Market Data

September 11, 2019

Employment by Industry Through August 2019

Written by Peter Wright

Job creation in August was disappointing even after being boosted by the addition of thousands of temporary Census workers.

In August, 3,000 jobs were created in manufacturing industries and 14,000 in construction activities. A reported 96,000 jobs were created in the private sector and government gained 34,000 positions. The federal government employment result was swelled by the addition of 25,000 temporary Census workers.

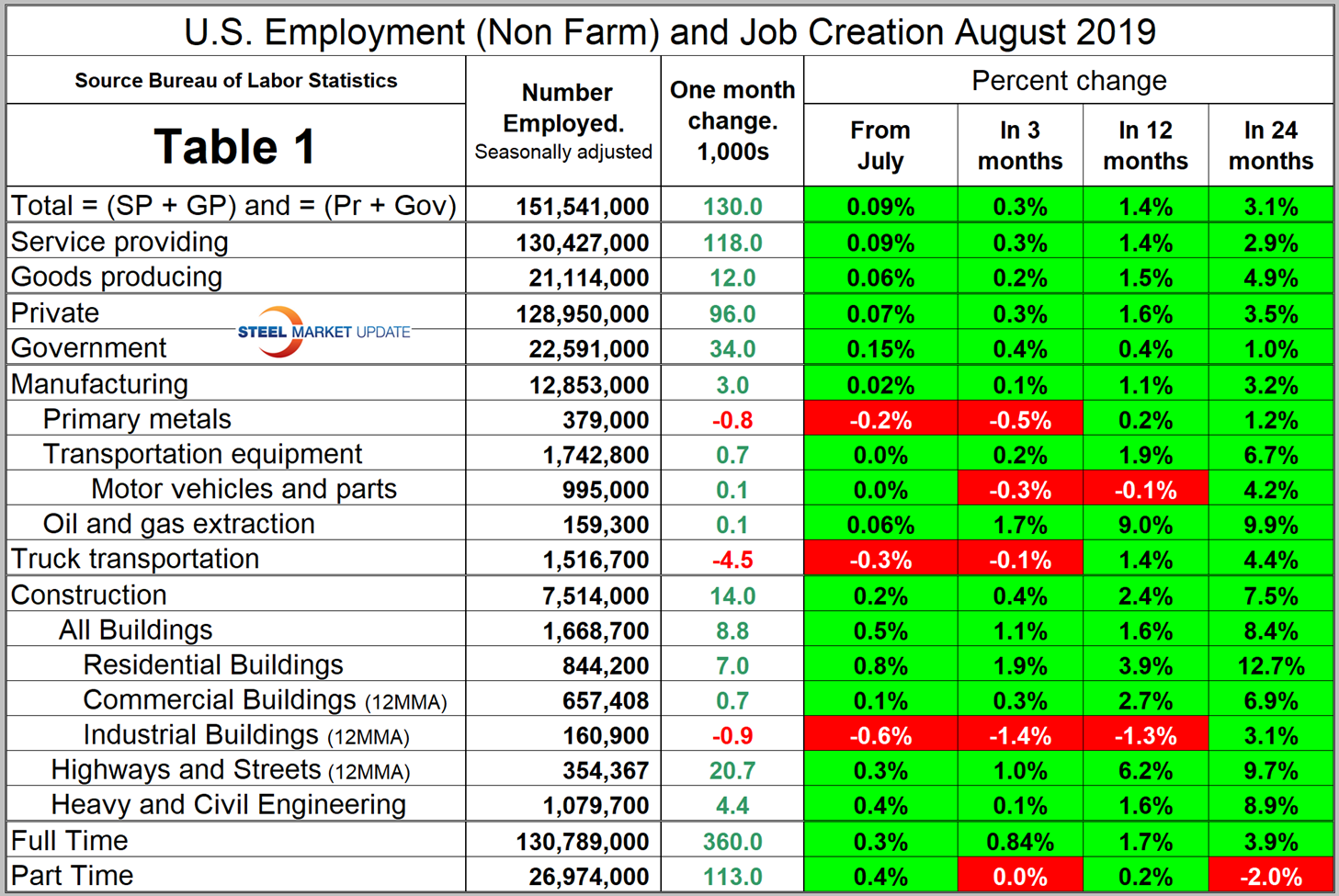

Table 1 breaks total employment down into service and goods-producing industries and then into private and government employees. Most of the goods-producing employees work in manufacturing and construction; the components of these two sectors of most relevance to steel people are broken out in Table 1.

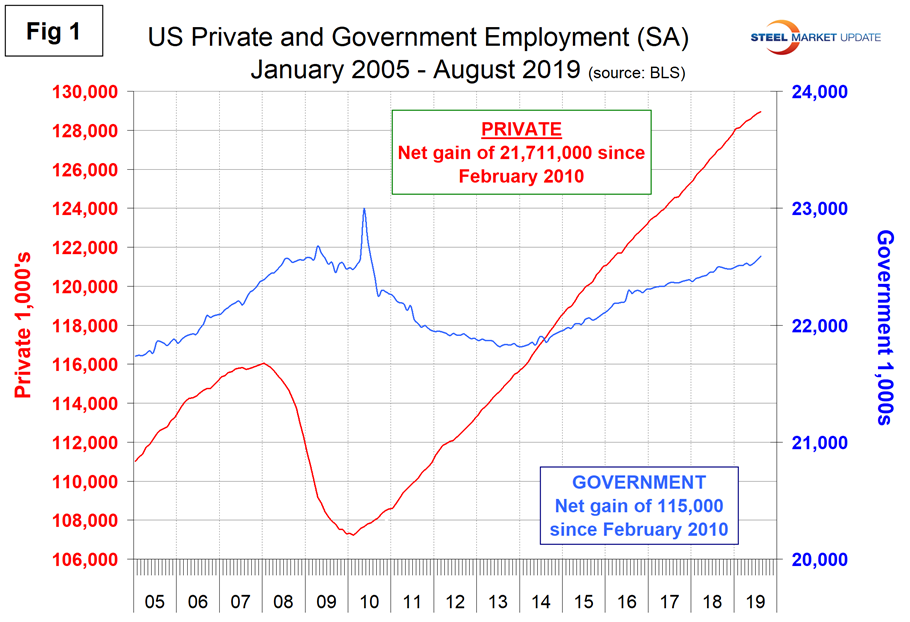

In August, the number employed by the federal government increased by 28,000. State government employment increased by 6,000 and the local level was unchanged. Since February 2010, the low point of total nonfarm payrolls, private employers have added 21,711,000 jobs as government has gained 115,000 (Figure 1).

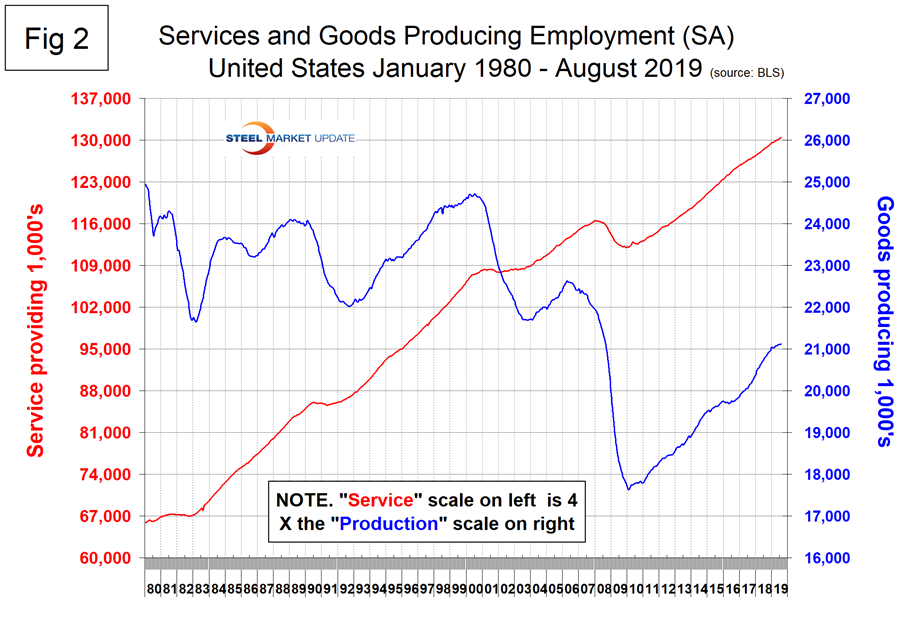

In August, service industries expanded by 118,000 as goods-producing industries, driven mainly by construction and manufacturing, gained 12,000 jobs (Figure 2). Since February 2010, service industries have added 18,339,000 and goods-producing 3,487,000 positions. This has been a drag on wage growth since the recession as service industries on average pay less than goods-producing industries such as manufacturing. The good news is that in the last 24 months the rate of job creation in goods-producing industries on a percentage basis has been higher than in service industries.

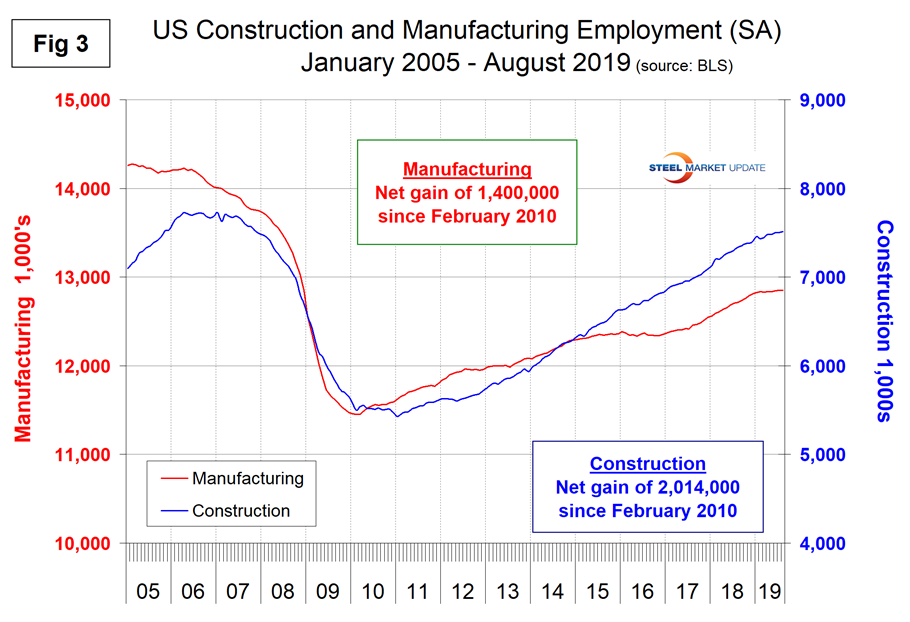

Construction was reported to have gained 14,000 jobs in August as manufacturing gained 3,000. Since and including January 2018, construction has added 421,000 and manufacturing 308,000 jobs. Manufacturing productivity improved by 0.2 percent in Q2 2019 after a gain of 0.9 percent in Q1 2019. Figure 3 shows the history of construction and manufacturing employment since August 2005. Construction has added 2,014,000 jobs and manufacturing 1,400,000 since the recessionary employment low point in February 2010.

Note, the subcomponents of both manufacturing and construction shown in Table 1 don’t add up to the total because we have only included those with the most relevance to the steel industry.

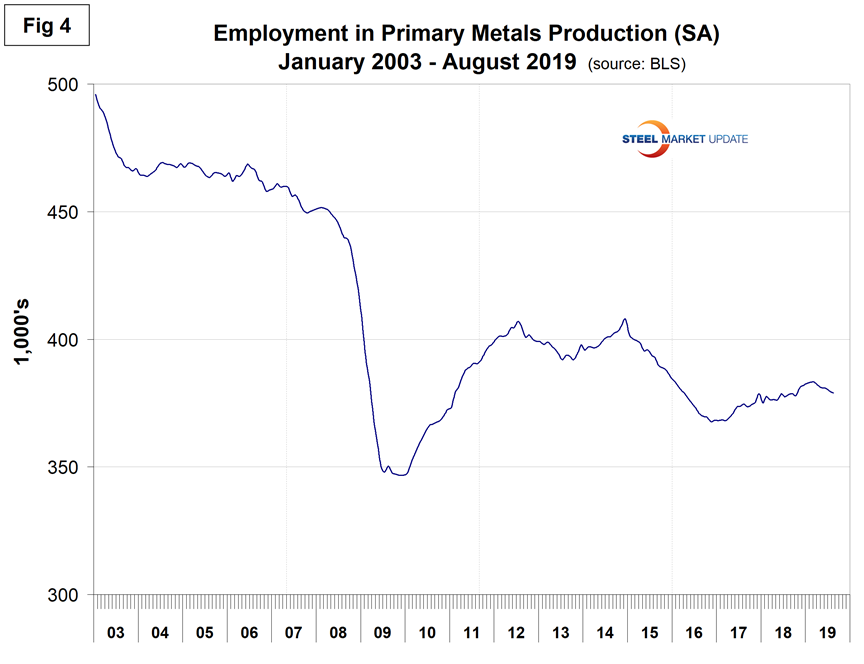

Table 1 shows that primary metals lost 800 jobs in August, and in the last 12 and 24 months has gained on a percentage basis less than manufacturing as a whole. Figure 4 shows the history of primary metals employment since January 2003. There has been a decline of 4,200 jobs in the last four months.

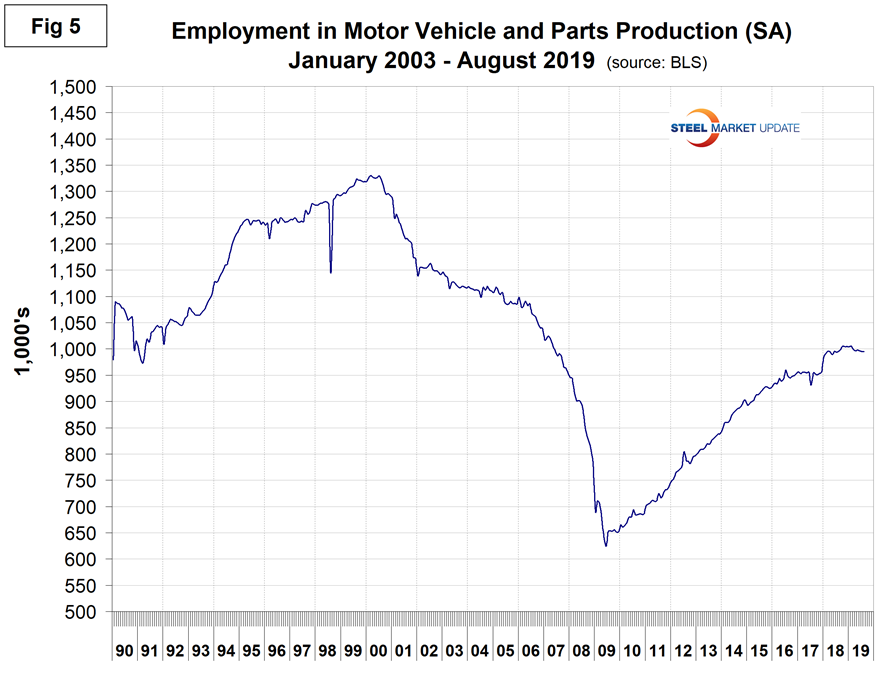

Motor vehicles and parts industries were reported to have gained 100 jobs in August. Figure 5 shows the history of motor vehicles and parts job creation.

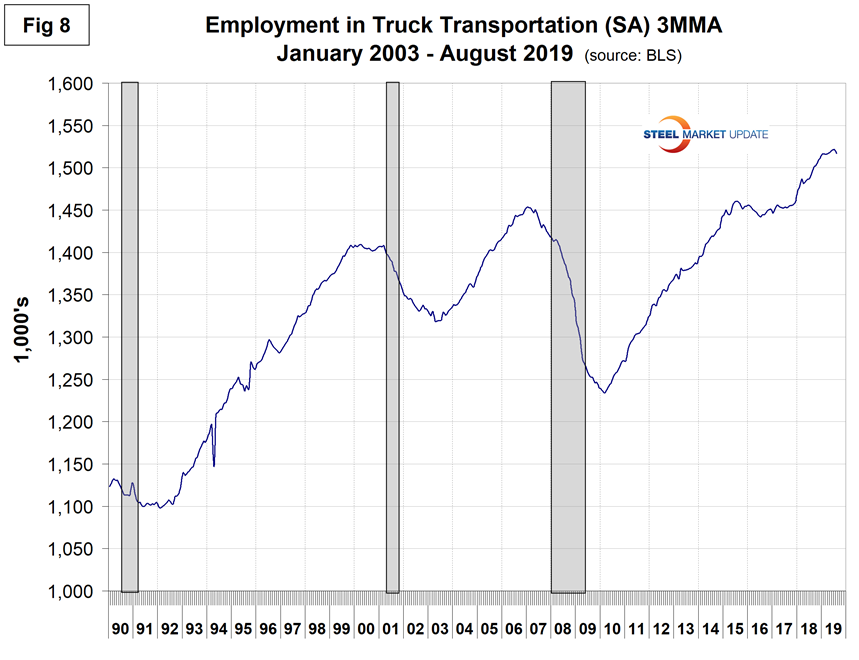

Trucking lost 4,500 jobs in August, resulting in a 12-month gain of 21,400. Employment in truck driving is one of SMU’s recession monitors and Figure 8 suggests that the economy is strong, but a couple more months of losses similar to August would be a cause for concern.

SMU Comment: The rate of job creation is slowing, and considering that the June and July results were revised down and August was boosted by 25,000 temporary Census workers, this was not a great report. Employment is now in its 10th year of uninterrupted growth. In the last 12 and 24 months, goods-producing industries have been generating jobs at a faster rate than service-providing industries, but that is changing and the reverse was the case in the last three months.

Explanation: On the first or second Friday of each month, the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. The BLS employment database is a reality check for other economic data streams such as manufacturing and construction. It is easy to drill down into the BLS database to obtain employment data for many subsectors of the economy. The important point about all these data streams is the direction in which they are headed.