. Combined, any price bounce will most likely be short lived.