Prices

September 19, 2019

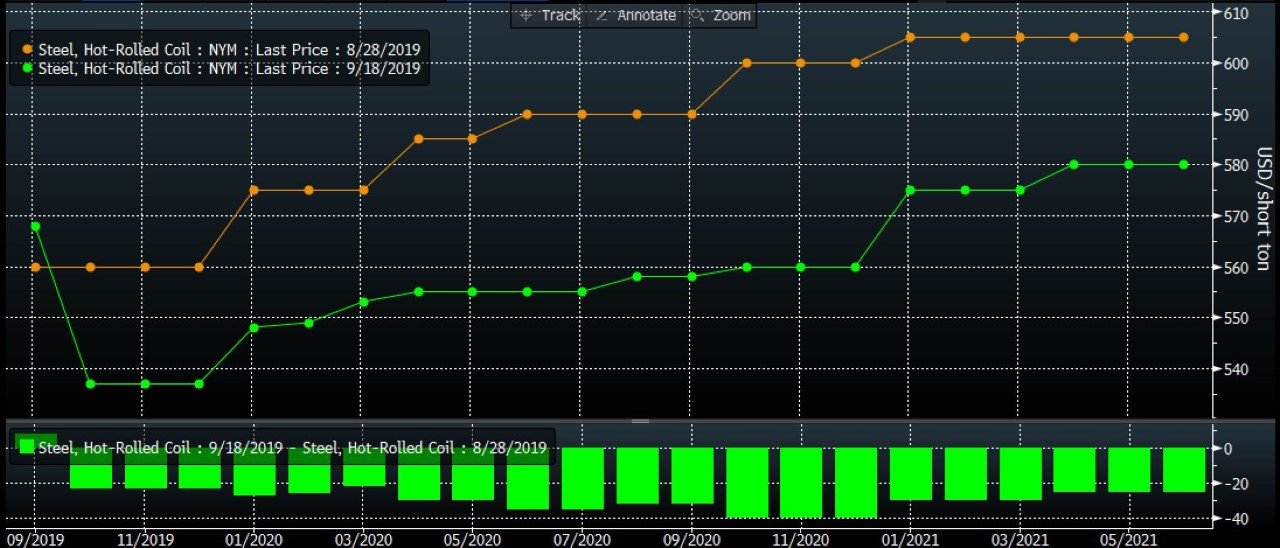

Hot Rolled Futures: Here We Go Down Again?

Written by Gaurav Chhibbar

SMU contributor Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Gaurav’s previous role, he was a trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. You can learn more about Metal Edge at www.metaledgepartners.com. Gaurav can be reached at gaurav@metaledgepartners.com for queries/comments/questions.

HRC futures in the past three weeks have been pushed significantly lower. The drop of $30-40 across the curve is one that has been felt the most by those who had bought long physical into the promise of a rally without hedging off a portion of that buy.

The market has thrown the bull case of a potential appreciation in steel prices out of the window. We called out this risk on our last writeup on Aug. 8, highlighting global demand concerns as well as pressure on the raw materials in the physical side.

The chart above highlights the scrap market challenge that is visible to all in the raw material space. The sharp drop-off is underscored by industrial demand weakness in Europe as well as pressure from physical flows coming to Turkey from both the Black Sea and the continental European market.

Despite the global pessimism and extremely difficult mill margin conditions in Europe and Asia, mills in the U.S. seem to have it slightly better. Well, at least on paper, and certainly I don’t mean the integrated mills but just the minis. The metal margin as shown in the chart below is still above the historical average of low $200s offering an opportunity for mills to sell portions of 2020 and buy scrap to lock that spread.

In the absence of the sellers of 2020, it won’t surprise anyone to see a steeper contango as spot market weakness persists in the wake of a buyers’ strike and short-term push to destock further. Having said that, distributor inventory levels in the U.S. are already below long-term averages. The ability to destock any more will be directly dependent on demand. Any demand surprise in Q4 or Q1 can squeeze the market to a higher price level. Speaking about a squeeze, the ore markets that lost >30 percent on spot pricing saw pricing support driven by profit taking and moved higher. Although Goldman’s ore outlook by the end of the next 60 days is around $115 /mt, the confidence in this ore rally is being questioned by some worried about fundamental demand in China.

For most of those looking at the markets at this point, the key determinant is going to be the total exposure they want to carry into Q4.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information