Market Data

September 4, 2019

Conference Board Reports Strong Consumer Confidence in August

Written by Peter Wright

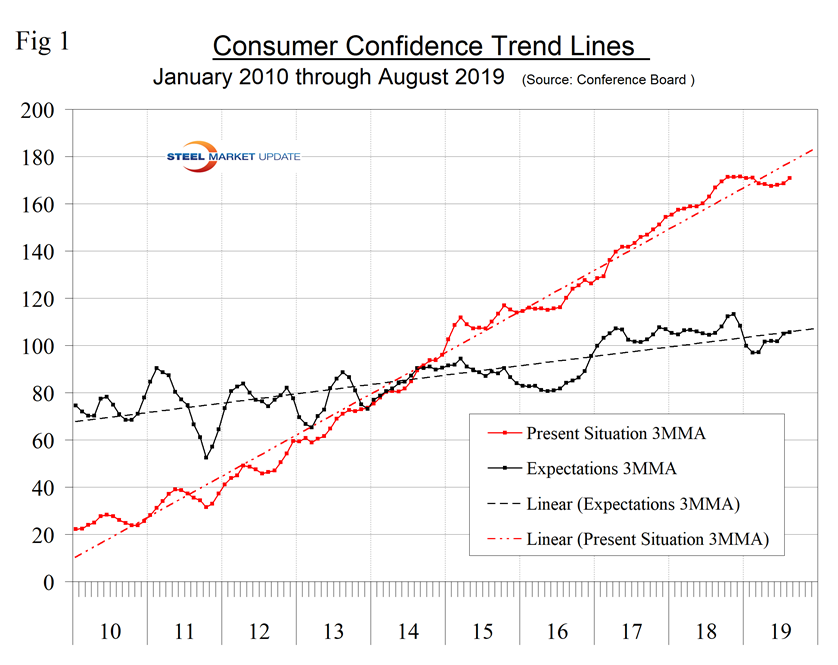

The Conference Board measure of consumer confidence is quite a volatile indicator, therefore we prefer to smooth the data with a moving average to reduce monthly variability. The composite value of consumer confidence in August was 135.1 with a three-month moving average (3MMA) of 131.7. June’s result of 124.3 now appears to be an outlier as three of the last four months have exceeded 130. This is why we consider a moving average. The composite index is made up of two subindexes: the consumer’s view of the present situation and his or her expectations for the future. In August, expectations returned to trend, but the consumer’s view of the present situation is still below the nine-year trend line (Figure 1).

Moody’s Analytics summarized as follows: “U.S. consumer confidence remains strong in August, even with the stock market on a wild ride, recession concerns increased and the trade tensions escalated. The takeaway from The Conference Board is that the strength of the labor market is offsetting the drags on sentiment. The Conference Board consumer confidence index slipped from a revised 135.8 in July (previously 135.7) to 135.1 in August, easily beating both our and consensus expectations. Confidence remains near its cyclical high of 137.9. Consumers’ assessment of present conditions increased while expectations slipped. Overall, the consumer could be up to the task of carrying the economy through the current soft patch.”

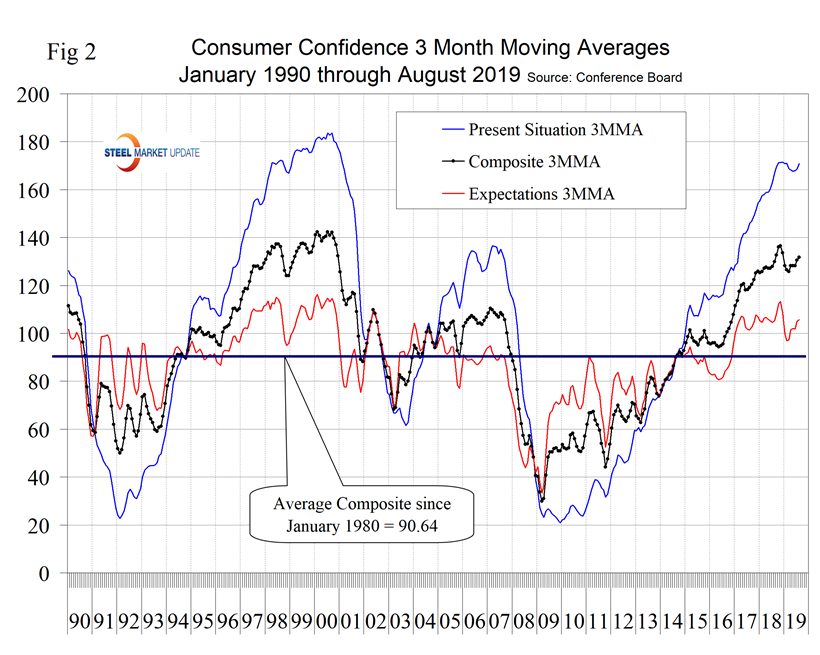

The consumer’s view of the present situation in August was the highest since November 2000 and expectations were the highest since December last year. The historical pattern of the 3MMA of the composite, the view of the present situation and expectations since January 1990 are shown in Figure 2.

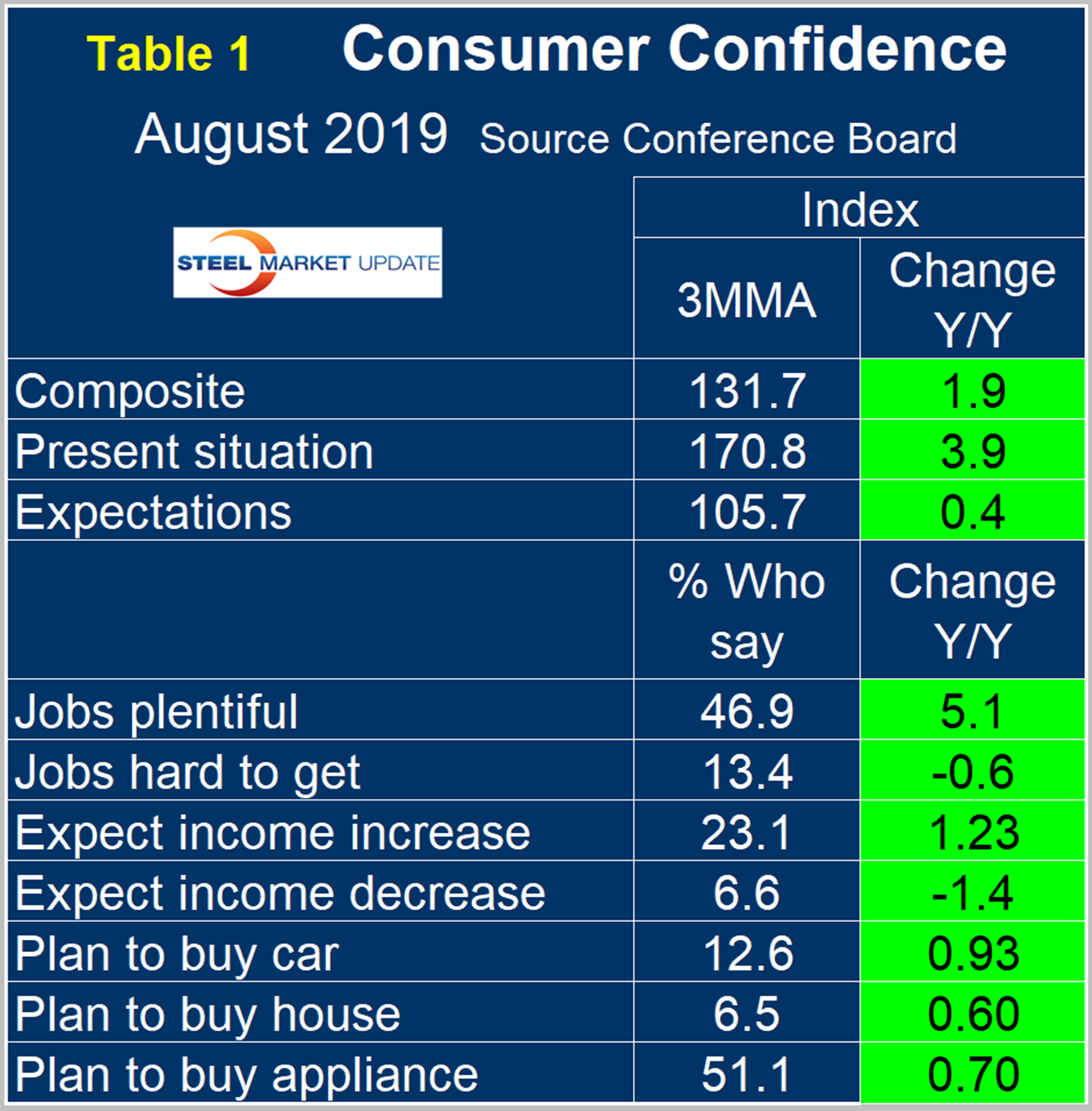

On a three-month moving average basis comparing August 2019 with August 2018, the 3MMA of the present situation was up by 3.9 points and expectations were up by 0.4 points (Table 1). The color codes show improvement or deterioration of the individual components in Table 1. July and August was the first months for the table to be all green since January 2018.

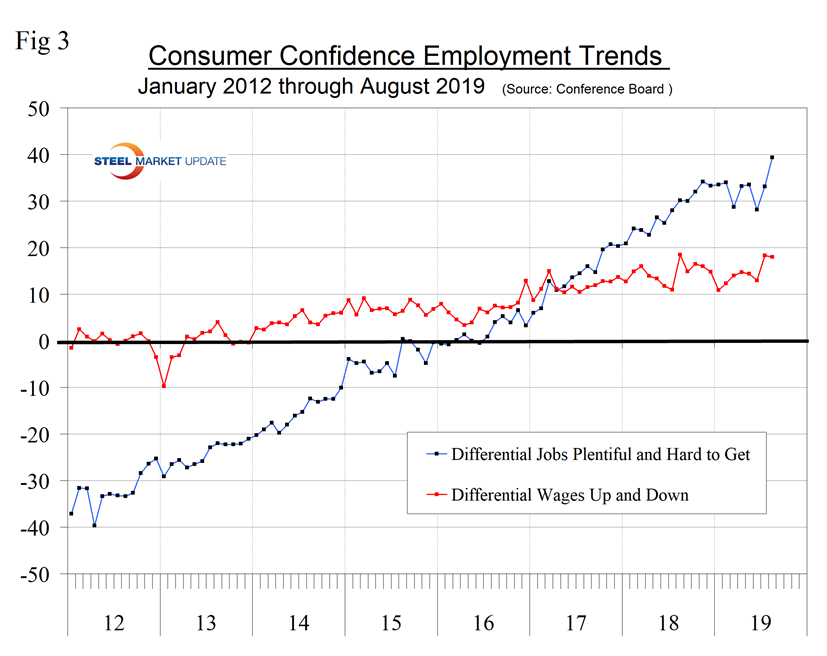

The Consumer Confidence report includes employment data that is still encouraging as 51.2 percent of respondents reported jobs to be plentiful and 13.4 percent reported jobs hard to get. Expectations for wage increases were also positive, with 23.8 percent expecting an increase and 5.8 percent expecting a decrease (Figure 3).

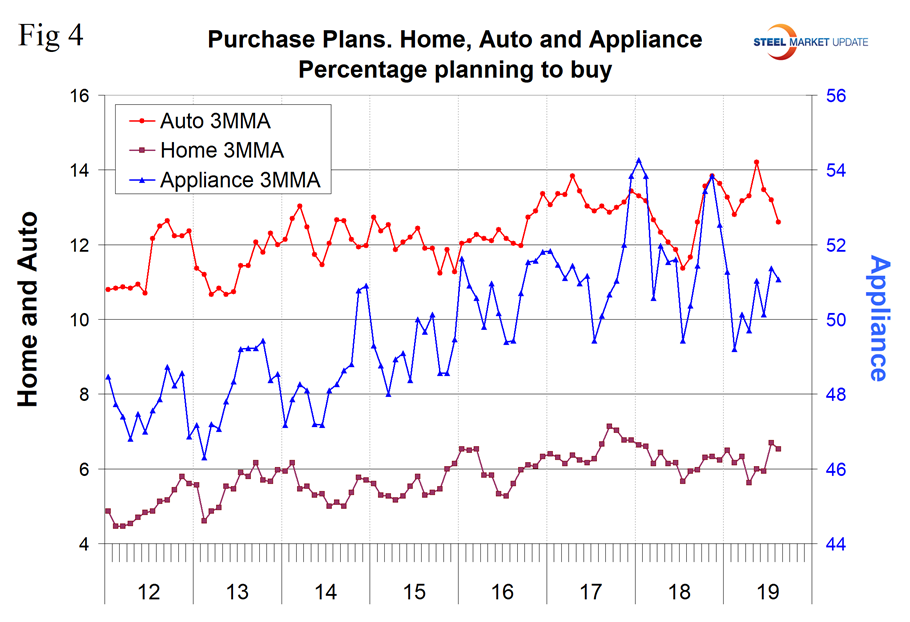

Consumer spending measures in August indicated that year-over-year plans to buy a car have increased by 12.6 percent, though there has been a decline in the last three months Plans to buy an appliance have been improving erratically for six months and plans to buy a house have not made progress in almost two years (Figure 4).

SMU Comment: The Conference Board Consumer Confidence Index is a volatile measure and must be reviewed as a three-month moving average to obtain a realistic view of trends. Steel demand is dependent on the growth of GDP, which in turn is strongly influenced by consumer confidence, disposable income and a willingness to spend. Therefore, this was another good report.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.