Market Segment

October 1, 2019

CRU: Chinese Policy Suggests Limited Winter Steel Cuts

Written by Tim Triplett

By CRU Analysts Ruilin Wang and Kevin Bai

China has released a draft emission control policy document for the 2019-2020 winter heating season (WHS). Although the overall target for air pollution control is tighter than last year, it will not lead to greater steel supply restrictions because:

• Clear regional targets to meet ultra-low emission standards for the steel industry have been set, and any mills that comply with this standard are exempted from any cutbacks. With more mills now meeting this standard, less steel production volume cuts are required to meet air pollution targets;

• Particular supply restriction dates/durations over the WHS have not been specified. Rather, ad-hoc supply restrictions during high air pollution days are likely to be the only mandated output cuts and then only for mills that do not meet the ultra-low emission standards. This means that, though cuts at certain times may be required, these will be applied to fewer mills and over short durations—depending on the weather. In these cases, lost production could be made up and the overall impact on supply will be limited.

Given that underlying steel demand, including in real estate and automotive sectors, is likely to weaken in the coming months, there is nothing in the latest policy announcement to support steel prices.

Clearer Skies Targeted Through More Measures

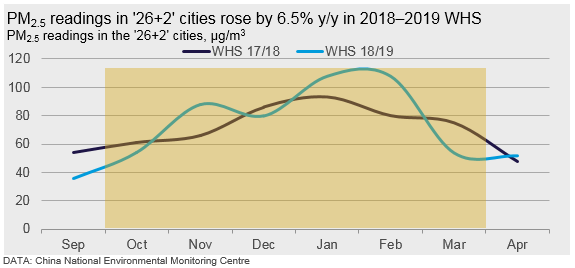

This year’s policy has the same geographical scope as in the past, targeting regions in the “26+2” cities with the same objective of maintaining air quality during the winter. However, this year, the target is to reduce PM2.5 readings in these cities by 5.5 percent and to reduce the number of high pollution days by 8 percent. This is more stringent than in the 2018-2019 WHS when the target was to reduce both criteria by 3 percent, although these previous targets were ultimately not met, with PM2.5 actually increasing by 6.5 percent (see chart below) and the number of high pollution days rising by 36.8 percent. While the 2019-2020 WHS targets are more challenging than a year ago, it ultimately seeks to return air quality levels to those during the 2017–2018 WHS.

To achieve this, the policy reiterates previous aims including supply-side reform in heavy industries (including steel, coke and cement) and plant relocations away from these cities to less pollution-sensitive areas. Other highlights include:

• Plant-by-plant production cuts (not limited to steel) determined by local governments;

• Acceleration of elimination of old and high emission vehicles;

• Reduction in coal consumption and the number of coal-fired power plants (city-by-city targets to be finalized) and support to clean energy generation;

• Acceleration in the transition from road to rail transportation, with support for dedicated railway projects with a total length of 1,586 km in 2019/20.

What’s New This Time?

The scope of the policy has remained broadly unchanged but there are much more detailed target and implementation guidelines. For the steel industry, there are three main differences:

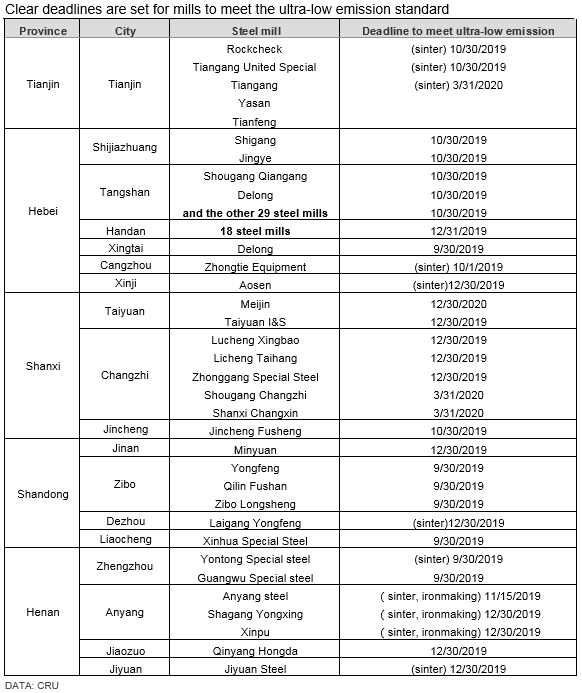

• Ultra-low emission standard implementation in steel industry has been stressed with different city level targets detailed. (The ultra-low emission standard for the steel industry was introduced to help environmental protection and advocate green and sustainable development. Under the guidelines published by the Ministry of Ecology and Environment in April 2019 with specific emission targets across the supply chain, 60 percent of capacity is expected to comply with ultra-low emission targets by the end of 2020 and 80 percent by 2025.) In contrast with past WHS policies, clear deadlines for individual steel mills to fulfill ultra-low emission standard have now been set (see table below);

• Producers, such as steel mills, for instance, will be ranked A, B and C according to the emission results. Mills that pass the ultra-low emission criteria are A rank, which can be exempted from any supply restrictions during the WHS. Other mills are categorized as B and C, which are subject to various levels of curtailments on a city-by-city or plant-by plant basis;

• No explicit supply cut dates and duration over the WHS are mentioned. This means actual production volume limits will be applied only on an ad-hoc basis during high pollutive days.

No Cutback Intensification So Steel Market Will be Less Tight

With more mills meeting ultra-low emission standards, fewer steel-specific output volume cutbacks are required. Taking Tangshan as an example, 31 steel plants in the city are required to achieve ultra-low emission standards by the end of October 2019, theoretically meaning no explicit supply restrictions will be required during the remaining five months in the WHS. This compares with last year when most of these mills were required to cut hot metal capacity by 20-50 percent.

Likewise, Hebei province will require 100 Mt /y of steel capacity and Shanxi province 15 Mt/y to meet the ultra-low emission standards by the end of December 2019. These steelmakers will then be categorized as A rank and can likewise be exempted from any supply restrictions during high pollutive days.

Chinese steel producers at large have also become much cleaner than they were in 2017-2018 by actively enhancing their emissions controls through significant investment in environmental protection facilities. Beyond the mandated compliance with ultra-low emissions, this is another reason why there will be less impact on supply this year.

Lastly, we believe that steel supply will be less restricted than last year as no specific supply cut dates and durations have been mandated. Rather, only ad-hoc supply cuts during high pollutive days will likely be seen, with scope for this to be compensated for by higher output in days where air pollution is less severe.

Therefore, steel prices will see little additional support over the coming WHS compared with prior winters. However, reactive city level regulations when pollution levels rise will lead to short-term supply restrictions and, therefore, will bring more short-term steel price volatility.

Risks to CRU’s Current View

Our current assumption is that all steel mills in the above table will meet the ultra-low emission standard by the stated deadlines, but this is not guaranteed. Mills that do not will be subject to output controls, as in prior years.

A variation of this is that only part of a particular mill’s operations meets the emission standards, leaving a potential production bottleneck where a non-compliant asset does not and is subject to volume output restrictions. An example of this is Tianjin, the only city that has disclosed some details in the draft document. As shown in the table above, sinter plants of Rockcheck Steel and Tiangang United Special Steel in Tianjin city will reach the ultra-low emission standard, but blast furnaces will not. Therefore, while sinter plants can be exempted from WHS cutbacks, two 500 m3 blast furnaces in Tiangang United Special Steel will need to be completely shut down. Therefore, it is still possible for the city-level government to implement stricter supply restrictions, which could mean more cutbacks at an individual city level. This could mean supply is less loose than this year’s policy statement would otherwise imply.

Less Tightening of Steel Market Expected

Although the overall target for pollution control in the WHS policy this year is tighter compared to last year, the steel market will not tighten as much as last winter as the focus is now on air quality, not output cuts, and steelworks’ emissions control is improved. In particular, mills that meet ultra-low emission standards will not be subject to any output controls.

Mills that do not meet this standard will be subject to output controls, though these are expected to be made on an ad-hoc basis (when air pollution is very high, for example) and not over large and pre-determined periods of time. This gives scope for steelmakers to make up for lost production. One consequence of this may be higher steel price volatility, however.

CRU will update its views on this subject as and when further policy detail, or information on ad-hoc cuts, becomes available.