Prices

October 3, 2019

CRU: Turkish Scrap Import Price Stable, for Now…

Written by Tim Triplett

By CRU Analyst Alexander Ordosch

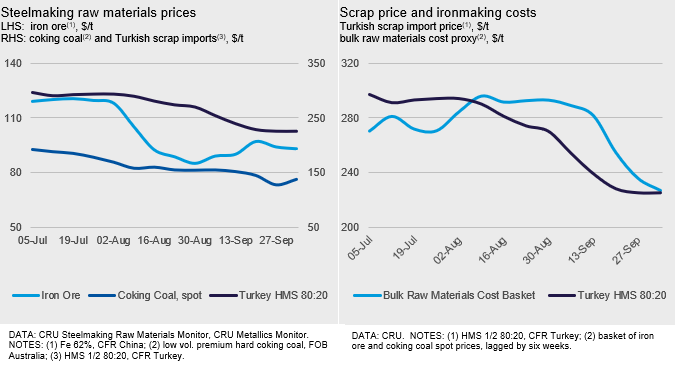

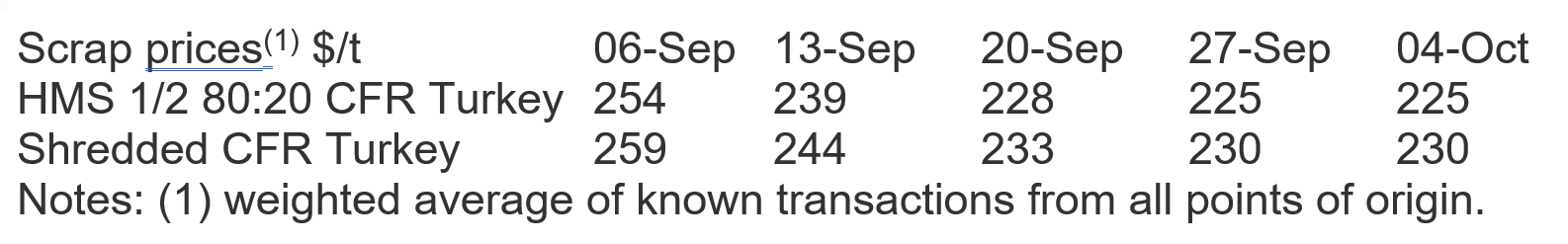

After several weeks of steady Turkish scrap, import prices were stable last week at $225 /t CFR for HMS 80:20. We have assessed seven deals totaling about 274 kt, indicating a second week of strong scrap purchasing activity.

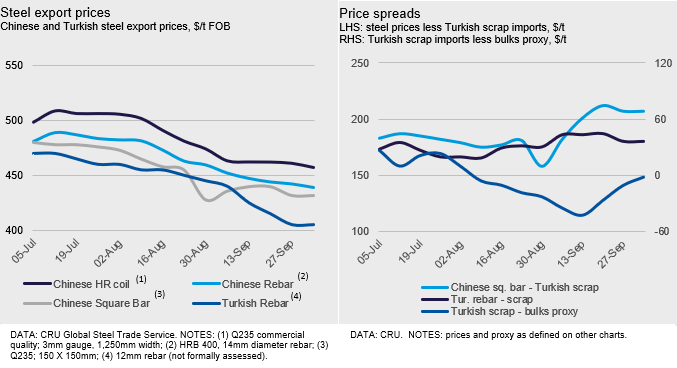

Turkish scrap import prices have now reached a level that allows Turkish steel mills to export rebar at a profit into the U.S. Additionally, the U.S. administration has announced to reduce the currently-in-place antidumping duties against Turkish mills; in some cases, this implies a reduction from more than 10 percent to about 1 percent. This will ease some of the competitive pressure for them because it reduces the landing cost of Turkish longs in the U.S. During recent weeks, we have heard of several small rebar shipments from Turkey to the U.S., but weaker steel demand in the U.S. may limit the opportunity for further rebar exports.

Alongside stable scrap prices, Turkish finished steel export prices also remained broadly stable at $405 /t FOB for rebar and $435 /t FOB (-$5 /t w/w) for wire rod. Steel export prices have generally declined together with scrap prices in recent weeks.

Global Scrap Price Weakness to Undermine Turkish Import Prices

U.S. scrap prices are looking to be down again in October, with expected falls of $30-40 /lt m/m. While this will reduce price support for Turkish scrap, falls will be limited by the already high differential to German scrap prices. Although we also expect German scrap prices to fall significantly in October, the differential has already had record levels. Therefore, we expect Turkish scrap price declines will be limited by falls in European scrap prices.

Overall, we still hold the view that the price floor for Turkish scrap for the next weeks remains at $215-220 /t CFR for HMS 80:20. Lower prices close to $200 /t CFR Turkey may only be reached if European scrap prices fall more sharply than expected and drop to near $200 /t in their respective domestic markets. While Italian obsolete scrap prices are already around $200 /t, German scrap prices still have room to fall, but there may be enough time and weakness in the steel industry in 2019 to allow that to happen.