Prices

September 24, 2019

CRU: Turkish Scrap Import Prices Fall to Lowest Level Since 2016

Written by Tim Triplett

BY CRU Analyst Alexander Ordosch

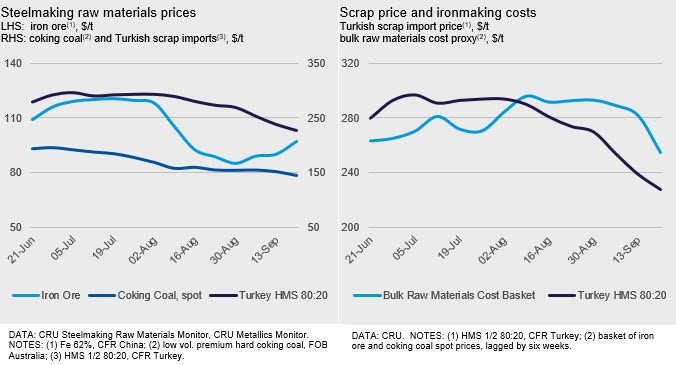

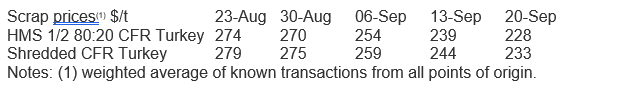

For the week ending Sept. 20, Turkish scrap import prices fell for the seventh consecutive week to $228 /t CFR for HMS 80:20, down $11 /t w/w. We assessed two deals from the UK totaling 37 kt of scrap. The current price is the lowest in the weekly price assessment on record and the lowest level since October 2016, when CRU’s monthly assessment hit $220 /t CFR.

Early indications from two weeks ago pointed to significantly lower Turkish scrap prices, because Turkish mills were offering $220 /t for scrap while scrap prices were still around $250 /t CFR. Pressure from Turkish mills compounded weak U.S. and European domestic scrap markets, and support for scrap prices vanished.

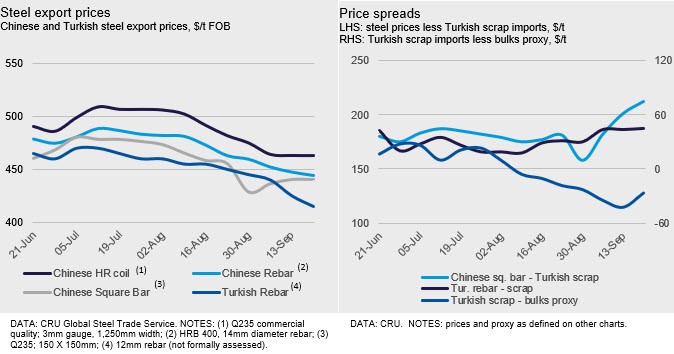

Turkish steel export prices weakened together with scrap prices; rebar and wire rod were down $10 /t w/w to $415 /t FOB Turkey and $450 /t FOB, respectively. Turkish steel export prices have declined by more than export offers from China since mid-August; Turkish rebar export prices fell $35 /t, compared to $19 /t for Chinese rebar. While relative stronger scrap and finished steel prices in Asia may have resulted in a potential opportunity for Turkish mills to sell material in the region, Indian offers are also highly competitive.

Price Floor of $200 /t Not Expected to be Reached

Turkish scrap prices have historically rebounded quickly once they fall to or below $200 /t. This is because supply dries up as scrap yards struggle to maintain profitability. We do not expect that scrap prices will reach this level, unless Chinese steel mills start exporting sizeable volumes of steel amid weak domestic conditions there. Chinese steel is currently higher cost than alternatives due to high domestic coal and scrap prices there. As steelmakers elsewhere are willing to accept prices below Chinese domestic prices, there is little incentive currently for exports, despite the drop in profitability.