Product

September 15, 2019

Service Center Spot Pricing: Looking Down

Written by John Packard

Any upward momentum the mills may have seen from their price increases earlier this summer has apparently run its course. Service centers are no longer supporting higher prices, according to findings from Steel Market Update’s latest market trends questionnaire.

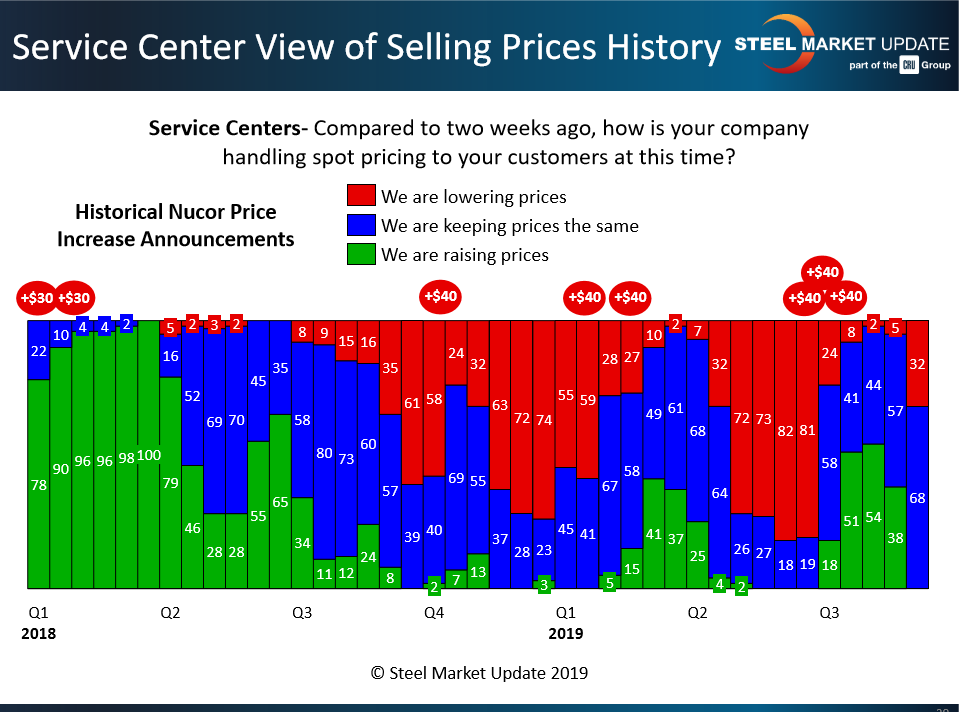

As seen in the chart below, none of the service center executives responding to SMU’s poll said they are still raising prices. Roughly two out of three said they are holding the line, but nearly one-third admit they are now lowering prices to close the sale.

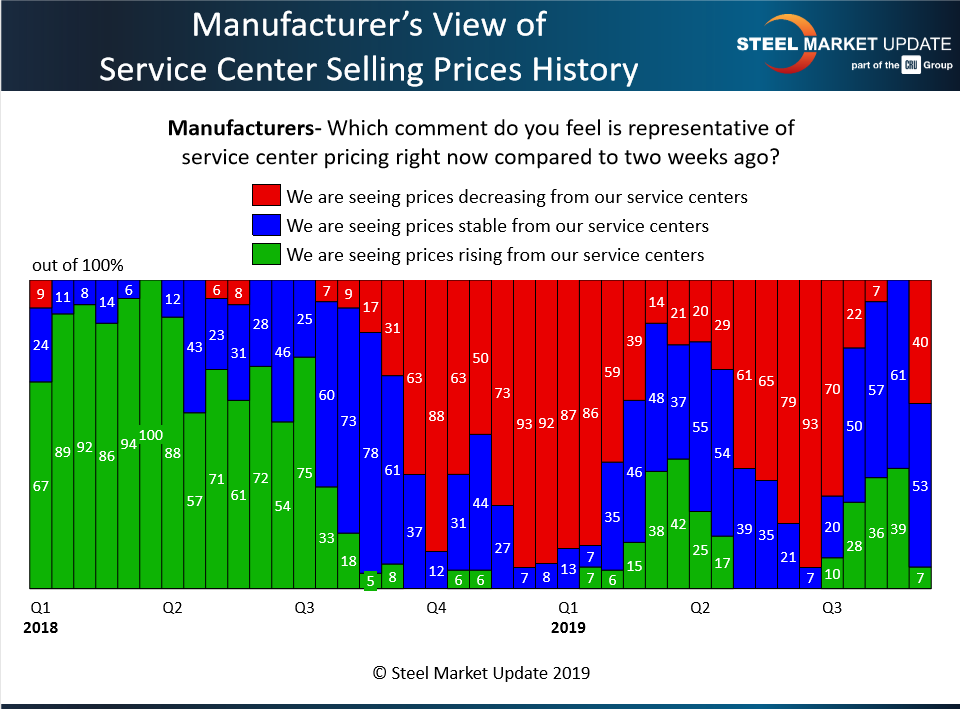

Corroborating the trend, only 7 percent of the manufacturers responding to SMU’s questionnaire report they are still seeing higher prices from their service center suppliers. Forty-percent say steel offers from service centers are now lower—a major shift from just a few weeks ago.

SMU data shows the benchmark price for hot rolled steel dropped from about $700 per ton at the beginning of the year to around $550 per ton by the end of June when the mills announced the first of three $40 price increases. In the weeks that followed, the HR price saw a brief bump to an average of $583 per ton, but has since slid back to around $575. Based on the latest feedback from service centers and their customers, it appears spot prices could trend further downward in the coming weeks.