Market Segment

September 12, 2019

CRU: Minimills Have a Big Cost Advantage, Right? Not So Fast…

Written by Tim Triplett

By CRU Senior Analyst Ryan Smith

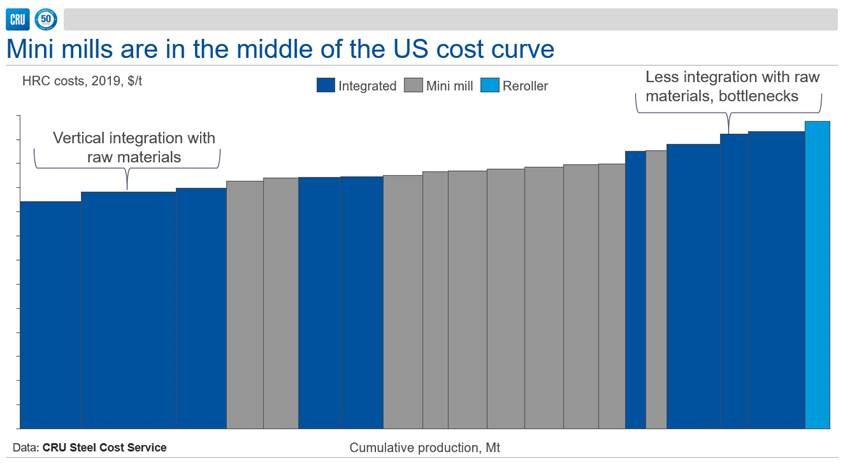

Most people believe that minimills, which remelt scrap in electric arc furnaces, have a big cost advantage over integrated mills, which feed ore and coking coal into giant blast furnaces. But such conventional thinking is an oversimplification of the cost comparison. Based on site costs alone, and where steelmaking input prices lie in 2019, minimills actually fall in the middle of the cost curve, according to CRU’s analysis. (See related article, “CRU: U.S. Minimill Costs Drop Below Integrated Mill Costs…But for How Long?“, elsewhere in this issue.)

This cost curve is benchmarked at the site cost level. Site costs, as the name implies, are all the costs incurred at the specific production site. For steel plants, site costs can be subdivided into raw material costs, conversion costs and fixed costs. Site costs do not include cost items related to legacy costs (i.e pension plans), R&D costs, technical support costs, etc. On this site-cost basis, U.S. minimills sit in the middle of CRU’s U.S. domestic cost curve in 2019, given current raw material price forecasts. This makes sense given that scrap prices generally average higher than ironmaking costs in the U.S. and globally.

Despite some U.S. integrated mills being lower cost on a site-cost basis, U.S. integrated mills realize lower EBITDA margins and generate less cash flow than minimills. This is due to a higher amount of the non-site costs related to legacy costs and the other items listed above. When it comes to free cash flow, the minimills are typically more profitable then the integrated sector as the integrated sector pays higher depreciation expenses and higher interest payments.

One fact worth pointing out is that U.S. integrated producers support more sophisticated clients and segments as there are still steel grades the minimills can’t make. To support these sophisticated sectors comes at a cost, in both additional sites costs as process steps such as secondary steelmaking are required, as well as costs related to technical support, the operation of R&D facilities, etc. In the future, if minimills are going to keep encroaching on the territory of the integrated players, they can be expected to pick up some of these additional costs, which will decrease their profitability and pull them closer to the integrated producers.

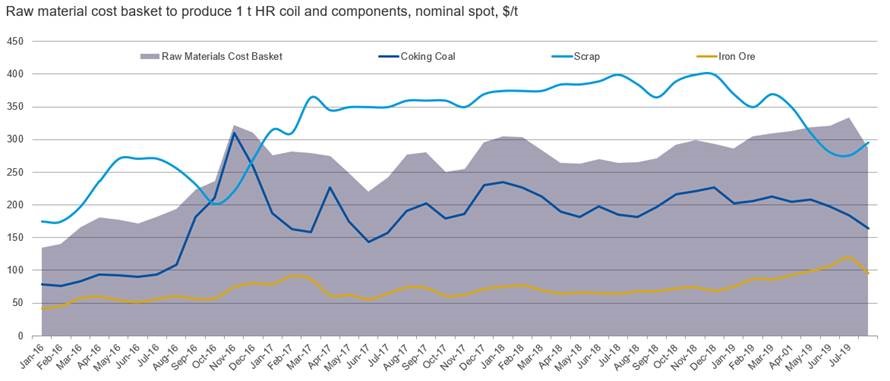

In terms of site costs, minimills must utilize “clean” iron units in their furnaces to dilute residuals that are present (and increasing) in the scrap. These clean iron inputs (HBI/DRI and Pig Iron) are priced at a premium to hot metal and lift EAF costs. Some minimill producers, like Nucor, have built their own HBI/DRI plants. These large facilities translate at a company level into higher depreciation costs, interest payments, and ultimately reduced cash flow.