Market Data

September 3, 2019

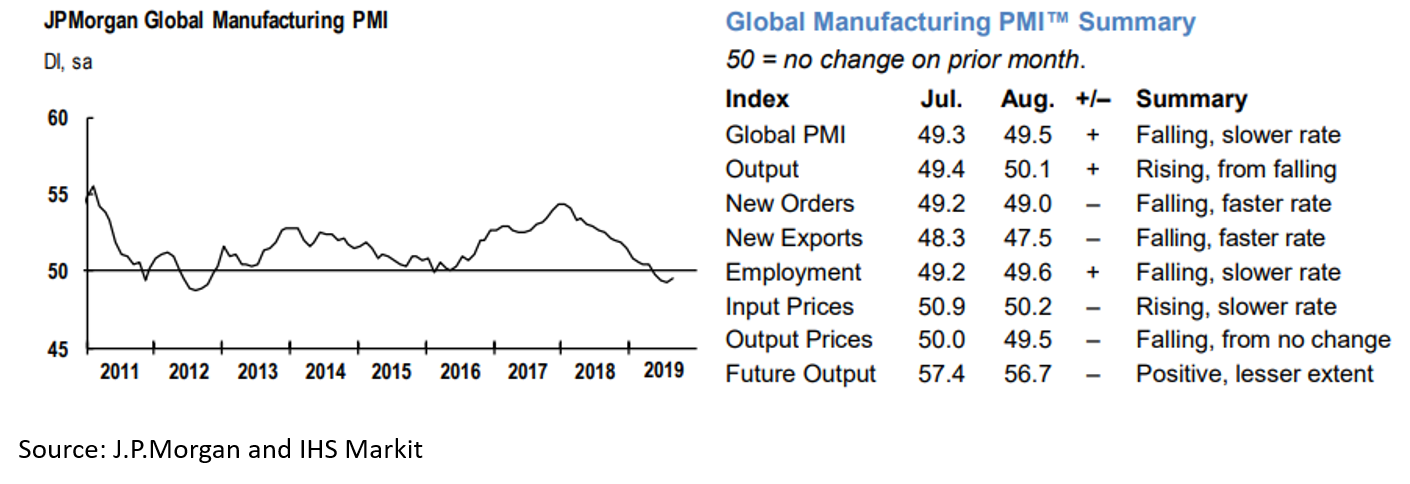

PMI Indicates Global Downturn for Manufacturing

Written by Sandy Williams

The global manufacturing sector downturn continued to worsen in August. The J.P.Morgan Global Manufacturing PMI posted a 49.5 for its fourth month of contraction. More than half of the nations surveyed by J.P.Morgan and IHS Markit had PMI readings below the neutral 50 mark last month, with Germany and the Czech Republic declining at the steepest rates. China and the U.S. showed growth, albeit weak, with PMIs of 50.4 and 50.3, respectively.

“While the global manufacturing output PMI increased in August, its level remained low signaling very modest growth in manufacturing output,” commented Olya Borichevska, from Global Economic Research at J.P.Morgan, “Away from the output index, detail of the PMI report points to weakening in activity. New order intakes fell at the joint-fastest pace in nearly seven years, business optimism dropped to a series record low, international trade flows weakened and the cyclically sensitive orders-to-inventory ratio hit its joint-lowest level since late 2012. Geopolitical uncertainty weighing on business capital investment remains the main drag on global industry. Developments on this front need to improve for industry to lift.”

Eurozone manufacturing remained solidly in contraction territory at a PMI reading of 47.0 in August. The index moved slightly higher from July’s level of 47.0 to its second lowest reading since April 2013. Greece posted a solid 54.9 in August for a four month high. France and Spain PMIs hovered close to the neutral zone at 51.5 and 51.1, respectively. The other five countries in the European Union remained in contraction with Germany posting the lowest PMI at 43.5.

“The deteriorating manufacturing conditions mean the goods-producing sector is likely to act as an increased drag on eurozone economic growth in the third quarter. At current levels, the survey is consistent with goods production declining at a quarterly rate of 1 percent,” said IHS Markit Chief Business Economist Chris Williamson. “Prices are falling as companies offer discounts in the face of disappointingly weak demand, and payroll numbers are being culled at one of the steepest rates seen over the past six years as companies increasingly seek to cut costs in the uncertain trading environment. Trade wars and tariffs remain the biggest concerns among producers, and the escalation of global trade war tensions in August encouraged further risk aversion.”

Despite an ongoing trade war with the U.S., the Caixin China General Manufacturing PMI rose to 50.4 in August from 49.9 in July. Domestic orders were stable but new export sales declined at a faster rate last month. Input costs fell allowing output charges to decline. “At the same time, sentiment regarding the 12-month outlook for output softened to a level that was among the lowest in the series history, with optimism dampened by worries over the future trading relationship of China and the U.S., as well as signs of weaker global conditions,” said IHS Markit.

Business conditions in Russia deteriorated to a PMI of 49.1 in August as new orders and output sharply dropped. New export orders saw a particularly sharp plunge during the month. Currency weakness drove up raw material prices that were partly passed on to customers. Inflation overall, however, remained relatively muted, said IHS Markit. Business firms remained confident that investment in new machinery and new product development would boost demand and output in the coming year.

The PMI for Canada fell into contraction in August, posting a 48.1 from 50.2 in July. The PMI was at a three-month low and indicated a modest downturn in manufacturing business conditions. New orders declined for the sixth month and at the fast rate since December 2015. Lower demand led to a marginal reduction in output. Capacity pressure eased and backlogs of work shortened. Delivery times improved as demand for inputs lessened, leading to less inventory purchasing. Stocks of finished inventories rose as sales weakened. Average output charges increased only slightly in August.

“August data also signaled a slide in growth projections across the manufacturing sector, with business optimism falling to its lowest level since early-2016. Concerns about the U.S.-China trade war and rising global economic uncertainty were often cited by survey respondents,” said Tim Moore, economics associate director at IHS Markit.

Business conditions continue to deteriorate in Mexico. The Manufacturing PMI fell to 49.0 in August from 49.8 in July. Output, new orders, purchasing and employment all fell as demand weakened. One of the few bright spots in the survey was an increase in exports for the first time in three months.

“The latest PMI figure highlighted the fastest deterioration in the health of the sector since data collection started in April 2011, a worrying sign after the official flash GDP print indicated the economy narrowly avoided entering a technical recession in the second quarter,” said Pollyanna De Lima, principal economist at IHS Markit. “The drop in the PMI reflected near survey-low readings for factory orders, production, stocks of purchases and employment. In fact, only three of the 14 measures increased from July. One of these was the Input Costs Index, which pointed to the sharpest rate of inflation for seven months. “

Manufacturing in the United States was essentially stagnant in August with the IHS Markit Manufacturing PMI at 50.3, its lowest reading since September 2009. Demand was subdued during the month resulting in some firms cutting production. Others reported increasing output in order to clear backlogs. Employment levels were broadly unchanged with some sectors reporting difficulty in finding qualified workers. Growth was muted for both input prices and output charges, and inventories fell for pre- and post-production stocks.

Manufacturing was a significant drag on the economy and GDP growth in the third quarter, said IHS Markit. “At current levels, the survey indicates that manufacturing production is falling at an annualized rate of approximately 3 percent,” said Williamson. “Deteriorating exports are the key to the downturn, with new orders from foreign markets dropping at the fastest rate since 2009. Many companies blame slower global economic growth for weakened order books, but also point the finger at rising trade war tensions and tariffs.”