Overseas

October 4, 2019

CRU: Sluggish Demand Turns Longs Sentiment Bearish

Written by Tim Triplett

By CRU Principal Analyst James Campbell

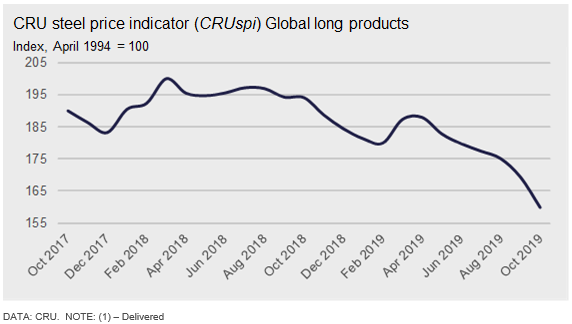

The decline of long product prices accelerated this month as demand in many regions around the world failed to ignite after the seasonally slow July-August period. Prices have now unwound to the level before the 2017-18 boom. Sluggish demand and falling scrap prices have turned sentiment bearish and buying activity has reduced on expectation of further price falls. Overall, the Global Long Products Price Indicator (CRUspi Longs) fell by -5.6 percent m/m to 159.9 in October 2019, with prices lower across all regions this month.

Slowing Growth Upsets the Balance of Supply and Demand

Last month, there was an expectation that demand would benefit from a seasonal improvement after the end of the northern hemisphere summer and rainy season in parts of Asia. A month further on and outside China, the recovery in demand has not happened. With orderbooks weaker than expected, domestic producers have used the recent scrap price falls to lower longs prices further in an attempt to attract orders. However, exporters have also lowered prices, in particular those from Turkey. The Turkish scrap price has now fallen by nearly $70/t since the end of July and producers there have used the full benefit of this decrease to compete with domestic producers in South East Asia. Domestic producers in the USA are also having to once again compete with Turkey as the lower scrap price combines with a preliminary reduction of anti-dumping duties to make exports to the country attractive again.

Of the longs-related prices assessed, 86 percent fell this month, while only two of our assessed prices increased: Chinese domestic prices for rebar and wire rod. The longs market in China has seen a turnaround this month. A seasonal improvement in demand occurred as construction activity picked up with cooler post-summer weather. This was not the only other factor at play. Additional output restrictions were enforced in the key cities of Tangshan and Handan, as well as the province of Shandong. This combination led to a rapid fall in stocks and, unlike the rest of the world, the right environment to support a price rise.

Winter Heating Season III: Lower Targets but Fewer Restrictions

The film industry is aware that sequels are a tricky proposition and the same was true of the second (2018-19) winter heating season. Last year, the target was to reduce PM2.5 and high pollution days by 3 percent. However, the targets were not met, with PM2.5 increasing by 6.5 percent and the number of high pollution days rising by 37 percent. The Chinese government is looking to address this, and targets announced in the recently published draft emission control policy this year are more challenging than a year ago. It ultimately seeks to return air quality levels to those during the 2017-2018 WHS. But although the overall target for air pollution control is tighter than last year, we do not expect greater steel supply restrictions. This is because with more mills now meeting ultra-low emission standards, fewer steel-specific output volume cutbacks are required.

Outlook: Close to the Floor But a Sustained Rise Unlikely Soon

The market remains more likely to be oversupplied rather than undersupplied, meaning the chances of a sustained price rise are low. Scrap prices are closing in on their lower limit, suggesting the price floor is close, particularly as many BF-BOF producers are losing money.

The Russian longs market has been buoyant in 2019, supporting a high domestic price premium over export alternatives. However, the market is slowing down ahead of winter, meaning Russian producers are likely to refocus attention on the export market once again. Although this is likely to further increase competition, it may in part be balanced by a reduction in Indian exports if demand there sees a late seasonal improvement.

In China, a restart of construction activity after the PRC 70th anniversary celebrations is likely to support prices in early October. However, prices are likely to be under increasing pressure as temporary supply restrictions around Beijing loosen. Thereafter, some volatility may be seen if new temporary restrictions are introduced on any high polluting days or provincial governments introduce more stringent winter heating season cuts to tackle local pollution issues.