Market Data

September 22, 2019

A Grim Global Economic Outlook from the OECD

Written by Sandy Williams

“Fragile and uncertain” is how the Organization for Economic Cooperation and Development (OECD) describes the current global economy. The OECD’s latest Interim Economic Outlook shows economic growth slowing as escalating trade conflicts impact confidence and investment and increase downside risks in financial markets.

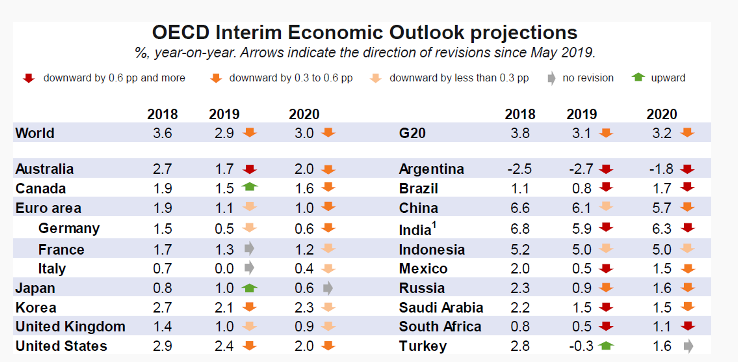

In May of 2018, the OECD was predicting global growth of 4 percent for 2019, but that forecast is now adjusted downward to 2.9 percent. The annualized growth rate for global investment increased at a pace of almost 5 percent in the first half of 2018, but the OECD expects that rate to slide below 1 percent in 2019, with trade falling from 4 percent into contraction.

“The proliferation of tariffs and subsidies and the increasing unpredictability of trade policies have destroyed growth in international trade, triggering a sharp slowdown in industrial output and investments,” said OECD Chief Economist Laurence Boone.

Uncertainty about future market conditions makes companies hesitant to commit to investment, and the longer investments are withheld the more potential for harm to future growth and employment.

The OECD lists, among others, the following warnings in the Interim Outlook:

- Service sector output has so far held up due to solid consumer demand, but persistent weakness in manufacturing sectors will weaken labor demand, household incomes and spending.

- Growth in China is expected to moderate gradually, but risks of a sharper slowdown and a prolonged period of very weak import demand are intensifying.

- Substantial uncertainty persists about the timing and nature of the withdrawal of the United Kingdom from the European Union. A no-deal exit would be costly in the near-term, potentially pushing the United Kingdom into recession in 2020 and reducing growth in Europe considerably.

- Collective effort is urgent to halt the buildup of trade-distorting tariffs and subsidies and to restore a transparent and predictable rules-based system that encourages businesses to invest.

“The global economy is facing increasingly serious headwinds and slow growth is becoming worryingly entrenched,” said Boone. “The uncertainty provoked by the continuing trade tensions has been long-lasting, reducing activity worldwide and jeopardizing our economic future. Governments need to seize the opportunity afforded by today’s low interest rates to renew investment in infrastructure and promote the economy of the future.”

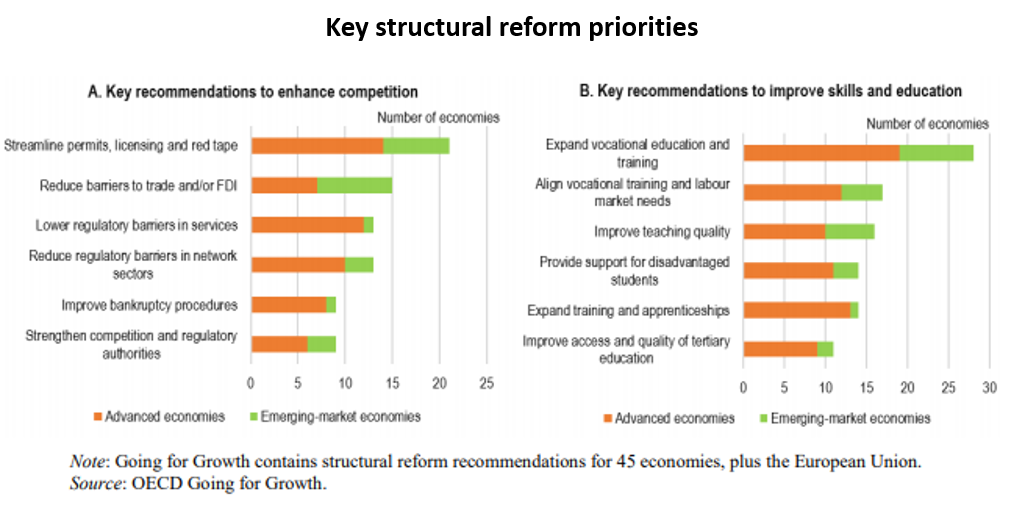

The OECD suggests that stronger fiscal and structural policy should accompany accommodative monetary policy in advanced economies. Public investment should take advantage of exceptionally low long-term interest rates to support near demand and future prosperity.

“Greater structural reform ambition is required in all economies to help offset the impact of the negative supply shocks from rising restrictions on trade and cross-border investment and enhance medium-term living standards and opportunities,” reported the OECD.

The Organization for Economic Co-operation and Development (OECD) is an international forum working with over 100 countries to promote policies to improve the economic and social well-being of all people. The OECD bringa together governments, policy makers and citizens to establish international norms and find evidence-based solutions to a range of social, economic and environmental challenges.