Market Data

September 17, 2019

PPI Data: Tinware Loses Ground vs. Aluminum

Written by Peter Wright

The composite producer price index of all commodities has been relatively stable in 2019, but tinware products are becoming very uncompetitive against aluminum.

This report is an analysis of Bureau of Labor Statistics data performed by staff of Steel Market Update and is intended to provide subscribers with a view of the competitive position of sheet steel, aluminum, plastic and wood. The analysis includes some downstream products and a comparison of truck and rail transportation.

![]()

On Sept. 11, the BLS released its series of PPIs for more than 10,000 goods and services through August. For an explanation of this program, see the end of this piece. The PPI data are helpful in monitoring price direction, though there may be a lag between the BLS reports and spot prices for steel products. We have also concluded that the actual index values of the PPIs of different products cannot be compared with one another because they are developed by different committees within the BLS. We believe this data is useful in comparing the direction of prices in the short and medium term, but tell us nothing about the absolute value.

As the BLS reported: “The Producer Price Index for final demand rose 0.1 percent in August, seasonally adjusted. Final demand prices moved up 0.2 percent in July and 0.1 percent in June. On an unadjusted basis, the final demand index rose 1.8 percent for the 12 months ended in August. In August, the advance in final demand prices is attributable to a 0.3 percent increase in the index for final demand services. In contrast, prices for final demand goods fell 0.5 percent.”

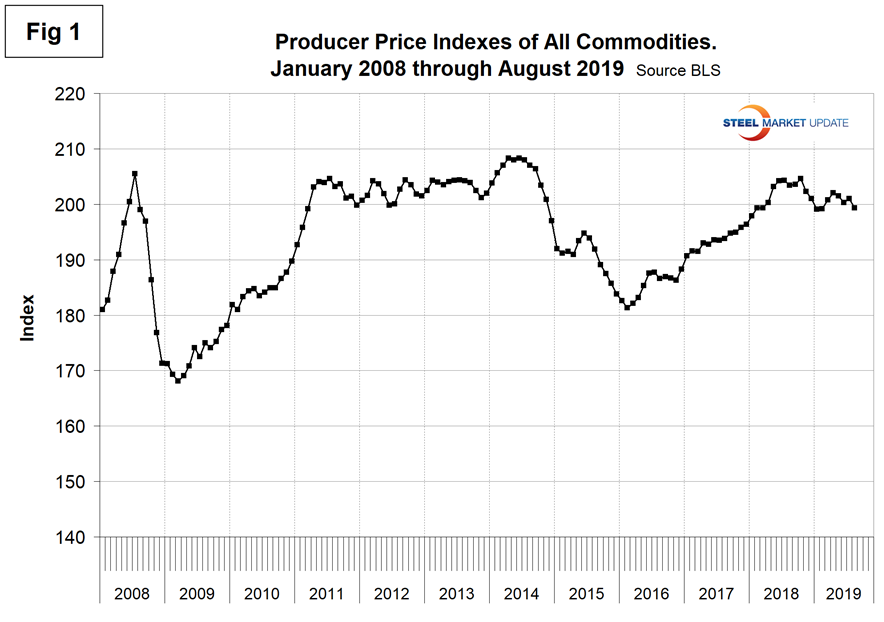

Figure 1 shows the composite PPI of all commodities since January 2008. The index rose steadily for two and a half years through mid-2018 before declining in November and December 2018. By August 2019, the index had reverted to its level in January and February. Overall, the composite was up by 2.9 percent in the 12 months of 2018 and down by 2.0 percent in August year over year.

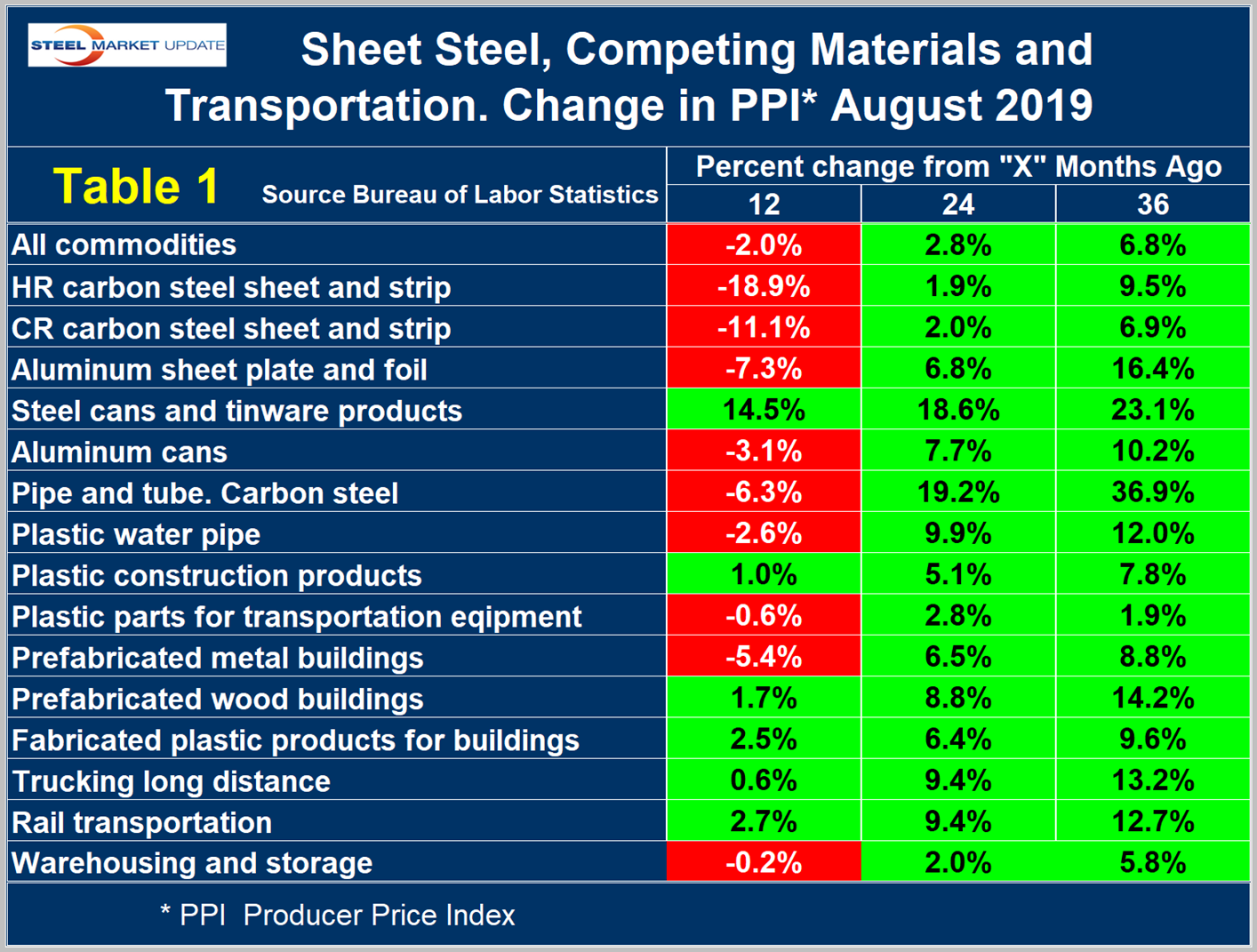

Table 1 is a summary of each segment that we examine on a year over one-, two- and three-year basis. The gain/loss pattern is shown by the color codes; we interpret rising prices as positive. We began this bimonthly analysis in January 2016 and the table has been predominantly green at the 24-month and 36-month level since February last year. In August, 10 of the 16 sectors were declining at the 12-month level, an increase from seven in our June analysis. The table includes direct comparisons where possible between steel and competing products, also some other plastic products for which there is no direct steel comparison and a measure of price changes for transportation, warehousing and storage. Some specific comparisons of steel and steel products with their competition are as follows. Please note the Y axes are not to the same scale.

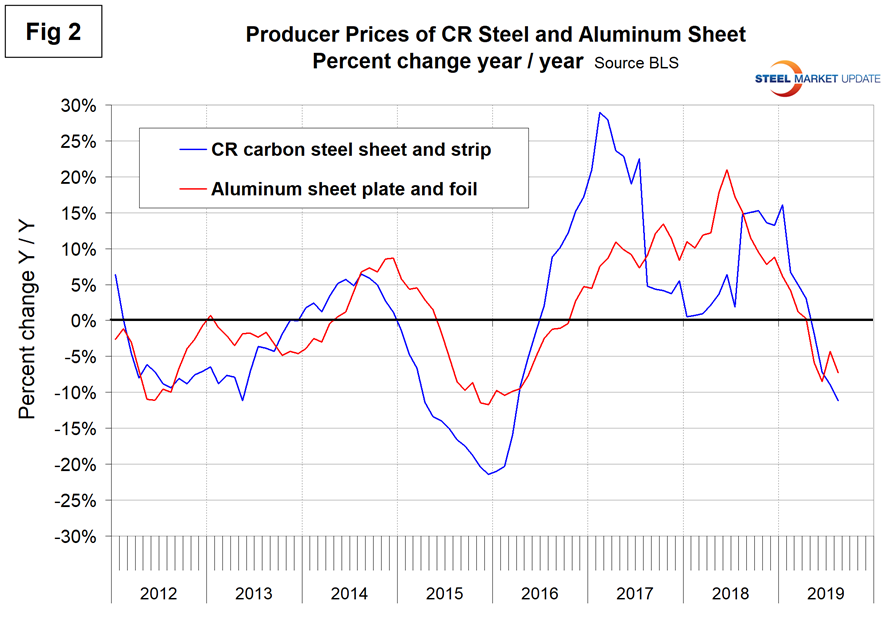

Figure 2 shows the year-over-year comparison of the price change of cold rolled steel sheet and flat rolled aluminum. The lines crossed in September last year and since then the price changes of steel and aluminum have been similar. In August 2019, the rate of change of the price indexes was negative 11.1 percent for steel and negative 7.3 percent for aluminum, both year over year.

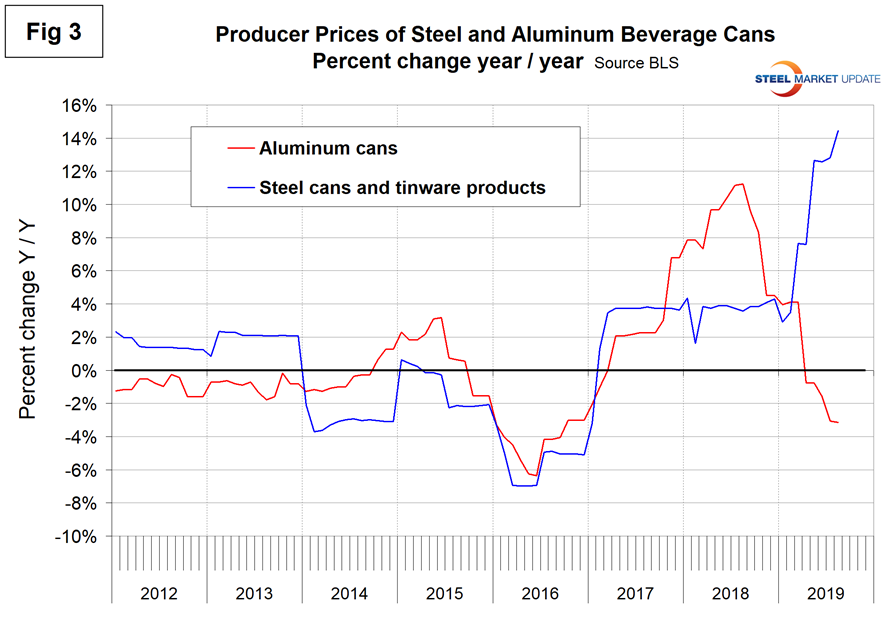

Figure 3 shows the same comparison for steel tinware products and aluminum cans, a very different scenario from their respective raw materials. The BLS data suggests that steel cans have experienced an increasing competitive disadvantage since February this year.

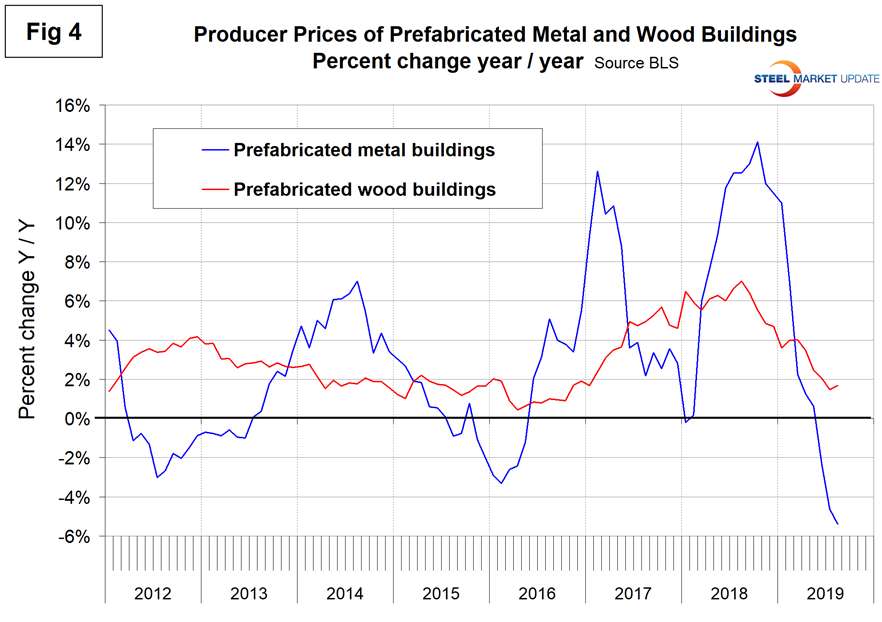

Figure 4 compares prefabricated metal with prefabricated wood buildings. In this analysis, steel has improved its competitive advantage this year. In 12 months through August, the PPI of wood buildings increased by 1.7 percent as steel buildings declined by 5.4 percent.

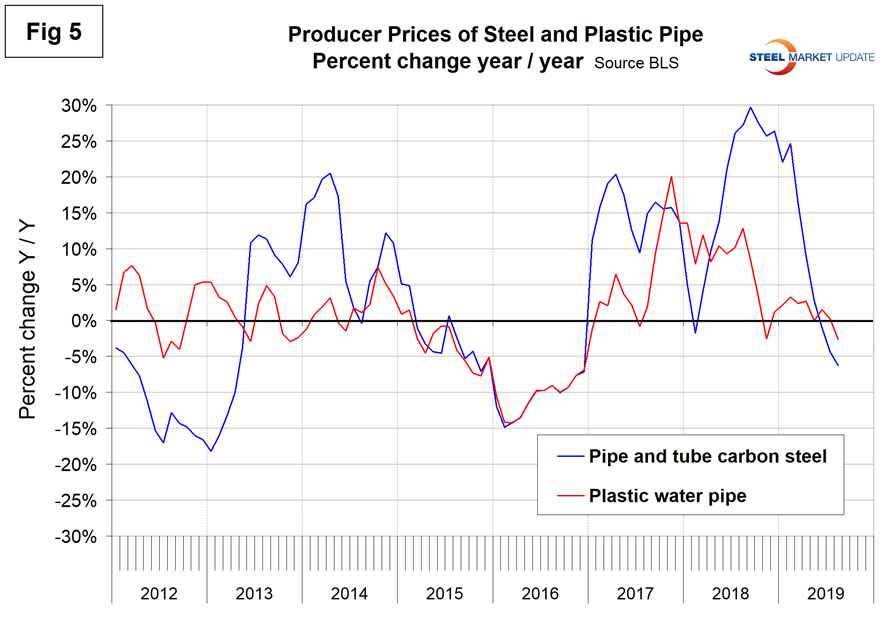

Figure 5 compares the price changes of steel and plastic pipe, which moved in opposite directions to the detriment of steel in 2018. Since then steel has come back in line with plastic.

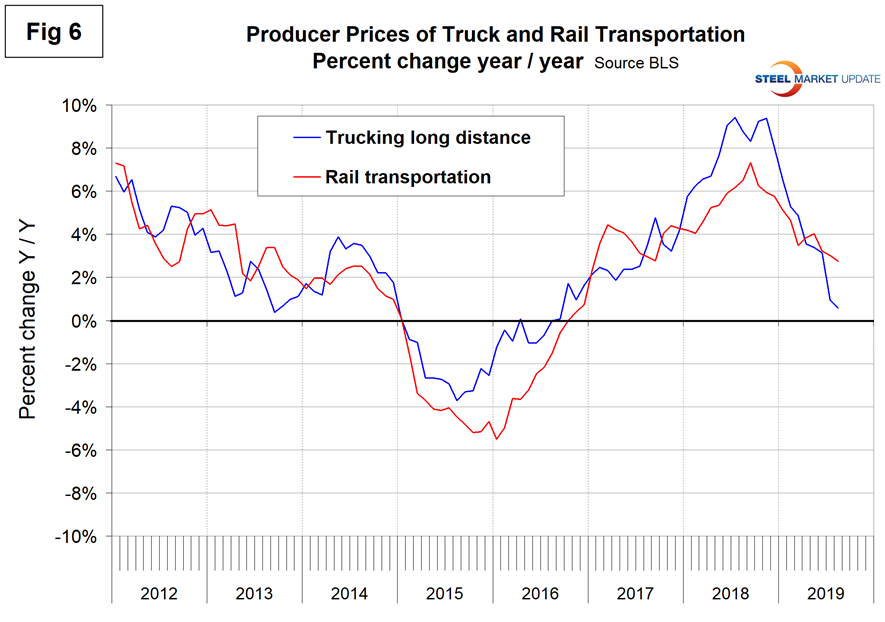

Figure 6 compares the changes in the price of truck and rail transportation. The escalation of truck transportation prices exceeded those of rail almost every month from January 2015 through May 2019, but in July and August the price of rail transportation increased more than for trucking.

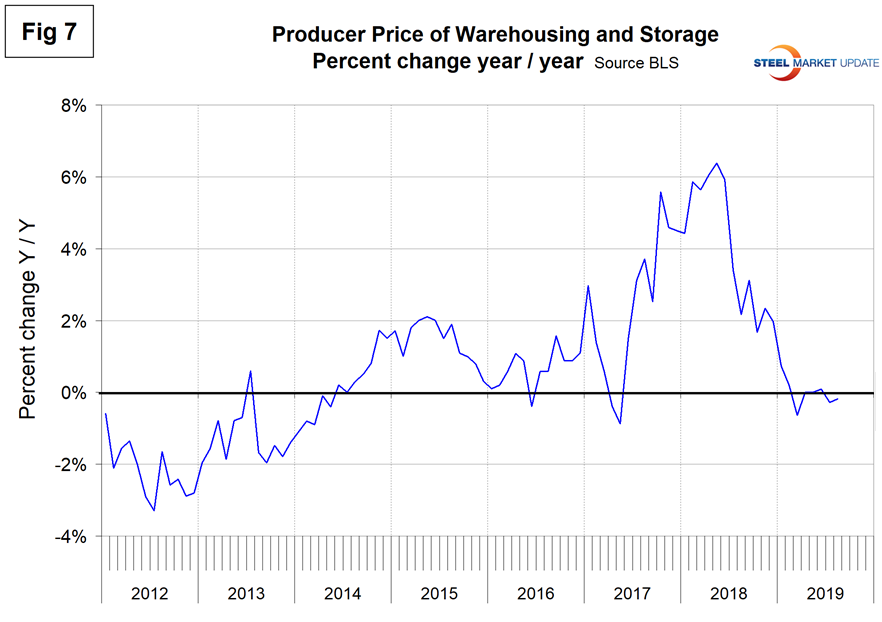

Figure 7 shows that the rate of change of the price of warehousing and storage has declined steadily since April last year and was negative in March, July and August this year.

The official description of this program from the BLS reads as follows: “The Producer Price Index (PPI) is a family of indexes that measure the average change over time in the prices received by domestic producers of goods and services. PPIs measure price change from the perspective of the seller. This contrasts with other measures, such as the Consumer Price Index (CPI). CPIs measure price change from the purchaser’s perspective. Sellers’ and purchasers’ prices can differ due to government subsidies, sales and excise taxes, and distribution costs. More than 10,000 PPIs for individual products and groups of products are released each month. PPIs are available for the products of virtually every industry in the mining and manufacturing sectors of the U.S. economy. New PPIs are gradually being introduced for the products of industries in the construction, trade, finance, and services sectors of the economy. More than 100,000 price quotations per month are organized into three sets of PPIs: (1) stage-of-processing indexes, (2) commodity indexes, and (3) indexes for the net output of industries and their products. The stage-of processing structure organizes products by class of buyer and degree of fabrication. The commodity structure organizes products by similarity of end use or material composition. The entire output of various industries is sampled to derive price indexes for the net output of industries and their products.”