Logistics

September 23, 2019

ATA: Trucking Trend Line Still Moving Up

Written by Sandy Williams

The trucking barometer is not pointing toward a recession, says the American Trucking Association, citing its latest For-Hire Truck Tonnage Index.

The August index declined 3.2 percent to a reading of 118.3 after climbing 6.2 percent in July. Compared to a year ago, the seasonally adjusted index was up 4.1 percent and gained 4.3 percent on a year-to-date basis.

“The large swings continued in August, but the good news is the trend line is still up,” said ATA Chief Economist Bob Costello. “While there is concern over economic growth, truck tonnage shows that it is unlikely the economy is slipping into a recession. It is important to note that ATA’s tonnage data is dominated by contract freight, which is performing significantly better than the plunge in spot market freight this year.”

DAT Trendlines reports that severe flooding in the Houston area due to tropical storm Imelda disrupted freight shipments and rates last week. Unlike Hurricane Dorian, which boosted inbound truck traffic before the storm, Imelda caused lost productivity and lower freight volumes into and out of the region.

The disruption led to lower load-to-truck ratios for all types of trucks. The national ratio for flatbed trucks fell 4.0 percent during the week of Sept. 16-22 to 13.77 loads per truck.

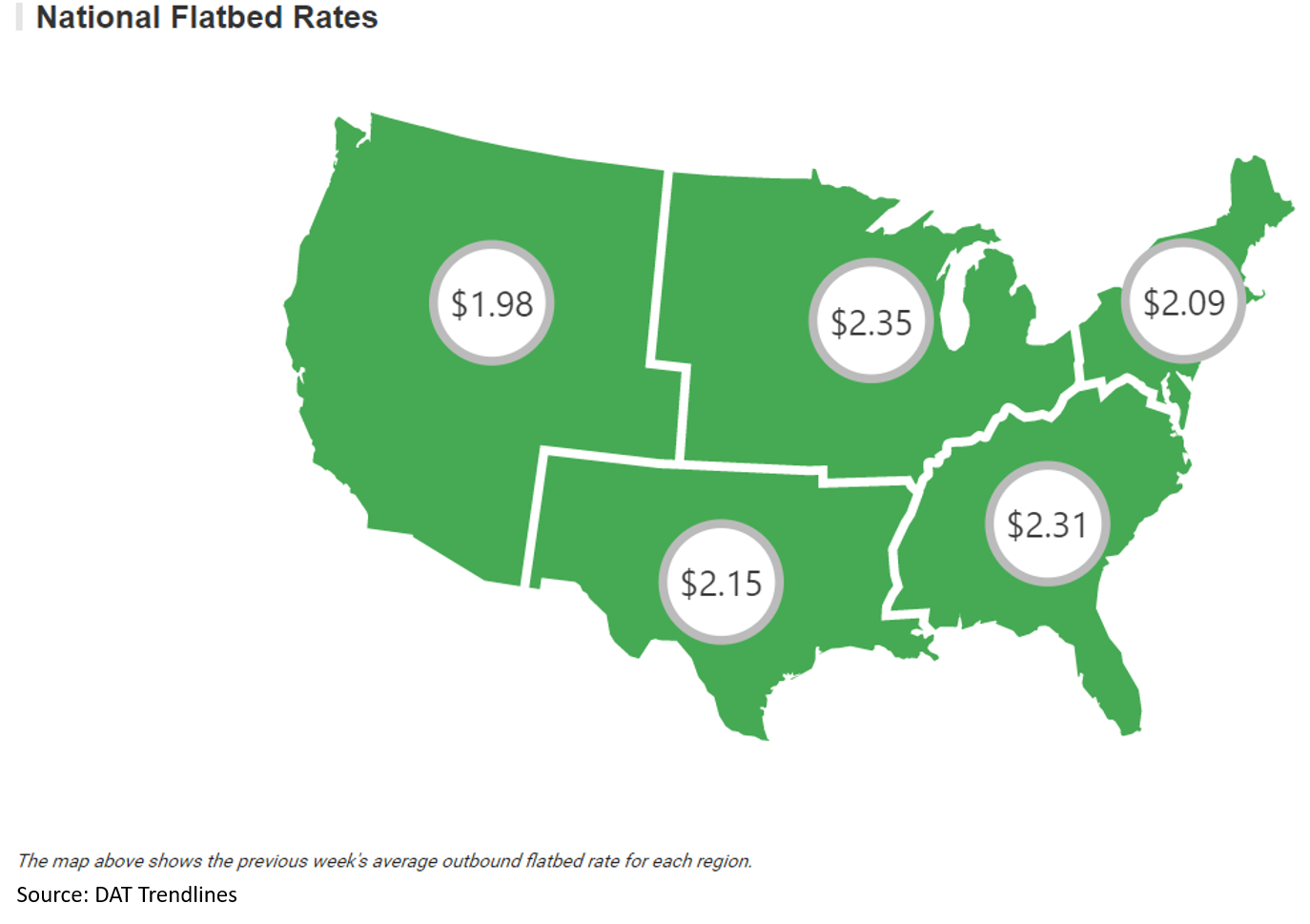

Flatbed spot rates rose 1.2 percent last week compared to the previous week. National spot rates for flatbeds averaged $2.19 per mile in September, down just slightly from $2.20 per mile in August.

As of Sept. 23, the U.S. on-highway diesel fuel price averaged $3.081 per gallon, up $0.094 from a week ago and down $0.190 from a year ago.