Analysis

September 17, 2019

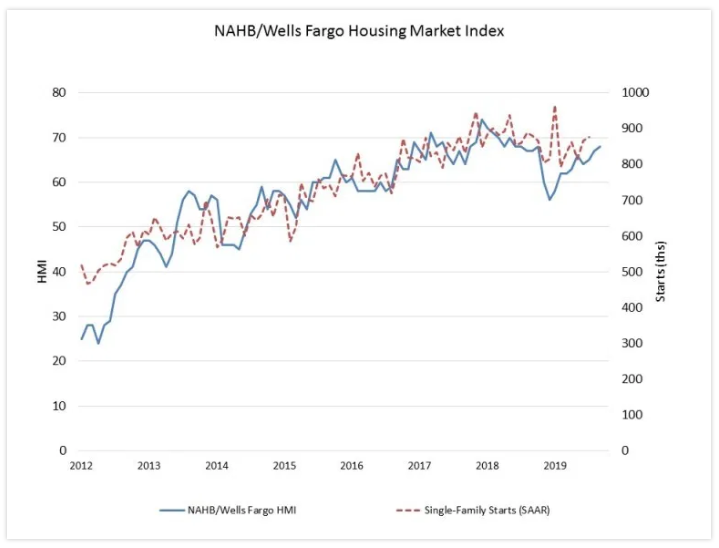

Builder Confidence at Year's High in September

Written by Sandy Williams

Builder confidence hit a one-year high in September, according to the latest NAHB/Wells Fargo Housing Market Index. The HMI, which measures builder perceptions of current and future sales of new single-family homes, rose one point to 68.

The HMI index gauging current sales conditions increased two points to 75 and the component measuring traffic of prospective buyers held steady at 50. The measure charting sales expectations in the next six months fell one point to 70.

“Low interest rates and solid demand continue to fuel builders’ sentiments even as they continue to grapple with ongoing supply-side challenges that hinder housing affordability, including a shortage of lots and labor,” said NAHB Chairman Greg Ugalde.

“Solid household formations and attractive mortgage rates are contributing to a positive builder outlook,” said NAHB Chief Economist Robert Dietz. “However, builders are expressing growing concerns regarding uncertainty stemming from the trade dispute with China. NAHB’s Home Building Geography Index indicates that the slowdown in the manufacturing sector is holding back home construction in some parts of the nation, although there is growth in rural and exurban areas.”

Regional indexes showed the three-month moving average improving in three regions and holding steady in one. The Northeast gained two points each for index readings of 59 and 75, respectively. The South was up one point to 70 and the Midwest was unchanged at 57.