Market Data

September 12, 2019

Steel Mill Negotiations: Pendulum Swings in Buyers' Favor

Written by Tim Triplett

The pendulum appears to have swung back in buyers’ favor as service centers and OEMs report most mills willing to negotiate to secure spot orders of all types of steel products.

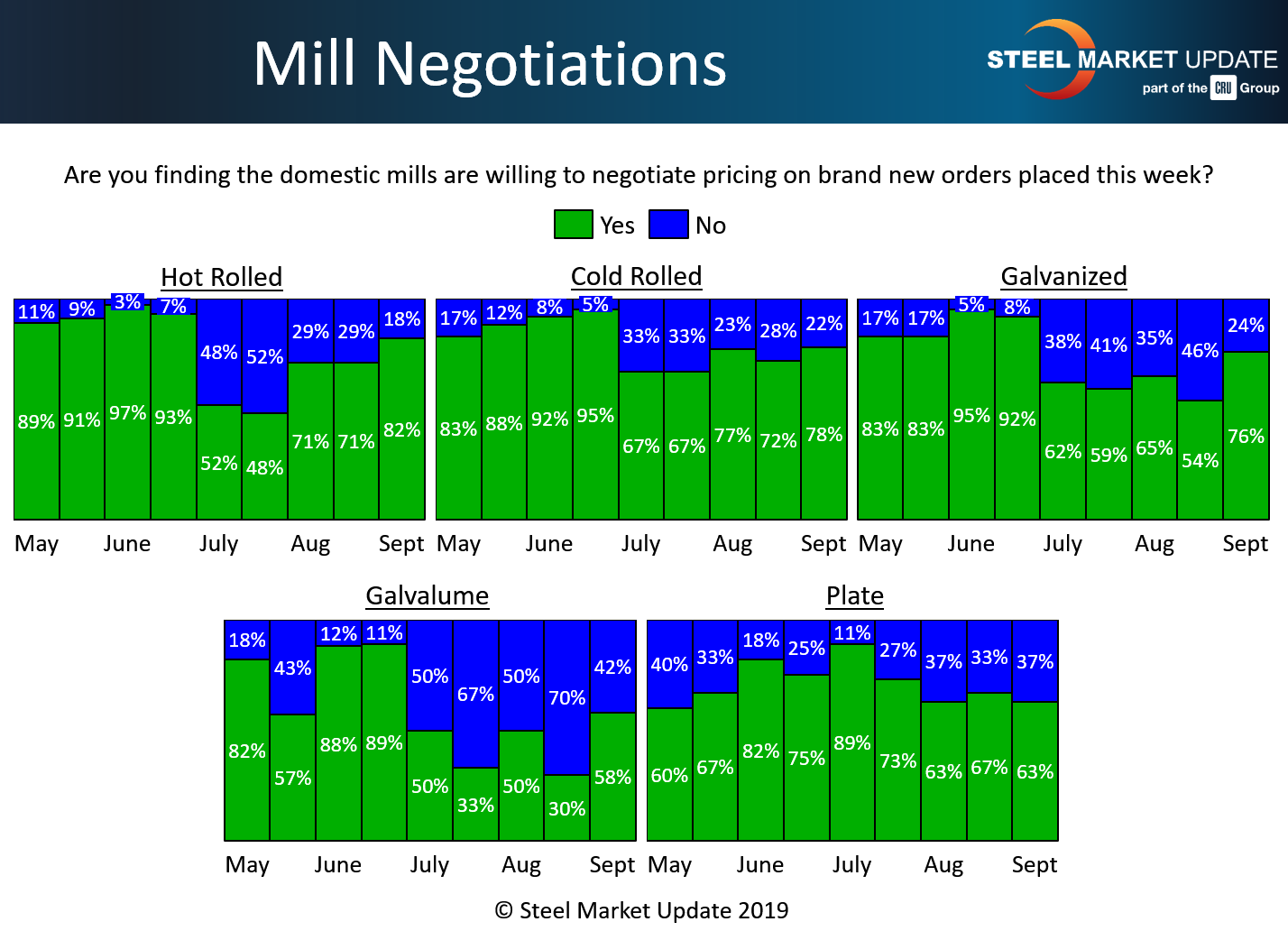

In the hot rolled segment, 82 percent of respondents to Steel Market Update’s market trends questionnaire this week said the mills were open to price talks on HR, up from 71 percent earlier in the month. Just 18 percent said their mill suppliers were holding the line.

In the cold rolled segment, 78 percent said the mills were negotiating, while just 22 percent said the mills were holding firm.

The plate segment has seen little change in the past few weeks as roughly two out of three buyers reported the mills open to negotiation.

Suppliers of galvanized steel appear much more likely to discuss discounts than they were a few weeks ago. Seventy-six percent said their galvanized suppliers are willing to deal, a jump of 22 percentage points from mid-August. Just 24 percent of respondents reported galv mills declining to compromise on price. The majority, 58 percent, said the mills are now also open to price talks on Galvalume.

SMU data shows the benchmark hot rolled price had dipped from about $700 per ton at the beginning of the year to around $550 per ton by the end of June when the mills announced the first of three $40 price increases. In the weeks that followed, the HR price saw a brief bump to an average of $583 a ton, but has since lost momentum and slid back to the current $575. SMU’s Price Momentum Indicator is pointing Lower, as HR prices are expected to decline over the next 30 days.

SMU’s Price Momentum Indicator remains Neutral on the other products as we wait for the market to establish a clear direction. But judging by the mills’ willingness to negotiate on cold rolled and coated products, their momentum may soon be pointing downward, as well.

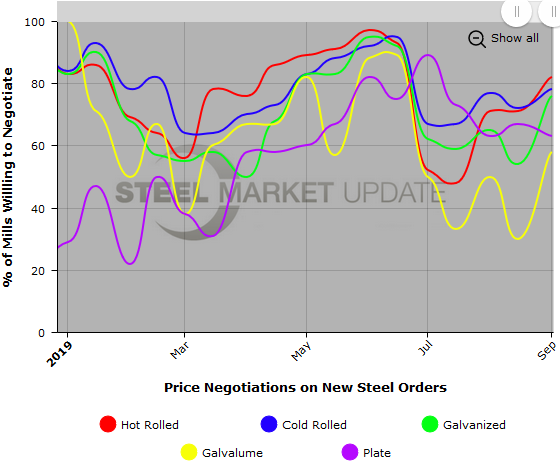

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (example below), visit our website here.